- Some stocks enjoy unanimous support from the market, with over 90% of the ratings as buy, and no sell ratings in sight

- However, this should not be the sole basis for your investment decision

- Let's take a closer look at these five stocks and explore the reasons behind their strong market support

In the world of investing, the market's consensus on a particular stock can be a valuable signal, but it's crucial to remember that it's just one piece of the puzzle. Market sentiment can be a powerful force, but it's not infallible.

However, when the market overwhelmingly leans towards either buying or selling a stock, it's worth taking a closer look to understand what's driving this consensus.

Today, we will delve deep into 5 stocks that enjoy nearly unanimous support from the market, with more than 90% buy ratings and not a single sell rating.

While there are many other factors one should analyze before deciding to buy a stock, it certainly piques our curiosity and prompts us to explore the reasons behind such resounding support.

1. Lamb Weston

Lamb Weston (NYSE:LW) is a major player in the frozen French fries industry, with its headquarters nestled in Eagle, Idaho. The company's roots trace back to its founding by Gilbert Lamb in 1950, with its early operations based in a former cooperative plant located in Weston, Oregon.

Currently, Lamb Weston boasts a dividend yield of +1.20%. Notably, the company delivered impressive results on July 25, surpassing market expectations with actual revenues up by +2.3% and an astounding +16.5% increase in earnings per share (EPS).

The upcoming results scheduled for October 4 are also anticipated to be stellar, featuring a projected surge in real revenues by +27.76% and a remarkable +34.10% growth in EPS. Looking ahead to FY2024, the company's earnings are expected to maintain an upward trajectory, with an estimated increase of +12%.

With a unanimous consensus from all eight ratings pegged at a resounding 100% buy, the market perceives Lamb Weston's potential range to be between $113 and $119. This level of unanimous support underscores the company's positive outlook and the confidence investors have in its future performance.

2. Delta Air Lines

Delta Air Lines (NYSE:DAL) stands as a foundational member of the SkyTeam alliance. This global airline coalition, including Aeromexico, Air France, and Korean Air, provides travelers access to an extensive network of destinations worldwide.

Investors in Delta Air Lines can benefit from a dividend yield of +1.06%, making it an attractive choice for income-seeking investors.

The company reported favorable results on July 13, marked by an improvement in actual revenues by +1.9% and an impressive +11.6% surge in earnings per share (EPS). The upcoming figures set to be unveiled on October 12 are anticipated to be even more promising, with projected growth in EPS reaching +32.57% and a notable uptick in real revenues by +13.98%.

Delta Air Lines holds a total of 20 ratings, comprising 19 buy recommendations and 1 hold recommendation, with no sell ratings in sight. The market's outlook for Delta Air Lines positions its potential in the range of $55 to $56, reflecting a favorable sentiment and optimism surrounding the company's future performance.

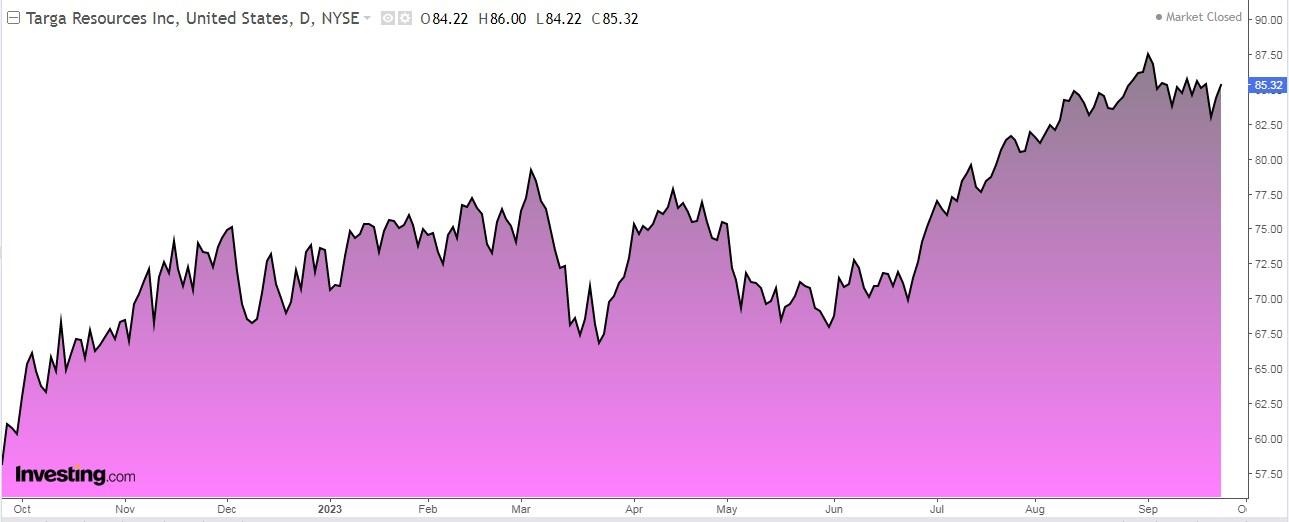

3. Targa Resources

Targa Resources (NYSE:TRGP), a company headquartered in Houston, Texas, stands as one of the largest infrastructure providers in the United States, specializing in the supply of natural gas. The company was founded on October 27, 2005, and has since played a significant role in the country's natural gas industry.

For income-oriented investors, Targa Resources offers an appealing dividend yield of +2.34%, making it an attractive choice for those seeking regular returns from their investments.

While the August 3 results may not have met expectations, there is optimism surrounding the upcoming November 2 results, which are anticipated to show significant improvement. The earnings per share (EPS) is expected to witness a robust increase of +37.5% in 2023, followed by an even more impressive growth of +41.6% in 2024.

Targa Resources currently boasts a total of 18 ratings, comprising 17 buy recommendations and 1 hold recommendation, with no sell ratings reported. The market's sentiment towards Targa Resources suggests a potential price target in the range of $95 to $98, highlighting the positive outlook for the company's future performance.

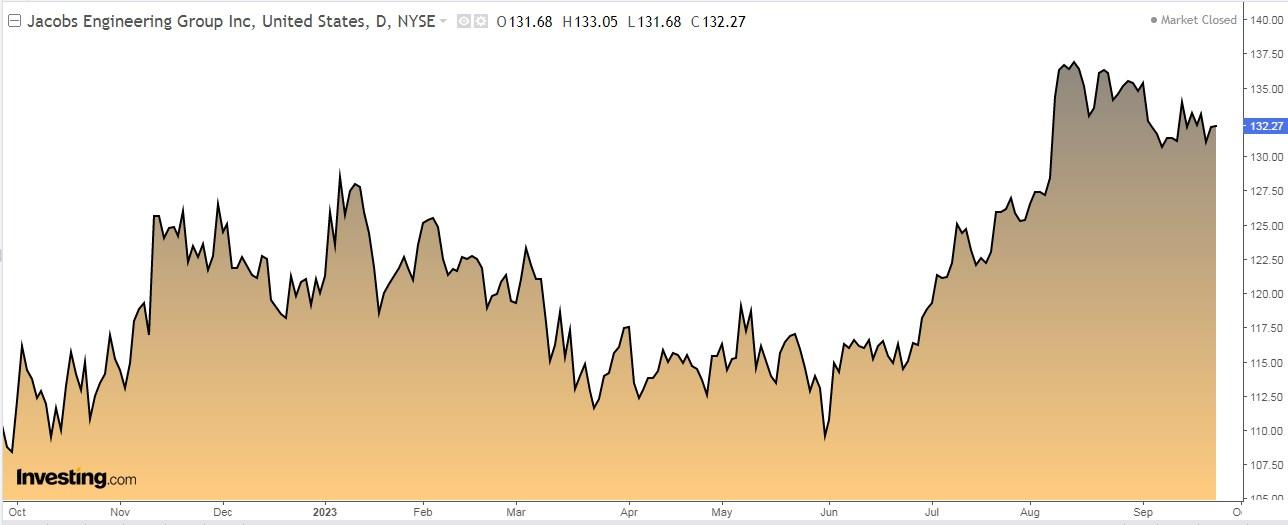

4. Jacobs Engineering Group

Jacobs Engineering Group (NYSE:J) specializes in providing a wide range of consulting services. Their expertise encompasses various fields, including cybersecurity and data analysis, catering to both government and private sector clients across regions such as the United States, Europe, Canada, India, and Asia.

For investors seeking reliable dividend income, Jacobs Solutions offers an appealing dividend yield of +0.80%, making it an attractive option for those who value steady returns from their investments.

The company's financial performance, as demonstrated in the August 8 earnings, exceeded expectations with actual revenues registering a significant increase of +2.6%. Looking ahead, investors can anticipate positive developments in the company's financials, with revenue growth projections of +8.3% in 2023 and +6.9% in 2024.

Additionally, earnings are expected to witness a substantial increase of +71% in the coming years. This growth trajectory is likely to contribute to enhanced cash flows, potentially leading to a higher valuation of the company's shares.

Currently, Jacobs Solutions holds 16 ratings, including 14 buy recommendations, 2 hold recommendations, and no sell ratings. The market sentiment surrounding Jacobs Solutions suggests a potential price target range of $153 to $156.

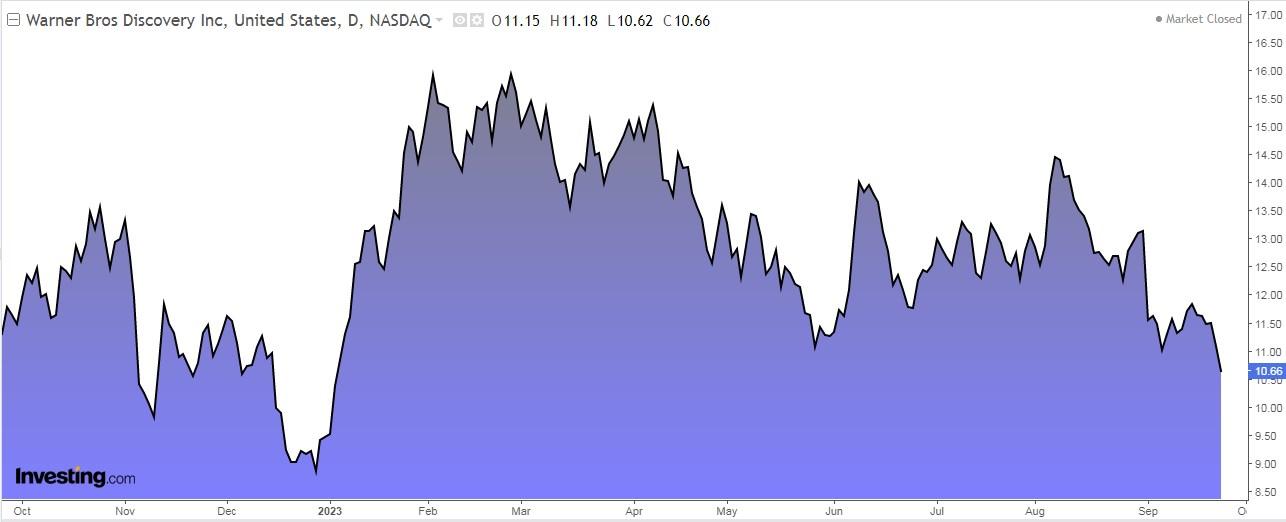

5. Warner Bros Discovery

Warner Bros Discovery (NASDAQ:WBD) was founded on April 8, 2022, after the merger between WarnerMedia and Discovery. Notably, the company's name is a fusion of two significant entities: WarnerMedia's flagship property, the Warner Bros. film studio, and the influential pay-TV network.

Upcoming earnings are scheduled for release on November 2. Projections indicate a remarkable growth in earnings per share (EPS), with an anticipated increase of +83.44%. Looking further ahead, the outlook remains favorable, with expected EPS growth of +153.1% in 2023 and +51.3% in 2024. In terms of revenues, analysts anticipate a robust figure, with forecasts pegged at $3.7 billion for the year.

The stock currently has 12 ratings, comprising 10 buy recommendations and 2 hold recommendations, with no sell ratings in sight. Market sentiment surrounding the company suggests considerable potential, with conservative estimates indicating a target price of $14.50, while a more aggressive outlook projects a target price of $19.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of assets, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor. The author does not own the stocks mentioned in the analysis.