Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

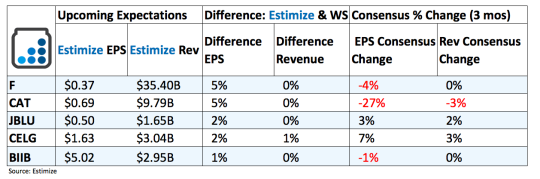

Ford Motors (NYSE:F): Donald Trump’s public shaming of American automakers General Motors and Ford puts pressure on forward looking estimates for fiscal 2017. If automakers move operations back to the United States, that would cause a great deal of pressure on overall performance. As for the fourth quarters, Ford experienced strong sales volumes in major markets and a considerable upswing in emerging ones.

Sales in China reportedly grew 14% to 1.27 million units in 2016, making Asia the company’s fastest growing sector. European sales came in about 6% higher to 1.25 million vehicles over the same time period. The combination of new product launches and low gas prices during 2016 helped boost sales volume. As gas prices start to rise sales of high margin SUVs and trucks will likely stagnate and thereby put pressure on profitability. Meanwhile a $3 billion pre tax loss related to employee benefits place additional constraints on the bottom line.

Caterpillar (NYSE:CAT): Investors expect industrial stocks to lead the way under under the Trump administration, with names like Caterpillar poised to make the biggest move. But given Caterpillar’s growing presence in international markets, Trump’s potential protectionist policies would cause more harm than good. Despite better than expected results lately, Caterpillar effectively continues to deliver negative growth for 8 quarters and counting.

The strength of the dollar remains a near term threat that affects metal prices and mining operations. Meanwhile political risks in China and Europe put operations in those regions at risk of slowing down and thereby hurting sales. Ongoing initiatives to reduce costs and restructure helps offset any losses incurred in domestic or international markets.

JetBlue (NASDAQ:JBLU): In a statement made in early 2017, JetBlue reported a 4.5% increase in traffic on a 3.1% capacity increase for the month of December. The figures pale in comparison to traffic results from November and October that came in 7.1% and 6.5% higher, respectively. Overall preliminary revenue per available seat mile for the three months fell by an average of 1.5%, largely due to the negative impact of Hurricane Matthew in October. Investors can also expect compressed margins amid rising fuel and labor costs.

To offset some of the downturn, JetBlue turned its sights to expanding flight coverage and improving the customer experience. The airline recently decided to resume commercial flights to Havana and expand service to Bermuda, highlighting its new focus on international markets. Meanwhile, all flights will now include free Wi-Fi access in addition to free streaming video service and 36 channels of DIRECTTV.

Celgene (NASDAQ:CELG): Financial performance continues to trend higher as Celgene makes a splash in the biotech industry. The company’s core drugs and main growth drivers focus on treating cancer and inflammatory drugs. They include Revlimid, Pomalyst/Imnovid and Abraxane, each of which continue to gain traction. Revlimid, in particular, is expected to deliver considerable improvement this quarter on consistent market share gains. Meanwhile the company intends to secure additional reimbursements internationally to boost drugs sales. Label expansion in markets like Japan and in the European Union will help edge higher.

Biogen (NASDAQ:BIIB): Lowering drug prices falls under President Trump’s list of actions he intends to take as a means to Make America Great. That poses a problem for companies like Biogen and Celgene that thrived in this hands-off type of environment. If Trump can break ground on the issue it would likely come at the cost of margins and profitability.

Any reference to Trump or drug prices in Biogen’s conference call could make a sizeable impact on forward estimates. For the fourth quarter though, performance will be driven by newer drugs like Zinbryta and legacy ones like Tecfidera. Ongoing restructuring initiatives, cost controls and headcount reduction put in place last year intend to lower operating expense and boost margins for the fourth quarters.