- While a lot of stocks offer dividends, some have been increasing it for a number of years

- These stocks can make a great addition to your dividend portfolio

- In this article, we will discuss five such stocks that that out in that context

The allure of dividends has always been a compelling factor for investors. In this article, we'll take a look at companies that not only offer an attractive dividend yield but also consistently and progressively increase their payouts in recent years.

In this context, let's delve into five stocks that stand out for their impressive dividends, guided by insights from InvestingPro.

1. Phillips 66

Phillips 66 (NYSE:PSX) works with oil and gas, specifically transports, stores, and delivers it. It was founded in 1875 and is headquartered in Houston.

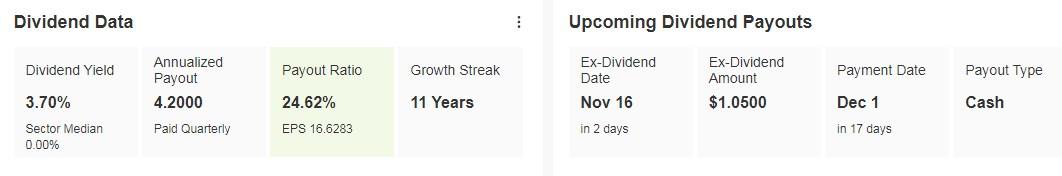

On December 1 it will distribute a dividend of $1.05 per share and to get it you have to own shares before November 16. The annual dividend yield is +3.70%. It has increased the dividend for 12 consecutive years.

Source: InvestingPro

On January 26, it will present its quarterly results.

Its shares are up +7% in the last year. Investors are attentive to the movements of oil prices, as a rise in crude oil benefits the company.

The market sees potential at $130.64, while InvestingPro models see it at $149.40.

Source: InvestingPro

2. Marathon Petroleum

Marathon Petroleum (NYSE:MPC) is a leading oil transportation, marketing and refining company.

It was a subsidiary of Marathon Oil (NYSE:MRO) until its corporate spin-off in 2011. It was founded in 1887 and is headquartered in Findlay, Ohio.

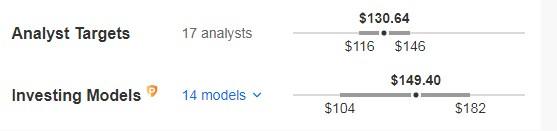

It will distribute a dividend of $0.825 per share on December 11, and to get it you must own shares by November 15. The annual dividend yield is +2.27%. It has increased the dividend for 11 consecutive years.

Source: InvestingPro

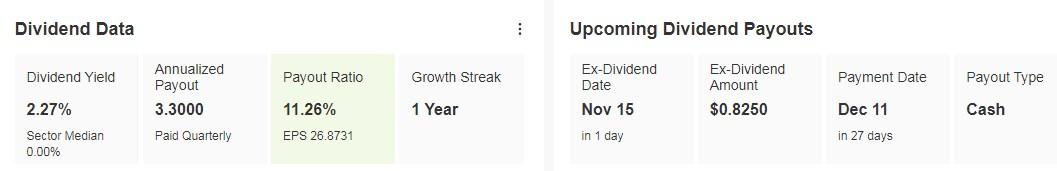

It presents its quarterly accounts on January 31 and is expected to increase actual revenue by +14.57% and earnings per share (EPS) by +18.59%.

Source: InvestingPro

Its shares are up +23.33% over the past year.

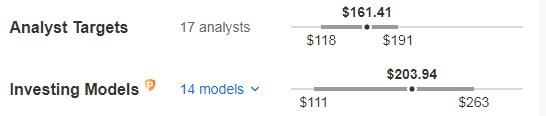

It has 17 ratings, of which 11 are buy, 6 are hold and none are sell.

The market gives it potential at $161.41, while InvestingPro models are more optimistic, putting it at $203.94.

Source: InvestingPro

3. VICI Properties

VICI Properties (NYSE:VICI) is a real estate asset investment trust (REIT) specializing in casino properties.

Based in New York, it was formed in 2017 as a spin-off from Caesars (NASDAQ:CZR) Entertainment Corporation as part of its bankruptcy reorganization.

It owns 53 casinos, hotels, racetracks, and 4 golf courses in the United States and Canada.

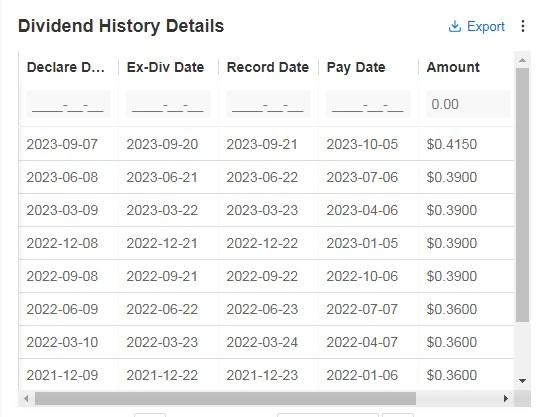

Its annual dividend yield is +5.83%. In September it increased by +6.4%. It has been increasing for 4 consecutive years.

Source: InvestingPro

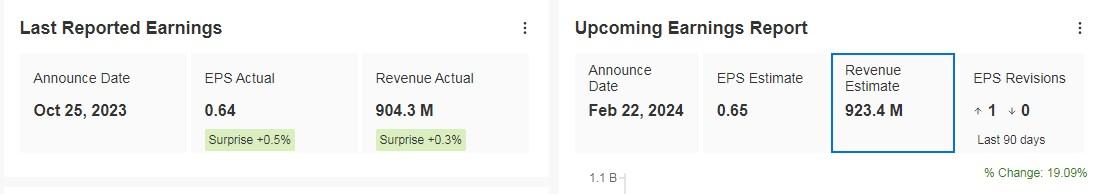

It presents its quarterly accounts on February 22 and is expected to increase real revenues by +19.09% and earnings per share (EPS) by +4.88%.

Source: InvestingPro

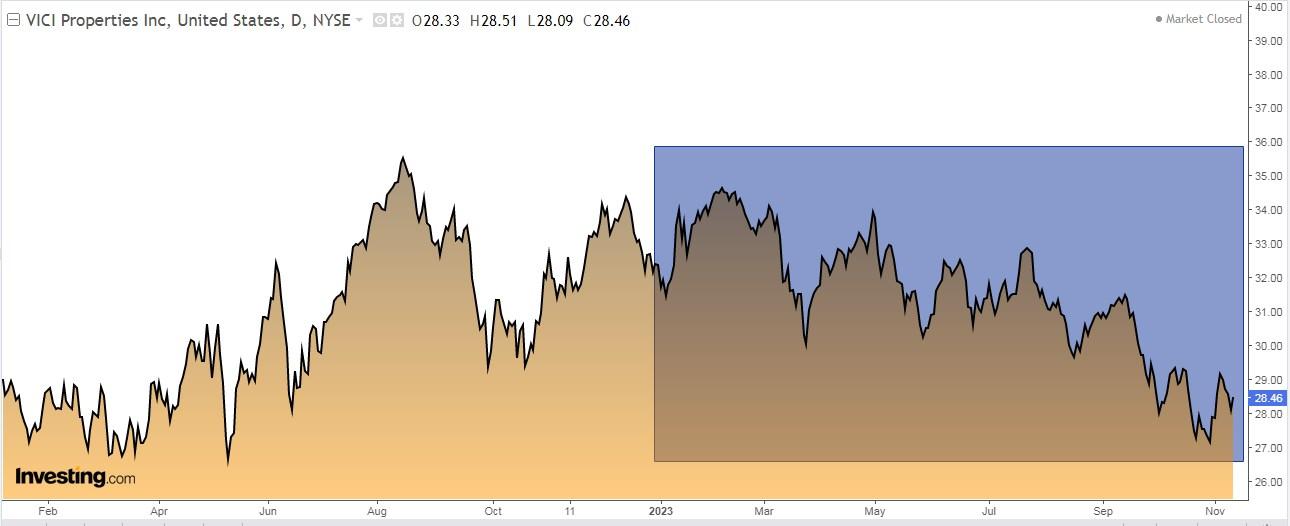

Its shares are down -5.45% in the last year.

It has 22 ratings, of which 19 are buy, 3 are hold and none are sell.

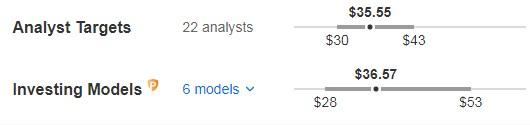

The market and InvestingPro models come to agree on the potential, in the first case at $35.55, in the second case at $36.57.

Source: InvestingPro

4. Innovative Industrial Properties

Innovative Industrial Properties (NYSE:IIPR) is a Maryland corporation focused on acquiring, owning and managing properties leased to experienced state-licensed operators for their regulated cannabis facilities.

Therefore, this company specializes in regulated cannabis facilities.

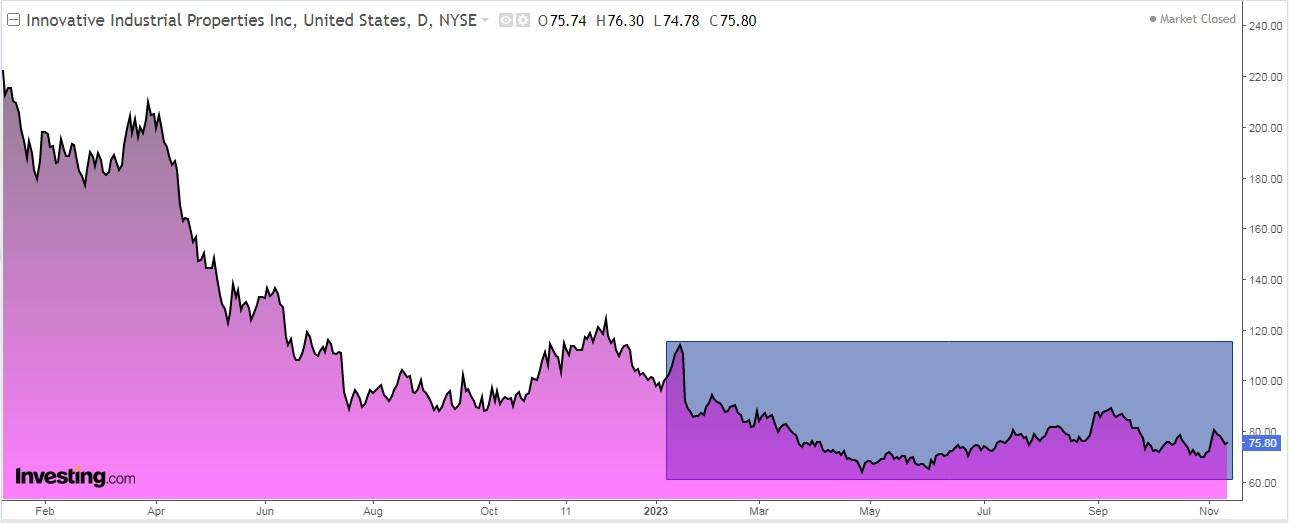

Its annual dividend yield is a whopping +9.50% and the dividend payout is a constant and regular thing for this company.

Source: InvestingPro

Yes, it is true that marijuana is not federally legal in the country, but as of today, there are some 42 states that do allow its sale, and regulation is more lax.

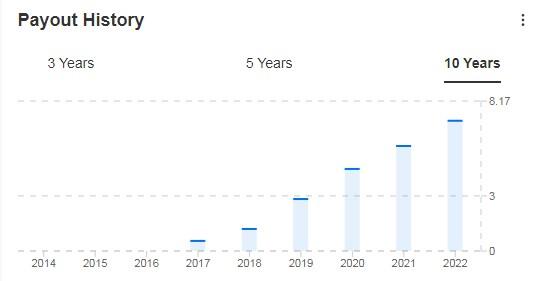

On February 21 it will render its accounts for the quarter and is expected to increase real revenues by +1.06% and +11.3% for 2023 as a whole.

Source: InvestingPro

Its shares fell by -5% in the quarter.

It has 5 ratings, of which 2 are buy, 3 are hold and none are sell.

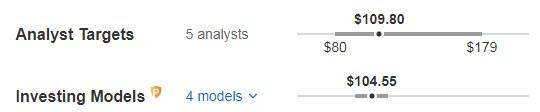

The market and InvestingPro models come to agree on the potential, in the first case at $109.80, and in the second case at $104.55.

Source: InvestingPro

5. Gilead Sciences

Gilead Sciences (NASDAQ:GILD) is a biopharmaceutical company that discovers, develops, and markets drugs in areas of unmet medical needs in the United States, Europe and internationally.

The company was incorporated in 1987 and is headquartered in Foster City, California.

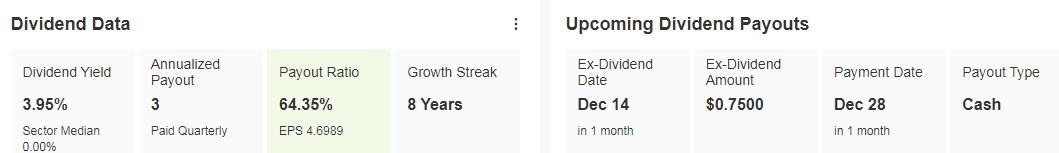

It distributes a dividend of $0.75 per share on December 28, and shares must be held prior to December 14 to earn the dividend. The annual dividend yield is +3.95%.

Source: InvestingPro

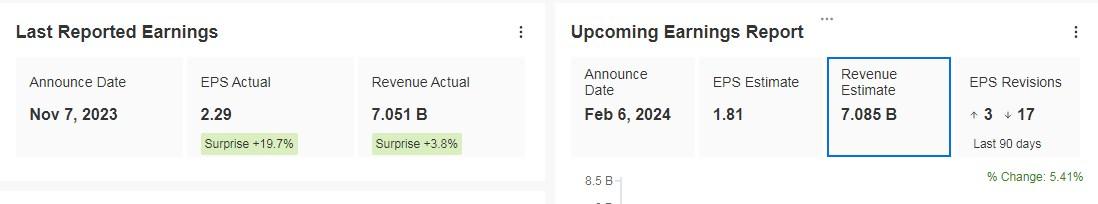

It presents its quarterly accounts on February 6 and is expected to increase actual revenue by +5.41% and earnings per share (EPS) by +4.40%.

Source: InvestingPro

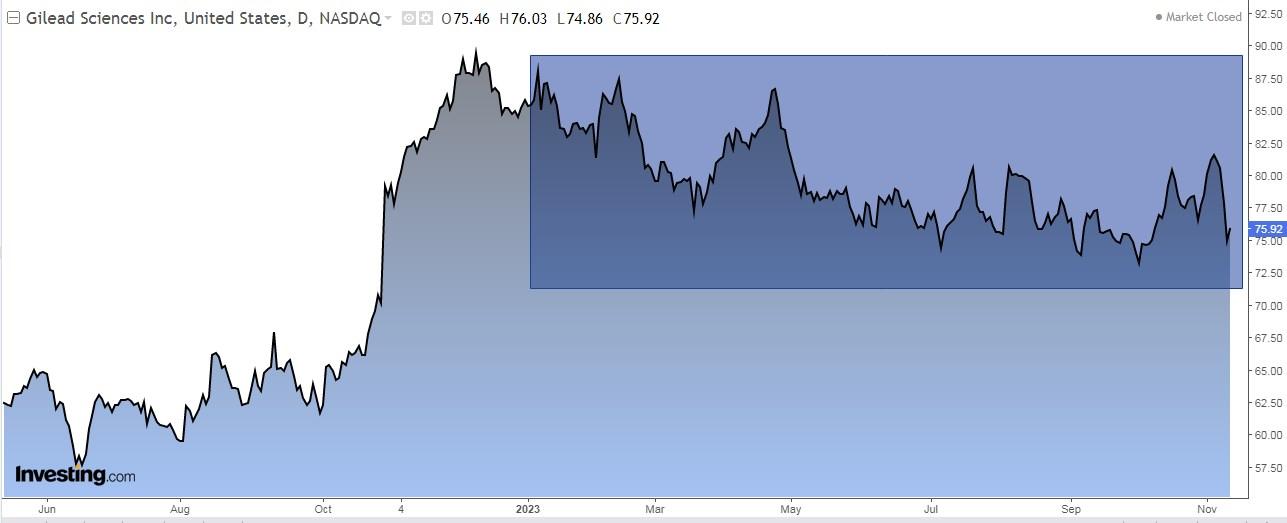

Its shares fell by -3.90% in the quarter.

It has 30 ratings, of which 17 are buy, 12 are hold and 1 is sell.

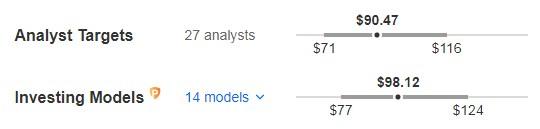

The market sees potential for it at $90.47, while InvestingPro models see it at $98.12.

Source: InvestingPro

Other stocks that also offer good dividend returns are Medtronic (NYSE:MDT), Duke Energy (NYSE:DUK), Blackstone (NYSE:BX), Truist Financial (NYSE:TFC), American Electric Power (NASDAQ:AEP), Pfizer (NYSE:PFE), Verizon (NYSE:VZ), Devon Energy Corporation (NYSE:DVN) and Altria (NYSE:MO).

***

Disclosure: The author holds no positions in any of the stocks mentioned in this report.