For many gold bears the fall in the price of gold against the US dollar was a sure sign that faith in the international reserve currency was back. However as Americans rush to order their coins from the US Mint and others lobby their state government to return precious metals to the monetary system, it seems as though the US Dollar is most certainly not back in favour.

Earlier today Arizona Governor Jan Brewer vetoed a bill that would have made gold and silver legal tender in the state, stating ‘administrative and fiscal burden’ which may have ‘resulted in lost tax revenue’. Despite this disappointing result, there remain several US states looking to return to sound money, as we explained in a previous article.

We take a quick look at 5 reasons why Americans might just want to return to sound money.

1. It says so in the US Constitution

‘No State Shall make any Thing but Gold and Silver Coin a Tender in Payment of Debts,’ so reads the US Constitution.

In 1971, President Nixon closed the gold window and cut all ties to gold. Since that fateful decision the government and Federal Reserve has ignored a fundamental section of their Constitution. However Arizona and Utah are working to pay their debts and taxes in gold and silver.

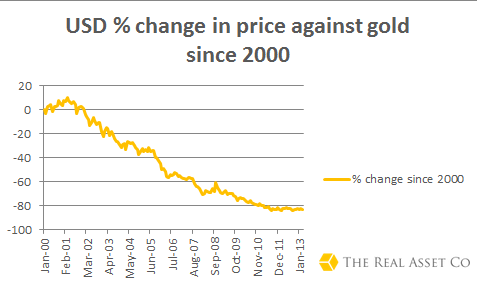

2. Lack of confidence in the US Dollar

As US citizens see their currency devalued they have two choices, either continue to use the US dollar as it loses value, or replace it with sound money, real money, that cannot be debased by the very same central bank who is debasing the sovereign currency. Put like that, it doesn’t seem to be too hard a decision.

Those who are campaigning for sound money in the US are doing so to protect themselves from dangers left in the trail of dollar debasement. A sentiment expressed by Republican Representative Glen Bradley, “In the event of hyperinflation, depression, or other economic calamity related to the breakdown of the Federal Reserve System … the State’s governmental finances and private economy will be thrown into chaos. “

US citizens don’t just have to live in Utah or Arizona to start voting with the money. The US Mint has seen record coin sales, particularly in the last month but significantly so since January.

3. Lack of confidence in the International monetary system

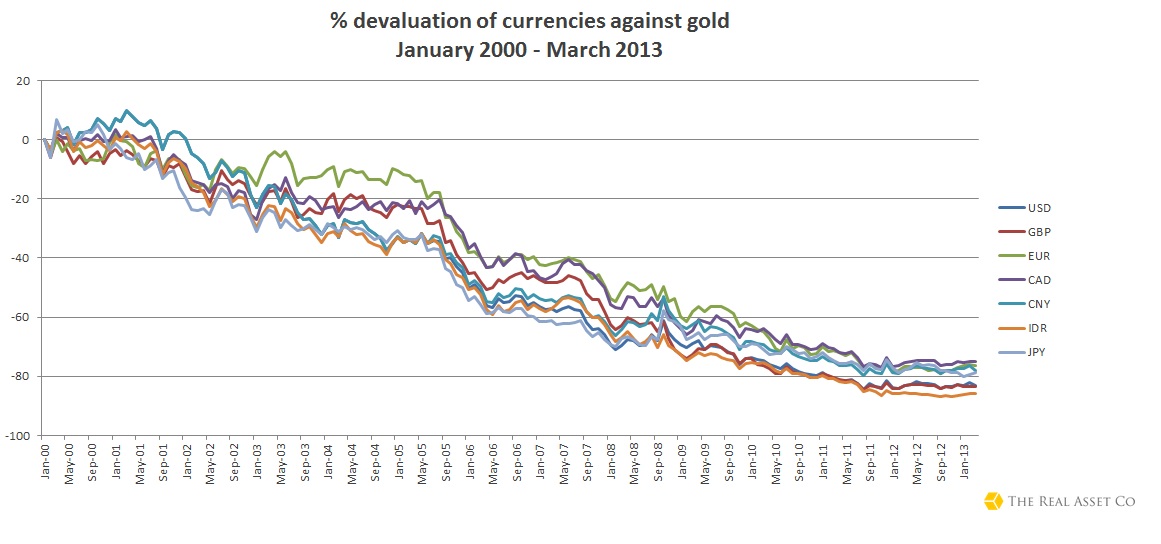

Clearly (see graph below) debasement is happening across the world.

Not only are currencies losing value against gold, but the efforts to debase currencies in order to boost economic growth aren’t exactly working. Central banks continue to push on with ‘temporary’ measures. In some countries we now hear whispers of ‘radical’ measures such as from Mark Carney here in the UK or over in Japan thanks to Abenomics.

As Eric Sprott so eloquently explained last year, ‘we are compelled to review the facts: Europe is currently experiencing severe bank runs, budgets in virtually every western country on the planet are out of control, the banking system is running excessive leverage and risk, the costs of servicing the ever-increasing amounts of government debt are rising rapidly, and the economies of Europe, Asia and the United States are slowing down or are in full contraction. There’s no sugar coating it and we have to stop listening to politicians and central planners who continue to downplay, obfuscate and flat out lie about the current economic reality… NOTHING the central bankers have done up to this point has WORKED.’

4. Following the BRICs’ lead

Whilst China, India and other Asian nations’ love for gold has been clear in the last month, after the fall in the gold price, this is not a new development. Gold purchases in the last decade have reached record levels in these countries, not just by individuals but also central banks.

In our recent The Real Asset Research Report we posited the idea that not only is the new BRICs’ bank looking reduce international dependency on the US dollar, but they’re also perhaps aiming to establish a gold-backed BRICs currency.

But a gold-backed BRIC currency is just an idea. In the meantime the currencies of the BRICs nations are being devalued (see previous graph) in response to this citizens are buying gold in their droves.

Taking China as an example, Voice of China reported earlier this week that China’s housewives are propping up the gold price having reportedly spent $16 billion on approximately 300 tonnes of gold. In 2001 when the Chinese government lifted its controls on the gold market, this promptly released a ‘pent up demand’ for the yellow metal. Gold demand for investment has increased by 14% a year since 2001, despite an increase in the gold price from $200 an ounce to $1600 an ounce.

The Chinese have not forgotten lessons from past generations that gold is money. It seems the Americans are regaining their memories too.

5. Liberty

Gold and silver have circulated through civilisations without the help of central authorities. What came first sound money or central banks isn’t exactly a chicken and egg question. Sound money naturally evolved, it was a liberated monetary system.

A fiat system has not been chosen by us, because we believe it is the best monetary system, instead it has been chosen by government and central banks in recent history. Its selection as our medium of exchange was not made by US citizens and therefore is a step towards the rescindment of liberty.

For central bankers and economists alike, gold and silver are clear defenders of liberty. Whilst official inflation remains apparently low, those saving and spending in dollars feel quite differently. Wealth is disappearing thanks to QE which amounts to wealth confiscation.

As Alan Greenspan wrote, “Gold and freedom are inseparable. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. Gold stands as the protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

Disclaimer: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

5 Reasons Why US States Are Keen To Return To Sound Money

Published 05/03/2013, 06:59 AM

Updated 05/14/2017, 06:45 AM

5 Reasons Why US States Are Keen To Return To Sound Money

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.