On Tuesday, January 24th, Las Vegas Sands (LVS) will release its third quarter earnings results after the bell. The company is a Zacks Rank 2 (Buy), and have a Value, Growth, and Momentum score of C.

Dave will look at Las Vegas Sands’ past earnings, take a look at what is currently going on with the company, and give us his thoughts on their upcoming earnings announcement.

Furthermore, Dave will uncover some potential options trades for investors looking to make a play on Las Vegas Sands ahead of earnings.

Las Vegas Sands in Focus

Las Vegas Sands Corp. is a hotel, gaming, and retail mall company headquartered in Las Vegas, Nevada. The company owns The Venetian Resort Hotel Casino, the Sands Expo and Convention Center, Venetian Interactive, an internet based venture, and Venetian Macao Limited, a developer of multiple casino hotel resort properties in The People's Republic of China's Special Administrative Region of Macao.

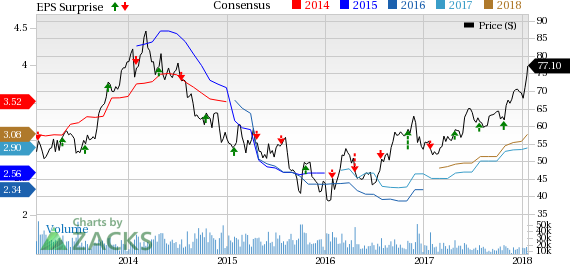

Las Vegas Sands is expected to report earnings at $0.77 per share according to the Zacks Consensus Estimate. Last quarter they beat earnings expectations by 14.93%. They reported earnings at $0.77per share, beating their estimate of $0.67. They have an average earnings surprise of 9.11% over the last 4 quarters.

Las Vegas Sands Corp. (LVS): Free Stock Analysis Report

Original post

Zacks Investment Research