On Thursday, January 9th, Delta Air Lines (NYSE:DAL) will release its fourth quarter earnings results after the bell. The company is a Zacks Rank 3 (Hold), and have a Value, Growth, and Momentum score of B.

Dave will look at Delta Air Lines’ past earnings, take a look at what is currently going on with the company, and give us his thoughts on their upcoming earnings announcement.

Furthermore, Dave will uncover some potential options trades for investors looking to make a play on Delta Air Lines ahead of earnings.

Delta Air Lines in Focus

Delta Air Lines, Inc. is a major American airline with its headquarters on the northern boundary of Hartsfield-Jackson Atlanta International Airport, within the city limits of Atlanta. Delta started operation by crop dusting and flying mail and then introduced passenger service. Delta's business is focused on making global connections, flying people and cargo throughout the United States and around the world. Delta Air Lines offers customers service to more destinations than any global airline with Delta and Delta Connection carrier service. Delta Air Lines and the Delta Connection carriers offer service to nearly 370 destinations on six continents. Delta has added more international capacity than all other U.S. airlines combined and is the leader across the Atlantic.

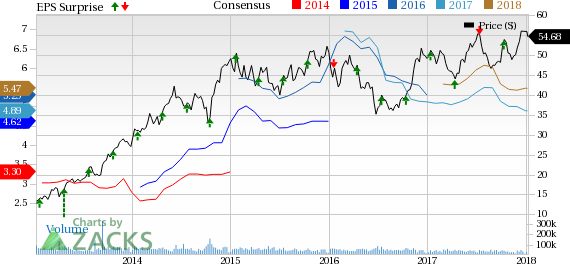

Delta Air Lines is expected to report at $0.90 per share according to the Zacks Consensus Estimate. Last quarter they beat earnings expectations by 1.95%. They reported earnings at $1.57per share, beating their estimate of $1.54. They have an average earnings surprise of 1.56% over the last 4 quarters.

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

Original post

Zacks Investment Research