On Thursday, American Express (NYSE:AXP) will release its fourth quarter earnings results after the bell. The company is a Zacks Rank 1 (Strong Buy), and have a Value, Growth, and Momentum score of B.

Dave will look at American Express’s past earnings, take a look at what is currently going on with the company, and give us his thoughts on their upcoming earnings announcement.

Furthermore, Dave will uncover some potential options trades for investors looking to make a play on American Express ahead of earnings.

American Express in Focus

American Express Company, together with its subsidiaries, provides charge and credit payment card products and travel-related services to consumers and businesses worldwide. It operates through four segments: U.S. Consumer Services, International Consumer and Network Services, Global Commercial Services, and Global Merchant Services. The company's products and services include charge and credit card products, as well as other payment and financing products; network services; expense management products and services; travel-related services; and stored value/prepaid products. Its products and services also comprise merchant acquisition and processing, servicing and settlement, merchant financing, point-of-sale marketing, and information products and services for merchants; and fraud prevention services, as well as the design and operation of customer loyalty programs.

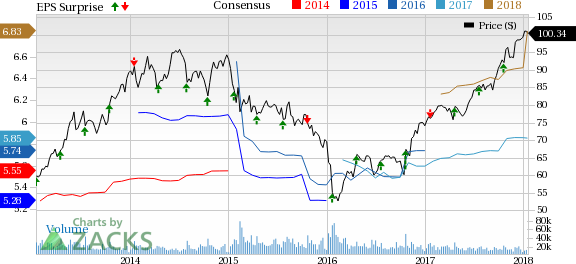

American Express is expected to report earnings at $1.54 per share according to the Zacks Consensus Estimate. Last quarter they beat earnings expectations by 2.04%. They reported earnings at $1.50 per share, beating their estimate of $1.47. They have an average earnings surprise of 0.07% over the last 4 quarters.