- Russia’s invasion of Ukraine has sent natural gas prices into the stratosphere.

- Now, Europe is racing to reduce its reliance on Russian energy, and the United States is ready and willing to lend a helping hand.

- A few stocks with ample free cash flows, stable balance sheets, and impressive capital returns are looking increasingly enticing.

Like their oil counterpart, natural gas markets continue to sizzle thanks to the invasion of Ukraine, Europe's over-reliance on Russian energy, and OPEC and its allies declining to offer relief.

U.S. natural gas prices (NG1:COM) pulled back 3.6% on Monday to settle at $4.833/MMBtu, reversing sharp overnight gains from Friday's $5.016 closing price as uncertainty over Russia's war with Ukraine gave way to forecasts for warmer weather in the U.S. European energy prices, as well as natural gas futures on the Dutch TTF, reached as high as $115/MMBtu before pulling back to ~$93.

However, the pullback could be short-lived, with Russia now threatening to retaliate against Western sanctions by shutting down gas exports. Russia supplies 40% of Europe's gas supplies.

For the first time since the invasion of Ukraine, Moscow has threatened to weaponize its energy exports in retaliation for Western sanctions. Alexander Novak, Russia's deputy prime minister, says his government has the "full right" to "impose an embargo" on gas supplies by halting gas supplies through the Nord Stream 1 pipeline with U.S. and European officials mulling a ban on Russian oil and gas imports.

The deputy PM has warned that Western countries could face oil prices of over $300 per barrel and the possible closure of the main Russia-Germany gas pipeline if they follow through on threats to cut energy supplies from Russia.

Novak added:

"It is absolutely clear that a rejection of Russian oil would lead to catastrophic consequences for the global market. The surge in prices would be unpredictable. It would be $300 per barrel if not more."

Novak says it would take Europe more than a year to replace the volume of oil it receives from Russia and added that Russia "knows where we could redirect the volumes to."

Meanwhile, OPEC continues to brush off Europe and the world's worst security crisis since WWII and says it will stick to its earlier plan for gradual output hikes. The OPEC+ coalition of oil producers says it will increase oil production by its monthly 400,000 b/d clip in April.

According to Energy Intelligence, Russian oil export flows have fallen by at least one-third—or some 2.5 million barrels per day—despite a discount of $11 per barrel versus dated Brent being offered for distressed cargoes of Russian Urals as traders and refiners continue to adopt self-imposed embargoes.

Refiners and banks are unwilling to do business with Russia due to the risk of falling under complex restrictions in different jurisdictions. Market participants are also concerned that measures directly targeting oil exports will soon arrive as fighting in Ukraine escalates.

In the case of OPEC+, the matter is not entirely in its hands. As we earlier reported, only a handful of OPEC+ members are in a position to rapidly ramp up production thanks to years of underinvestment.

Back in October, Amrita Sen of Energy Aspects told Reuters that only Saudi Arabia, the United Arab Emirates, Kuwait, Iraq, and Azerbaijan are in a position to boost their production to meet set OPEC quotas, while the other eight members are likely to struggle due to sharp declines in production and lack of investments.

With uncertainty rife in the gas markets, global gas and LNG demand robust, and U.S. gas prices trading at a fraction of their European counterparts, the natural gas thesis remains strongly bullish. Here are five stocks whose ample free cash flows, stable balance sheets, and impressive capital returns make them enticing.

1. Chesapeake Energy Corp

- Market Cap: $10.1B

- YTD Returns: 35.4%

Commodity price hedging is a popular trading strategy frequently used by oil and gas producers as well as heavy consumers of energy commodities such as airlines to protect themselves against market fluctuations. During times of falling crude prices, oil and gas producers normally use a short hedge to lock in oil prices if they believe prices are likely to go even lower in the future.

Unfortunately, hedging also means that these companies are unable to enjoy the benefits of rising gas prices and can in fact lead to hedging losses. However, some bold producers betting on a commodity rally hedge only minimally or not at all.

Tudor Pickering rates Chesapeake Energy Corp (NASDAQ:CHK) a Buy, saying the company remains one of the few producers that remain relatively unhedged.

This might come off as an odd pick given Chesapeake's history, but it somehow makes sense at this point.

Widely regarded as a fracking pioneer and the king of unconventional drilling, Chesapeake Energy has been in dire straits after taking on too much debt and expanding too aggressively. For years, Chesapeake borrowed heavily to finance an aggressive expansion of its shale projects.

The company only managed to survive through rounds of asset sales (which management is averse to), debt restructuring, and M&A but could not prevent the inevitable—Chesapeake filed for Chapter 11 in January 2020, becoming the largest U.S. oil and gas producer to seek bankruptcy protection in recent years.

Thankfully, Chesapeake successfully emerged from bankruptcy last year with the ongoing commodity rally offering the company a major lifeline.

The new Chesapeake Energy has a strong balance sheet with low leverage and a much more disciplined CAPEX strategy.

The company is targeting $2 billion of FCF over the next five years, enough to improve its financial position significantly.

CHK shares have nearly doubled since its March comeback.

2. Antero Resources

- Market Cap: $8.0B

- YTD Returns: 50.0%

Colorado-based Antero Resources (NYSE:AR) is the 3rd largest U.S. natural gas producer, pumping 3.2 bcf/d of natural gas from the Appalachian Basin where it owns 612,000 net acres of oil and gas properties sitting on 18,893 billion cubic feet (535 billion cubic meters) of estimated proved reserves.

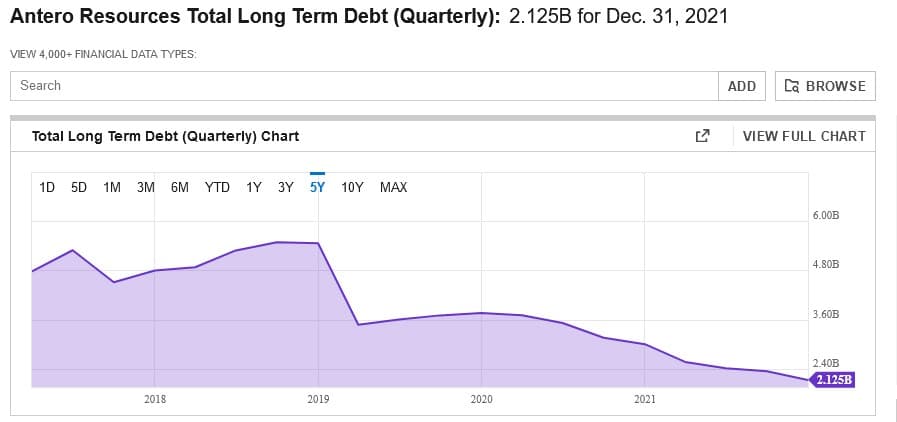

The company has been plagued by worries regarding its ballooning long-term debt. Luckily, the company has been able to pay down more than 50% of that debt which currently stands at $2.12B.

AR has initiated a $1.0B share repurchase program, good for 16% of market cap, and plans to return 25-50% of free cash flow to shareholders going forward (2021 free cash flow of $849m would result in ~5% buyback under the new scheme). Capex, including drilling and completion capital is budgeted at $675-700m, good for a mere 5% Y/Y increase, while 2022 production was guided to 3.3bcfe/d (midpoint), essentially flat with 2021 levels.

Management plans to generate ~$1.6b of free cash flow at strip commodity prices, which would allow the Company to repurchase ~10% of its shares at current prices. Marking its second year of maintenance capital, and having hit debt reduction targets, Antero is yet another E&P shifting its focus to shareholder returns.

3. EQT Corp

- Market Cap: $9.9B

- YTD Returns: 21.6%

Shares of Pennsylvania-based EQT (NYSE:EQT) are up 75.1% YTD, making the stock a top-performer in the mid-cap oil and gas sector. EQT is a pure-play natural gas company with ~19.8 trillion cubic feet of proven natural gas, NGLs, and crude oil reserves across approximately 1.8 million gross acres.

EQT is no longer in growth mode and considers acquisitions as its second act in a bid to gain economies of scale and help it return capital to shareholders, though its high-profile merger with CNX Resources (NYSE:CNX) failed to sail through.

EQT also is considering a path to net-zero status, starting by replacing equipment that runs on fossil fuels with electric-powered devices as well as using real-time sensors and other technologies in a bid to cut drilling time and energy. ESG plays within the fossil fuel sector tend to go down well with investors.

EQT continues to be a leader in the field of advanced horizontal drilling technology, designed to minimize the potential impact of drilling-related activities and reduce the overall environmental footprint.

EQT has recently underperformed its peers due to a poor hedging strategy. Luckily, the company is only 40% hedged for 2023 thus giving it better exposure to higher commodity prices as the energy crisis continues to bite.

4. Ovintiv

- Market Cap: $12.4B

- YTD Returns: 49.6%

A frequently off-the-radar name, Denver, Colorado-based Ovintiv (NYSE:OVV) has been seeing undeniable positive prospects. Ovintiv, together with its subsidiaries, engages in the exploration, development, production, and marketing of natural gas, oil, and natural gas liquids. It operates through USA Operations, Canadian Operations, and Market Optimization segments.

OVV has been on a tear ever since CitiGroup upgraded shares to Buy from Neutral, citing the company's improved balance sheet and leverage ratios, including the likely achievement of its $4.5B debt target by year-end 2021.

Although OVV shares have climbed 75% over the past 12 months, they still have additional upside thanks to higher oil prices and sees the company having attractive free cash flow at its updated price deck.

OVV stock appears ideal for investors seeking mid-cap E&P exposure without going too much further on the risk curve.

5. Cheniere Energy

- Market Cap: $35.5B

- YTD Returns: 37.1%

The global energy transition was in full swing well before the Ukraine crisis, yet natural gas markets remained in decent shape thanks to natural gas being increasingly viewed as a bridge that will facilitate the transition from coal to renewable energy, especially in power generation.

Even better: Liquified Natural Gas (LNG) managed to continue recording demand growth even during times of high levels of LNG market volatility with both extreme oversupply and extreme tightness during the course of the year.

Cheniere Energy (NYSE:LNG), a leading pure-play LNG producer, is perfectly positioned to benefit from these trends.

With the global shift towards cleaner energy sources in full swing, LNG and natural gas bring the benefits of being the cleanest-burning hydrocarbon, producing half the greenhouse gas emissions and less than one-tenth of the air pollutants of coal. Consequently, LNG demand is expected to grow 3.4% per annum through 2035, with some 100 million metric tons of additional capacity required to meet both demand growth and decline from existing projects.

Natural gas use in power generation capacity is expected to grow by an additional 300 GW by 2040, equivalent to 300 million tonnes of LNG, with the majority of that demand coming from Asia, especially China, India, and other Southeast Asia countries.

That marks natural gas/LNG as the only fossil fuel that will experience any kind of growth over the next two decades. Goldman sees a strong ramp in contracted U.S. LNG export capacity and solid exposure to spot pricing for remaining volume helping Cheniere record free-cash-flow growth of ~50% from 2021 levels.

The 60-year liquefied natural gas industry has a new hierarchy in place, and it's opening up new trading opportunities. For the first time ever, the United States has become the world's largest LNG exporter, establishing itself as a bona fide natural gas superpower.

From a position of relative obscurity just five years ago, the U.S. LNG sector has rapidly risen through the ranks to challenge the heavyweights. U.S. liquefied natural gas (LNG) export capacity has expanded rapidly since the Lower 48 states first began exporting LNG in 2016. In 2020, the United States became the world's third-largest LNG exporter, behind Australia and Qatar.

And now, the United States has become the world's biggest liquefied natural gas (LNG) exporter as deliveries surged to energy-starved Europe. According to ship-tracking data compiled by Bloomberg, output from American facilities edged above Qatar in December after a jump in exports from the Sabine Pass and Freeport facilities, with Cheniere Energy saying last month that a new production unit at its Sabine Pass plant in Louisiana produced its first cargo.

In the same vein, China has become the world's biggest LNG importer, managing to overtake Japan for the first time since the latter pioneered the industry in the 1970s.

It's a major tailwind for Cheniere Energy, given its already strong market share.