Higher uncertainty and weaker global growth strengthen the case for further Fed easing

On Friday, we updated our Fed call and we now expect five more 25bp cuts (one at each of the next five meetings), taking the target range to 0.75-1.00% in March.

In this presentation, we illustrate our Fed view with charts. For the full analysis, see FOMC Research –New Fed call: Five more from Fed, 15 August.

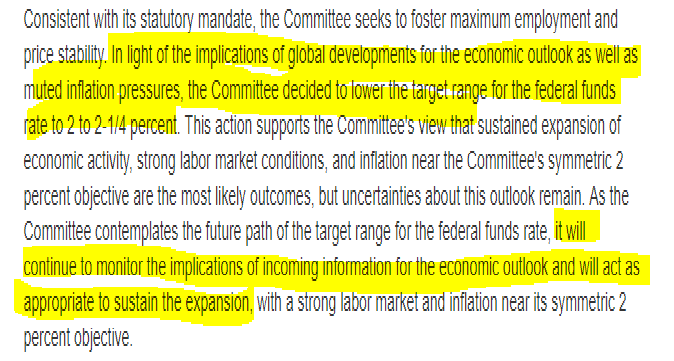

Three important factors for the Fed cut in July:

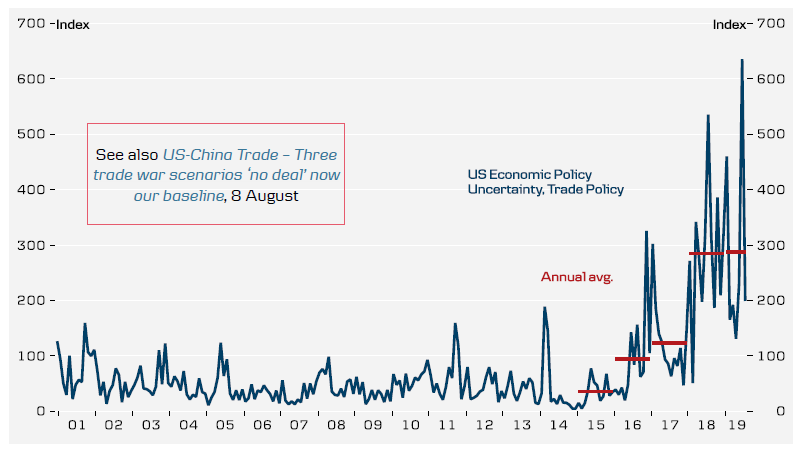

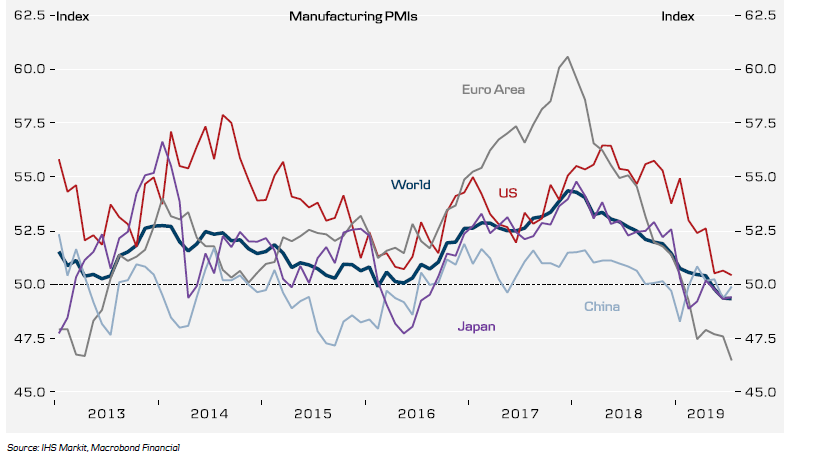

1.Higher global (trade) uncertainty (worsened since July).

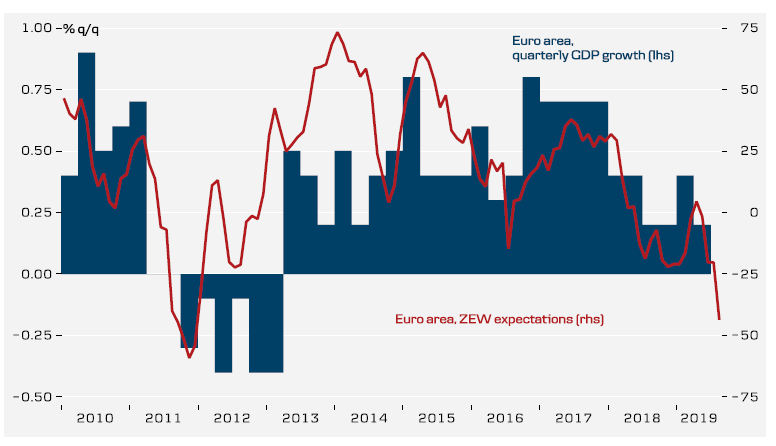

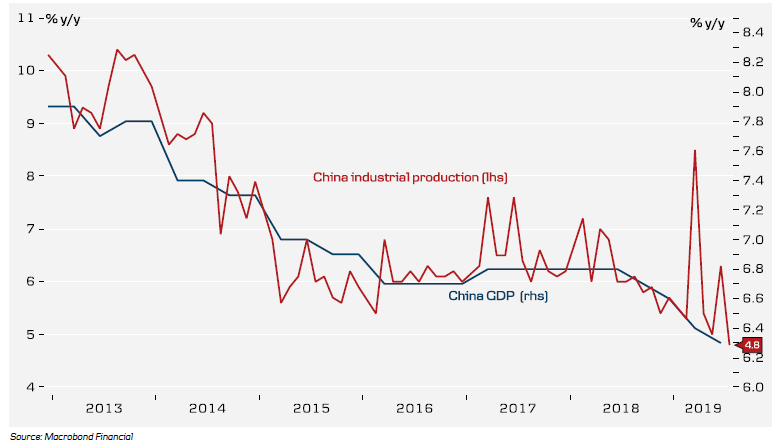

2.Weaker global growth (worsened since July).

3.Inflation remains subdued (neutral since July).

The following is from the FOMC statement on 31 July 2019 (our own highlights).

Trade policy uncertainty extremely high – now difficult to see a deal on this side of the US presidential election (new call)

Slower GDP growth and increasing pessimism in the euro area

Chinese industrial production growth in July weakest since 1990

US manufacturing not immune to what happens in the rest of the world

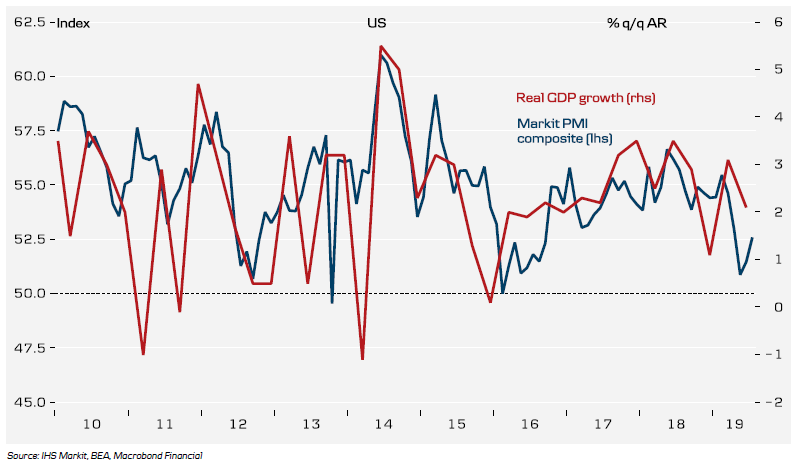

US growth has peaked, according to PMIs

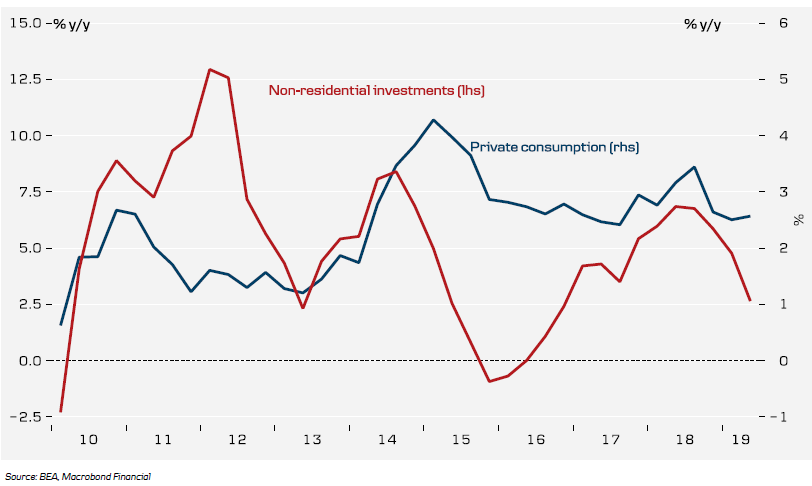

Private consumption growth solid, non-residential investments under pressure

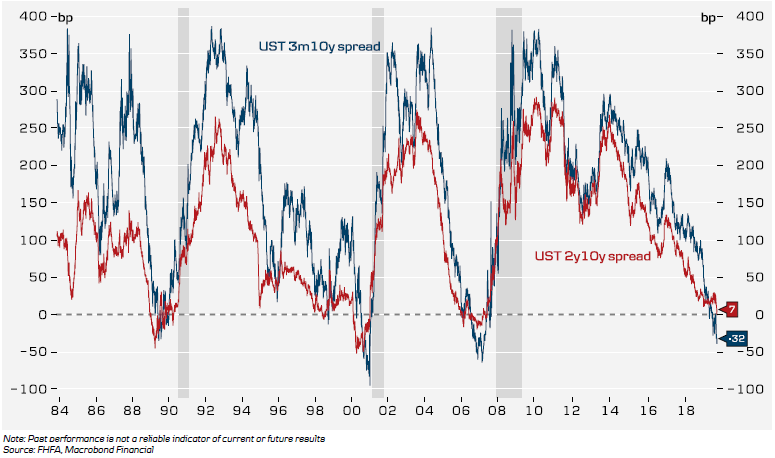

Yield curve inversion is a concern (considered a good recession indicator 1-2 years down the road)

To read the entire report Please click on the pdf File Below..