Earnings will continue to roll in the week of August 12 from companies such as Jd.Com (NASDAQ:JD), Walmart (NYSE:WMT), Cisco (NASDAQ:CSCO), Alibaba (NYSE:BABA), and NVIDIA (NASDAQ:NVDA). Here are predictions about where their stocks could head next.

JD (JD)

JD will report results on Tuesday morning before the start of trading. The stock is in the crosshairs of the China/U.S. trade conflict, with the rise and fall of the Chinese yuan having the most significant impact. The stock has the makings of what seems to be a double top, a bearish reversal pattern. $26 has been a considerable level of support, and it appears the stock may be due to fall below that support level and drop towards $24.75.

Look at how closely the JD and the yuan follow each other.

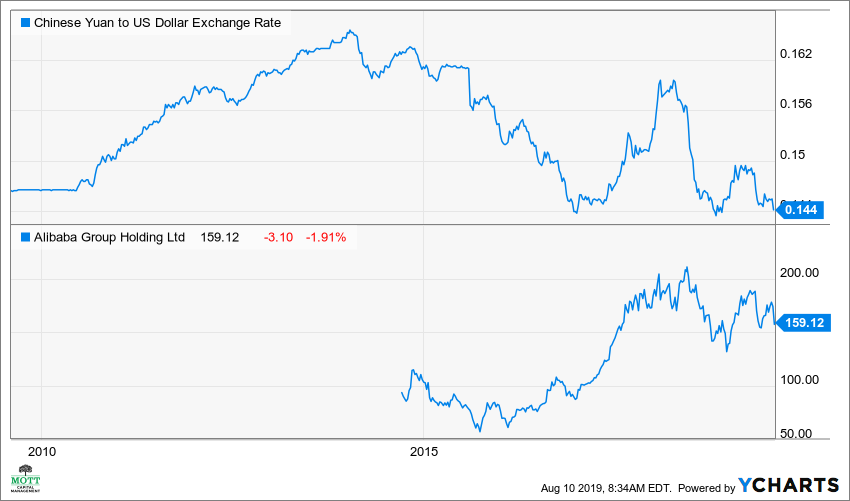

Alibaba (BABA)

That same relationship between Alibaba and the yuan also exists. It is something at very least worth monitoring.

The chart is weak and recently fell out of a rising wedge. Support comes at $151, and then at $141.

Walmart (WMT)

Walmart will report results this week on August 15. For Walmart, it comes down to 2 things, eCommerce growth and how tariffs will affect margins. The chart shows some short-term weakness is possible with a drop to $103. However, the long-term setup appears bullish with the stock channeling higher towards $120.

Cisco (CSCO )

Cisco will report on August 14, and there shouldn’t be many surprises. The company already noted last quarter that the effects of the tariffs were baked into earnings guidance. The stock has found support at $52.25, and needs to hold here; otherwise, the downside risk is to around $49. However, I think the company reports better than expected results and shares rise back towards the highs at $57.25.

Nvidia (NVDA)

Finally, Nvidia will report on August 15, and the stock has been consolidating the last few months between $140 and $190, making higher lows and lower highs. Earnings expectations are pretty low this quarter, so it allows the company the opportunity to beat. I think the stock heads higher following results towards $170.