Five days cannot tell you much about the future direction of market-based securities or their respective asset classes. They may, however, be able to provide insight into the more pressing issues or lingering worries on the minds of investors.

For example, many folks believe that Europe’s sovereign debt crisis effectively ended in 2011 when the head of the European Central Bank (ECB) declared it would do “whatever it takes” to preserve the euro. Yet the four worst borrowing-n-spending offenders in the euro-zone – Portugal, Italy, Greece and Spain – chalked up the poorest 5-day performances of any unleveraged vehicles in the entire ETF universe. Perhaps the “PIGS” problem still has a way to go before reaching a resolution.

Europe’s Debt-TO-GDP Offenders Fall Off Their Horses Again |

||||||

| 5-Day % | ||||||

|

-12.2% | |||||

|

-7.5% | |||||

|

-7.4% | |||||

|

-6.2% | |||||

|

-3.5% | |||||

In truth, not everyone concurs that peripheral countries in Europe are going to face debt scrutiny once again. Heck, Argentina has technically defaulted on its sovereign bonds, while stocks in Global X Argentina (NYSE:ARGT) have fared better than the ETFs for Portugal, Italy, Greece or Spain. Does the selling have to do more with the Russia-Ukraine conflict, then? That may be an easy target, but my sense is that deflation and headline bank bailouts are reigniting old doubts about the euro-zone’s ability to put recession in the rear-view mirror.

Now let’s shift to five of the best performing ETFs (unleveraged) over the prior trading week. Those that produced positive returns come from outside of the stock world.

Are These ETFs The Safest Of Havens? |

||||||

| 5-Day % | ||||||

|

4.5% | |||||

|

2.3% | |||||

|

2.3% | |||||

|

2.0% | |||||

|

0.9% | |||||

The easiest analysis would explain away the gains as a function of recent geopolitical tensions – Ukraine, Gaza and now Iraq. However, that would fail to account for the reality that long bonds in ETFs like PIMCO 25+ Zero Coupon (NYSE:ZROZ) and Vanguard Extended Duration (NYSE:EDV) have been atop the leader-board from the very first day of 2014. Perceived safe haven currencies like the Japanese yen and perceived safer haven commodities like Gold have also been winning since the initial trading session of this year. Only the singular food commodity (wheat) can be dismissed as a 5-day oddity.

So what is really happening, then? There is a slow leak in the front tire of the economic tricycle — a slow leak in the expansion of credit. Businesses and consumers (to a lesser extent) have been chowing down on easy money. However, the U.S. Federal Reserve is looking to make it a bit more challenging to borrow and spend. In a healthy economy, that might not be such a big deal. On the other hand, if credit growth wanes, where will additional economic growth emanate from? It has yet to come from median family income because inflation-adjusted wages are in the same place that they were back in 2009. Nor is it coming from employees in the workforce as the percentage of the working-aged adult population remains near its lowest levels in nearly 40 years. In essence, if the U.S. economy does not get its credit growth, its unlikely to see its gross domestic product (GDP) maintain modest expansion. That spooks stocks; it sends investors flocking to “risk-off” assets.

In the volatile week, not every “safer” asset flourished, nor did every “risky” asset nose-dive. These five stock ETFs held their ground rather nicely:

Why Is The Demand For Exposure To Asian Stocks Rising? |

||||||

| 5-Day % | ||||||

|

2.4% | |||||

|

1.7% | |||||

|

1.5% | |||||

|

0.8% | |||||

|

0.7% | |||||

What may be particularly impressive about these results is the ability for investors to look past geopolitical troubles around the world as they focus on favorable technical indicators as well as undeniable fundamental value. I am not suggesting that Asian stocks would not fall in a prolonged correction or bearish turn of events for developed market equities. However, the severe three-year underperformance for the region provided a bit of a buffer against exogenous misgivings.

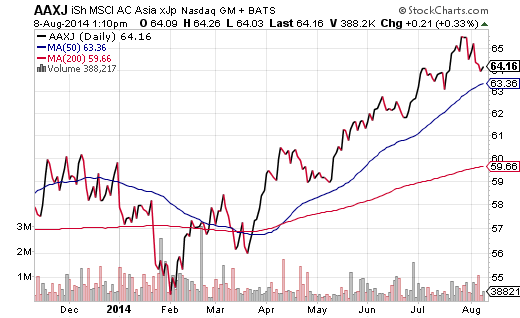

The affinity that I have maintained for Asian equities since April involved desirable fundamentals combined with attractive technical price movement. Fortunately, those conditions still exist for regional assets such as iShares MSCI Asia excl Japan (NASDAQ:AAXJ). Perhaps I explained it best in commentary from May (Bargain ETFs Are Sitting In Plain Sight.) I wrote: ” Getting AAXJ for the same price as one might have paid three year earlier is a reasonable risk, particularly when one understands how to use stop-limit loss orders.” Granted, AAXJ may be 6% higher than what one would have paid for shares back in May of 2011; it may be 5% higher than what you would have paid in May of 2014. Nevertheless, I view Asian stocks as a bargain that one would be wise to incrementally add to a diversified portfolio.