Whether it's a bubble, or viral adoption, or something else, I think most would agree that the rise of Bitcoin and cryptocurrencies in general has been simply astonishing. There is very little precedent (if any) for the pace and magnitude of it. And it brings into focus a couple of issues like the often ephemeral and fluid nature of "fundamentals" (the key fundamental variable for Bitcoin is probably how many people end up using it). But while I won't go into detail on the fundamentals or speculate on the end game for Bitcoin and the various alt-coins, I do have a set of very interesting charts that put the rise of Bitcoin into perspective.

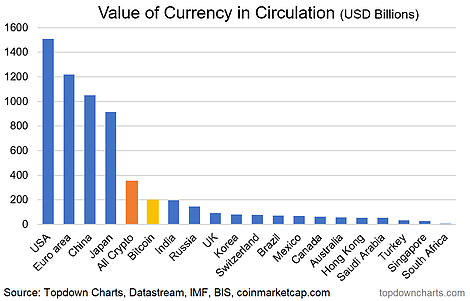

1. How does bitcoin rank? This chart shows the value of currency in circulation across some of the world's major economies. The data comes from the Bank for International Settlements, and basically Bitcoin is the 5th largest currency by value at this time. [although note: it could change by the minute given the volatility of the bitcoin price!]

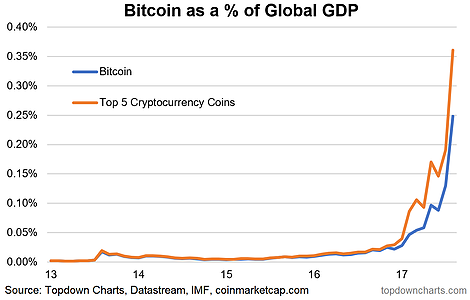

2. Bitcoin in perspective: Another key chart that puts it in perspective is to show how Bitcoin compares to world GDP - there have been some reports that Bitcoin total market cap is now larger than certain economies and we saw in the previous chart how it ranks vs other currencies, but this one shows that the total value of Bitcoin is now 1/4% of world GDP, and it's higher if you include the various other crypto-coins.

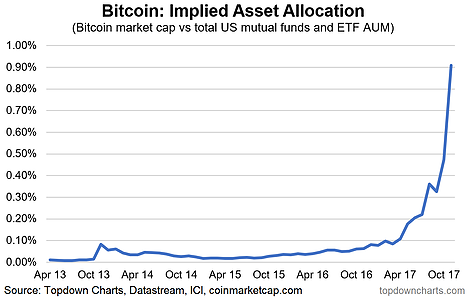

3. Bitcoin allocations? Taking a similar approach, here's how it compares to the total value of assets under management in US mutual funds and exchange traded funds. While it is an incomplete view, as Bitcoin is a global phenomenon rather than a US-only thing, the punchline is the "implied asset allocation" is almost 1% and that brings it close to some (at least sub-sets of) more traditional asset classes.

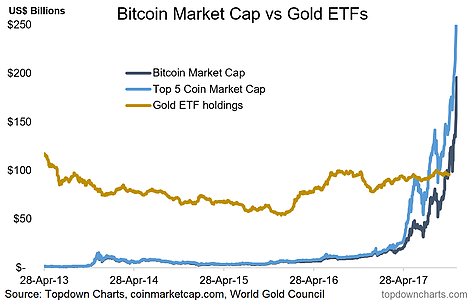

4. Bitcoin vs Gold: I should first point out that obviously the total value of gold in existence is vastly greater than that held by ETFs, but given Bitcoin is electronic and easily tradeable, gold ETFs present a more fungible or closer equivalent for comparison purposes. That said, the total market cap of Bitcoin and the top alt-coins is significantly higher than the total amount of gold held in exchange traded funds.

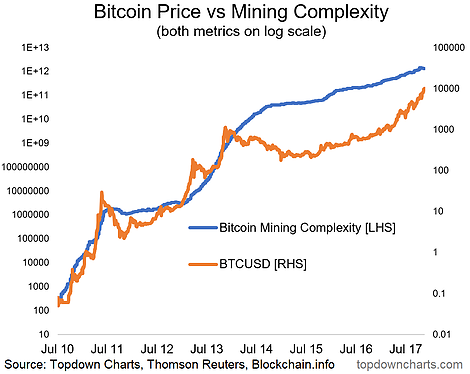

5. Mining complexity: If there is one thing that has grown faster and higher than the price of Bitcoin, then it's Bitcoin Mining Complexity. This makes sense because a higher Bitcoin price creates an incentive for more people to start mining and invest more in Bitcoin mining technology. The price of Bitcoin, the level of adoption, and competition among miners are among the factors relevant in this relationship and it is very much a self-reinforcing feedback loop.

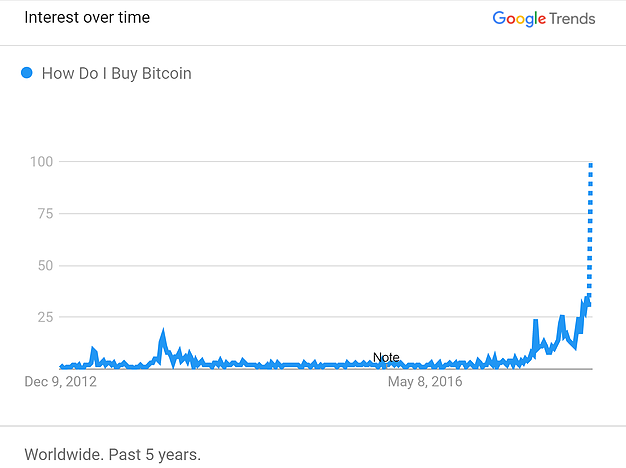

BONUS CHART: The final chart is a bit of a fun one which shows the amount of search activity on Google) for the term "How Do I Buy Bitcoin" - and it just goes to show... depending on your opinion, how much of a mania it is or how viral the adoption is becoming! (and by the way, both viewpoints could be right).