Shares of Gilead Sciences Inc, (GILD), Netflix Inc, (NFLX) and Tesla Motors Inc, (TSLA) have rocketed to record peaks. The S&P 500 is on track for its best monthly performance since October. And the overwhelming majority of CNBC commentators assure viewers that the bullish case for stocks rests on a solid foundation.

While there may not be a compelling reason to abandon broad market equity exposure in developed markets like the United States and Europe, risk-off safety seeking is on the rise. Inflows into bonds and precious metals have helped push prices of both asset classes significantly higher in 2014.

In 2012 and in 2013, economic data did not require excuses about weather patterns. The percentage of companies beating earnings expectations rarely disappointed. And monetary stimulus had never been more accommodating. Today, the economic news disappoints regularly, earnings growth appears to be decelerating and the Federal Reserve is reining in its electronic dollar creation. It follows that many investors still feel good about purchasing the dips, yet they are also acquiring risk-off investments while simultaneously dumping emerging market equities.

If January’s sell-off and February’s rebound suggest anything, it is the fact that 2014 figures to be a rockier road. Similarly, here are 5 ETF indicators that point to more choppiness ahead:

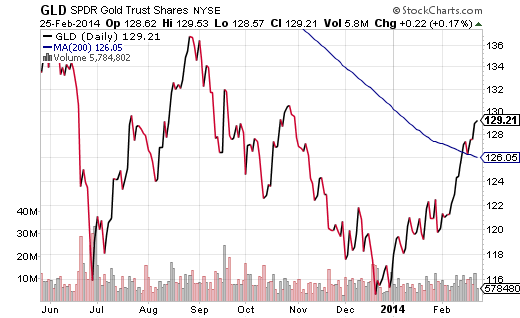

1. SPDR Gold Trust (GLD). Most in the media have been bashing the yellow metal for years. Scores of forecasters had been projecting that the spot price would drop to $1000 per ounce or less by the end of 2014. Instead, GLD is up more than 10% year-to-date near $1350 per ounce, while analysts have scrambled to upwardly revise their 2014 estimates. More importantly, the price of GLD crossed above its 200-day moving average on the upside for the first time in more than 12 months.

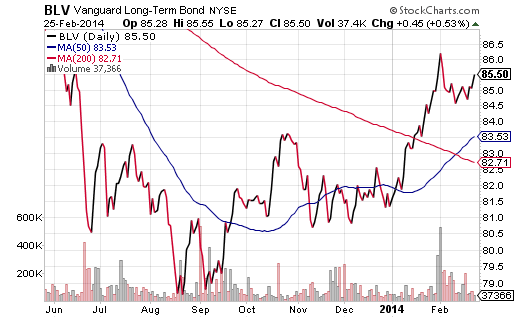

2. Vanguard Long-Term Bond (BLV). The herd had all but declared the death of bonds at the end of 2013. I challenged that conventional wisdom in my article about lower interest rates in 2014. Indeed, one would expect the Vanguard Long-Term Bond ETF, (BLV) to be an unloved outcast if rising rates were the predominant fear right now. Instead, the short-term trendline for BLV (a.k.a. 50-day moving average) has climbed above the long-term trendline (200-day) in what is often referred to as a “golden cross.”

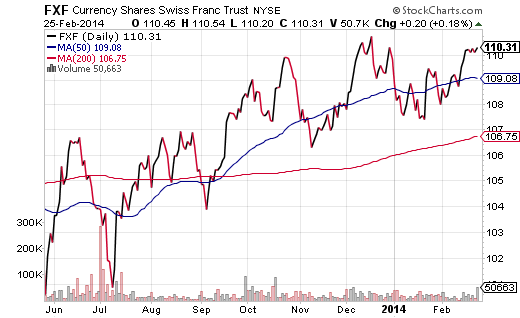

3. CurrencyShares Swiss Franc (FXF). There are not a lot of currencies that investors gravitate to during times of uncertainty. The Swiss Franc tends to be one of those currencies. Not only is FXF approaching a new 52-week high, but volume has been picking up as well.

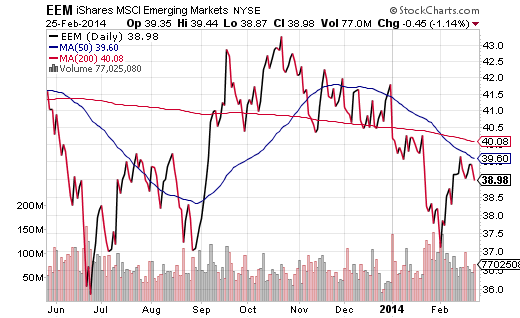

4. iShares MSCI Emerging Markets (EEM). It is true that developed world stocks decoupled from emerging market stocks in 2013. That said, one would be hard-pressed to find another year where the S&P 500 pole vaulted 29% higher while the MSCI Emerging Market Index logged a negative -6%. The point here is that if corporations in countries like China, India and Brazil crater in 2014, they are more likely to drag on developed world stock funds the way that they did in January. Recently, EEM experienced a dreaded “death cross” with its 50-day trendline crossing below its 200-day moving average.

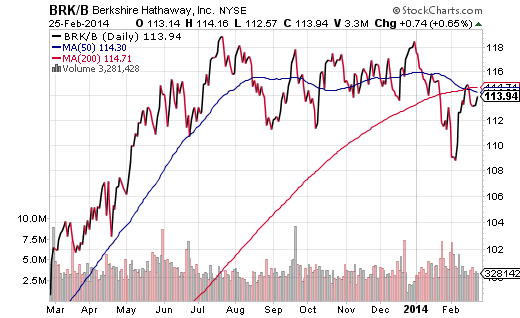

5. Berkshire Hathaway (BRK.B). Yes, technically the Oracle of Omaha’s holding company is not an exchange-traded vehicle nor a mutual fund. Nevertheless, BRK.B often serves as a barometer on investor sentiment. In fact, it is rare for a bull market to be healthy when it is leaving Warren Buffett behind. The price of BRK.B has been stagnant for 9 months. Moreover, BRK.B is also the unfortunate recipient of the unkind chart pattern known as a “death cross.”

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.