- The only thing certain about Q4 is uncertainty and that volatility is rising.

- These economic trends will be drivers of daily action this quarter.

- Oil prices and inflation are the biggest risks.

The only thing to be sure of as Q4 2023 begins is uncertainty. It is uncertain if inflation is tame, if the Fed is finished hiking rates if earnings growth will be as robust as expected, and if the market will move higher or lower. Investors need to be aware of the forces driving the market to be prepared for what may come. Investors will have opportunities regardless of whether the broad market moves up or down in Q4.

The Labor Market Is Normalizing

The labor market data has been mixed with numerous signals of impending doom all year, but none have borne fruit. The takeaway is that the labor market is normalizing to levels in alignment with the pre-pandemic period, and those times were decent, verging on robust. What investors should expect in Q4 is for normalized trends to take hold, including steadily increasing unemployment levels as seasonal jobs are shed. This is not a red flag unless total jobless claims spike above 2.25 million at the high, from the 1.669 million reported for the 1st week of September. The high should be reached in late December and reported in early January.

On the hiring end, hiring should hold steady near 150,000-200,000 through the end of the year. Historically, December, January, and February tend to be solid hiring months for non-seasonal employment. In this scenario, wage inflation will persist in the 4% to 5% range.

Inflation Will Be Persistent

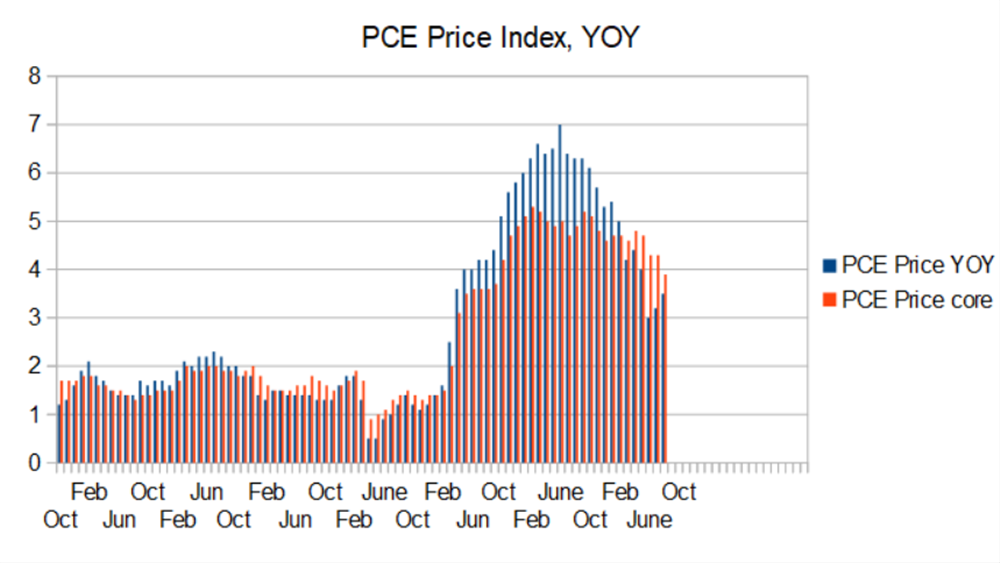

The inflation data does not align with a downtrend, at least not yet. The latest data suggests inflation is accelerating and may increase at the core level over the next 2 months. The PCE data shows headline consumer inflation up 0.4% MoM from the previous 0.2% and the YOY figure accelerating by 0.2%. This is due to higher oil prices not showing up in the core figures, but that will come. This means consumers can expect inflation to hold steady in the high 3% to low 4% range and possibly accelerate as the season progresses. This will cut into consumer spending power and keep the FOMC's foot on the economic brakes.

Persistent inflation means the Fed will stay hawkish. The odds of another interest rate hike are still iffy, but it cannot be ruled out completely. Regardless, the FOMC doesn't expect inflation to hit its target of 2% until 2025 or later, and it will keep rates higher than normal until then.

The Housing Market Is Slowing: Home Builders Loving It

High-interest rates have shackled the existing home market. The latest data shows pending sales, a leading indicator of existing sales, down 19% YOY and outpacing existing sales by several hundred basis points. This suggests that the existing home market's slowdown is worsening because of interest rates. The rate on a new 30-year mortgage is more than 8% for many would-be sellers and a prohibitive factor when existing homes are leveraged at much lower rates.

While bad news for realtors, homeowners, and the home improvement market, it's great news for home builders. They are supported by historically low inventory and pent-up demand that has the industry on the verge of returning to growth.

Oil Prices Are Trending Higher

The price of WTI entered Q4, pulling back from recent highs, but a reversal is not expected. OPEC+ Russia has the oil market skewed toward higher prices and is keeping global production below demand. The signs of shortfall have increased, and US officials predict a nearly 230 million daily deficit. The bottom line is that consumers will be paying more for heating oil and gasoline, and soon, higher energy prices will be seen in the inflation data. Energy stocks are trending higher; some may break out to new highs soon.

Retail Sales Will Be Sluggish

Retail sales are expected to grow only by mid-single-digits this holiday season. The biggest cause of the slowdown is the decline in YOY inflation, so the forecast may be cautious. The volume will be flat to slightly higher, with the rest of the increase driven by pricing. Digital will be the hot spot and may grow by low single digits. Consumers will be focused on bargains, so the off-price retailers may see some strength.