With more than 200 cryptocurrency exchanges, the market becomes extremely competitive. To stand out from the crowd, exchanges have to come up with new products like derivatives, fixed income, tokenized assets, and portfolio tokens. We picked five exchanges that offer unique products to their users.

Derivatives on crypto

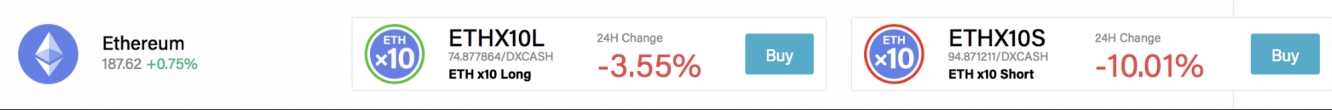

Since Okex introduced futures and perpetual swaps in late 2018, there is no shortage in derivatives on various exchanges. These derivatives have two use cases. The first one is leveraging the returns. That is, whenever a cryptocurrency changes by 1% the investor gains or loses 1% times leverage. So, if you get 100x leverage and buy the asset, you can double your investment, should the asset go up by 1%. The problem is you lose your money if it goes down.The second use case is shorting. That is, when the crypto goes down, you get profit on your short position. Always mind the cost of funding and other associated charges. In the screenshot below long 10x levered ETH contract on DX.exchange loses 3.55% despite a 0.75% gain in the underlying Some companies are taking this to the next level and offer their clients a tool to bet on volatility, regardless of market direction. With volatility cards from BitMax users can profit, when the return of the asset ends up in a certain range. This offer makes BitMax stand out from now-common directional levered products. Traders can choose not only the range of return but also the time frame: ten minutes, one hour or one day.

Fixed income deposits

Although crypto exchanges are all about trading and it is not recommended to store idle cryptos there, some exchanges now offer interest on deposits. The offer is simple: lock up your crypto with us for several months and get paid for that.

This offer found its client and CoinTiger had to temporarily stop accepting new deposits to this program.

10% per annum in USD is considered sky-high level in the fiat world, but it’s perfectly acceptable in crypto, thanks to the high cost of funding on derivatives.

It’s interesting that Binance had to play catch-up here and introduced lending functionality only this August. That said, all three lots were sold out shortly after the launch.

Indeed, the concept looks very compelling to users: passive income in crypto is the dream of any HODLer. Also, thanks for getting out the middleman and profitable business model, exchanges offer better rates than independent companies.

Tokenized assets

Putting real assets on the blockchain was the buzzword of 2018. Not everyone succeeded. Those who did, now offer investors returns of real-world assets.

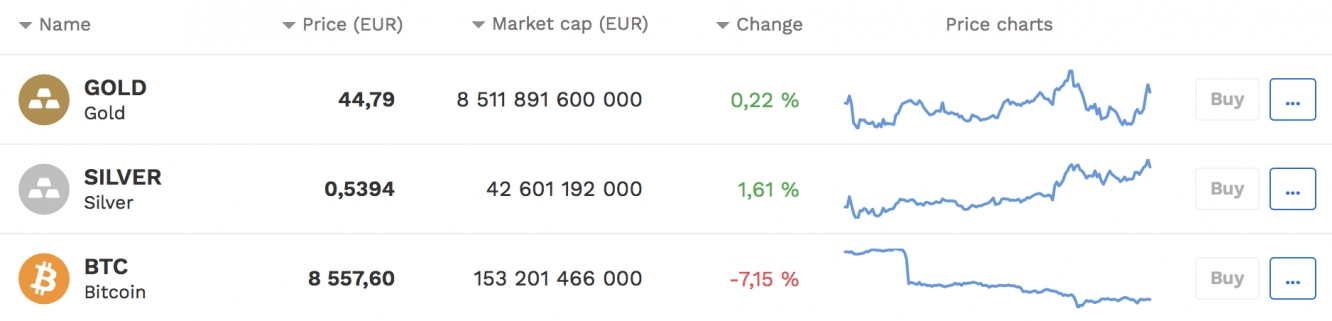

BitPanda tokenized gold and silver so that the users can trade them as a safe haven amid market turbulence like in the screenshot below:

It’s good to have non-crypto assets in the portfolio to mitigate the risk of sharp declines. Note, that BTC price in the picture is in euros, not dollars.

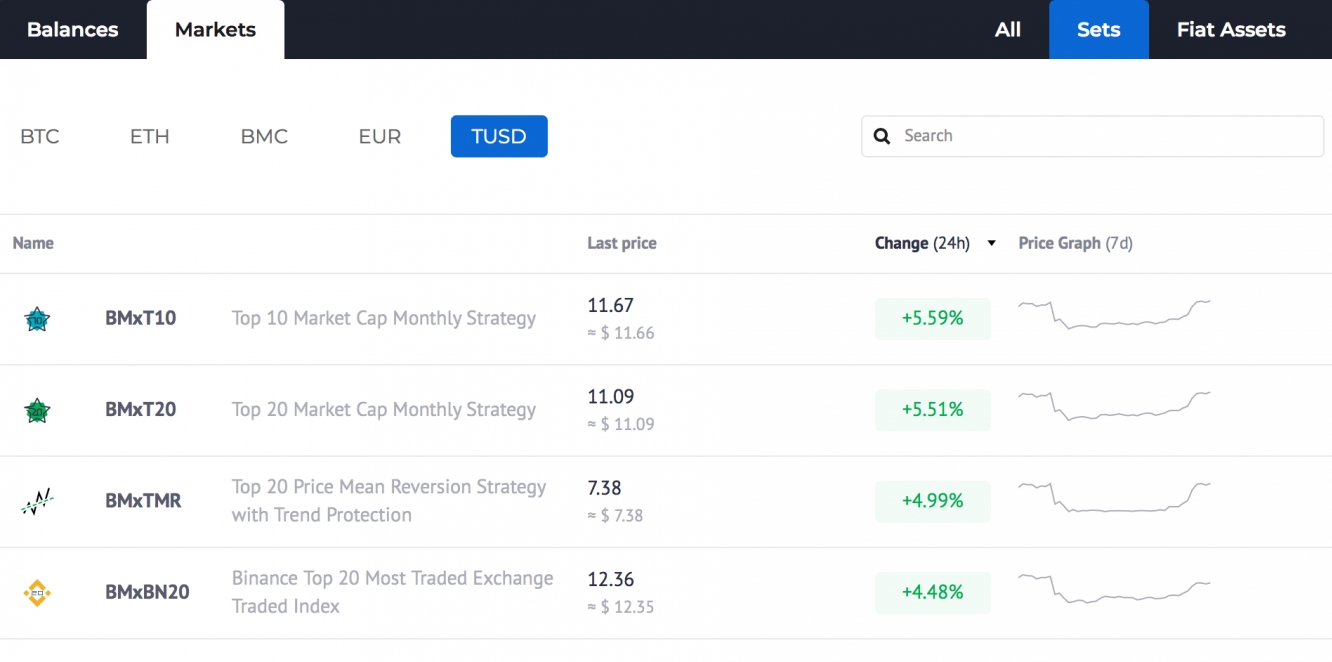

Another company, Blackmoon, pushed the concept further by offering stocks, including access to IPOs, and proprietary portfolios in addition to crypto exchange functionality. With portfolios or sets as the company calls them, traders can trade multiple stocks or cryptos as a single token. It is an open question whether there is a way to arbitrage between a set and the tokens it includes.

Most of the traders have more than two active accounts with different exchanges. With crypto pairs and liquidity harmonizing between the exchanges, new products and services become the only way to differentiate. Here is your list of 5 exchanges that innovate with products:

- On BitMax traders could bet on the amplitude of market movements or hedge their positions with volatility cards.

- With CoinTiger account investors and traders could get up to 20% annualized on BTC, USDT, and bitCNY.

- Binance has always been the headliner and introduced lending in BNB, ETC, and USDT, although with lower rates.

- With BitPanda account investors can add precious metals to their crypto portfolio and use it as a hedge from market meltdowns.

- On Blackmoon traders can trade entire crypto portfolios in one trade to save on fees or to exploit arbitrage between portfolio and the tokens it includes.

Leave your comments, what new products you recently used on crypto exchanges.