In up years like 2013, there is an interesting phenomenon which we like to take advantage of: buying shares of quality stocks that have taken the biggest hits during the year and are ripe for tax-loss selling to offset gains in other holdings. To see how this works, look at the Dow’s worst performer in 2012, Hewlett Packard (HPQ).

From its November low to the end of January 2013, just two months, it rose 47%. As long as we stick with quality firms, this has been a particularly successful year-end/new year strategy for us for many years. Here are my top 5 picks for tax season bounce-back this year. All have fine balance sheets and profitability and growth profiles:

Titan International (TWI) is down about 33% in 2013. The manufacturer of tires, wheels and brake assemblies for the agricultural, earthmoving, construction, military and timber industries continues to suffer from a build-up in tire inventory in the farm and construction industry. When agriculture and mining were doing well, tire sales were too. But excess inventory that has been dropped into the aftermarket from the farm, construction and mining industries has impacted pricing. This is a solid company with a solid future and rebound potential.

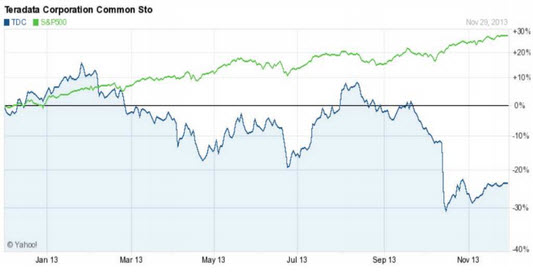

Teradata (TDC) is down nearly 25% and has likely the most fickle holders of all in tech investors. When this giant cloud storage and Big Data analytics firm had a downturn in their international operations, tech buyers deserted them in throngs. Will they return the second TDC shows an uptick in revenue or earnings? Probably.

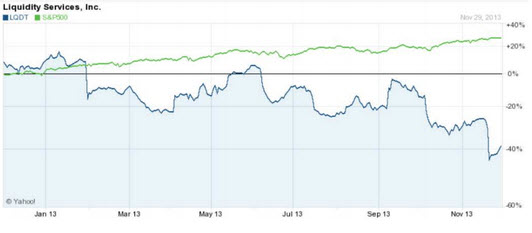

Liquidity Services (LQDT) may be the most rebound-likely pick of all. Down nearly 40%, this quality company offers an online auction marketplace for surplus and salvage assets, providing corporate and manufacturing professionals access to a global, organized supply of surplus and salvage assets presented with digital imagesand other relevant product information. They create a more liquid marketplace by so doing. The company’s product offerings are organized into categories across major industries like consumer electronics, apparel, scientific equipment, aerospace parts, technology hardware, energy equipment, fleet and transportation equipment and more.

American Eagle Outfitters (AEO) serves the fickle 15-25 year old clothing buyer. Not exactly the most stable demographic and AEO will one day likely die by that sword; I just don’t think the demise is imminent.

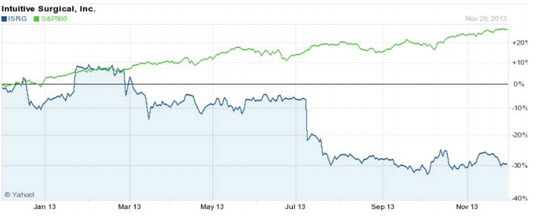

And for the big spenders, Intuitive Surgical (ISRG) which sells da Vinci robotic surgical systems, is down 30% as hospital admissions have been weak and negative publicity affected the amount of procedures performed. I think the stock is oversold and due for a bounce.

Disclaimer: As Registered Investment Advisors, we see it as our responsibility to advise the following: we do not know your personal financial situation, so the information contained in this communiqué represents the opinions of the staff of Stanford Wealth Management, and should not be construed as personalized investment advice.

Past performance is no guarantee of future results, rather an obvious statement but clearly too often unheeded judging by the number of investors who buy the current #1 mutual fund only to watch it plummet next month.

We encourage you to do your own research on individual issues we recommend for your analysis to see if they might be of value in your own investing. We take our responsibility to proffer intelligent commentary seriously, but it should not be assumed that investing in any securities we are investing in will always be profitable. We do our best to get it right, and we "eat our own cooking," but we could be wrong, hence our full disclosure as to whether we own or are buying the investments we write about.