Inflation is relatively low compared with the post-pandemic surge, when the year-over-year change for the Consumer Price Index (CPI) peaked at 9.0% in June 2022. The current 2.7% pace through this past November is tame by comparison. The concern is that inflation has turned sticky lately, just ahead of expectations for a Trump 2.0 regime shift in government policies that some economists predict could lift pricing pressure. The bond market, as a result, is increasingly demanding a higher risk premium via higher yields.

Forecasts of what may happen, or not, should always be viewed cautiously, of course. But it’s forever prudent to monitor incoming data for perspective on how the macroeconomic winds are blowing. No one can predict the future, but trends often have a habit of persisting until some event changes the course.

With that in mind, here’s a quick look at five key charts for evaluating how the inflationary outlook is shaping up as the President-elect prepares to take office on Jan. 20. There are many more data sets to evaluate, of course, but here’s a quick overview that can serve as a first approximation of the state of pricing pressure.

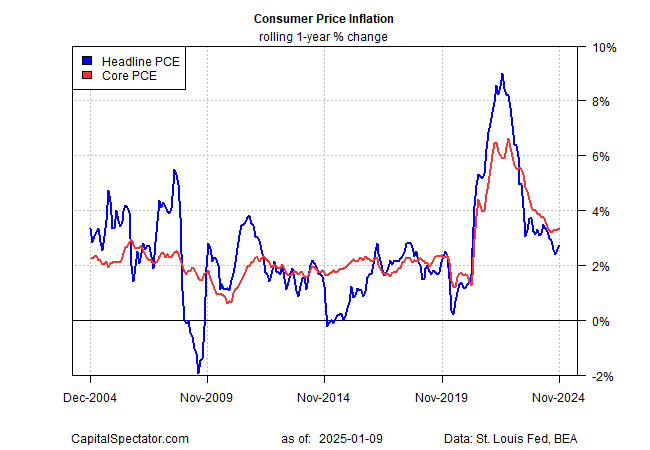

1. YoY Change in Inflation

Let’s begin with the year-over-year change in headline and core CPI. Disinflation has clearly stalled recently. Although there’s room for debate on whether this is noise or signal, the gradual but persistent rebound in core CPI (a relatively robust measure of the trend) suggests inflation has stabilized.

That’s a concern when you consider 1) core CPI, running at a 3.3% annual rate remains elevated relative to its pre-pandemic trend; and 2) core CPI’s pace remains substantially above the Fed’s 2% target. If changes to government policy in the months ahead turn out to have an inflationary bias, the relatively sticky pace of core CPI will likely pick up on the shift and move higher.

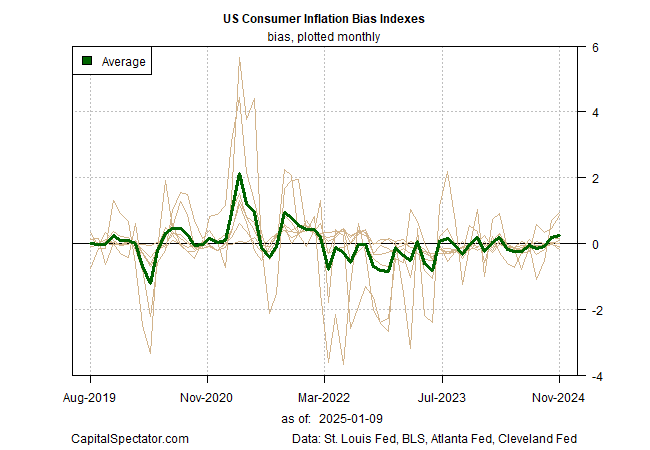

2. Consumer Index Inflation Bias Index

A proprietary measure of inflation bias (one of several metrics published in the monthly US Inflation Trend Chartbook) reflects the recent reflationary shift.

The average for this indicator is several conventional and alternative inflation indicators published by the government and regional Fed banks to estimate a relatively robust profile of pricing pressure bias.

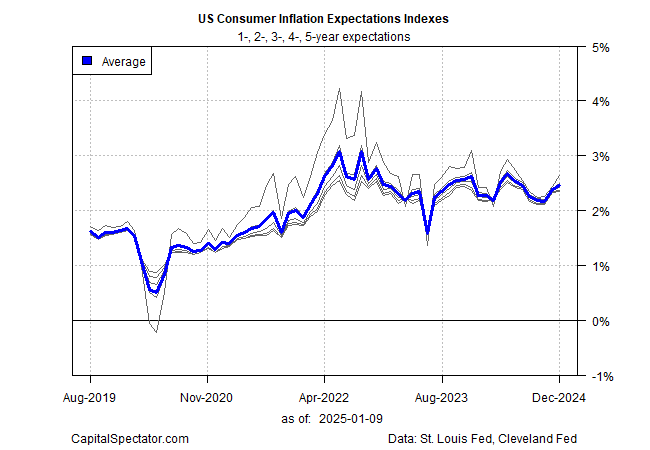

3. Consumer Inflation Expectations

Consumer inflation expectations still looks relatively moderate through December, based on modeling by the Cleveland Fed. Yet it’s also clear that the public’s outlook for inflation is trending up again. This shift deserves close monitoring. If the latest uptick takes out the previous high it would signal a higher level of concern that the Fed is starting to lose control of the inflation narrative in the public sphere.

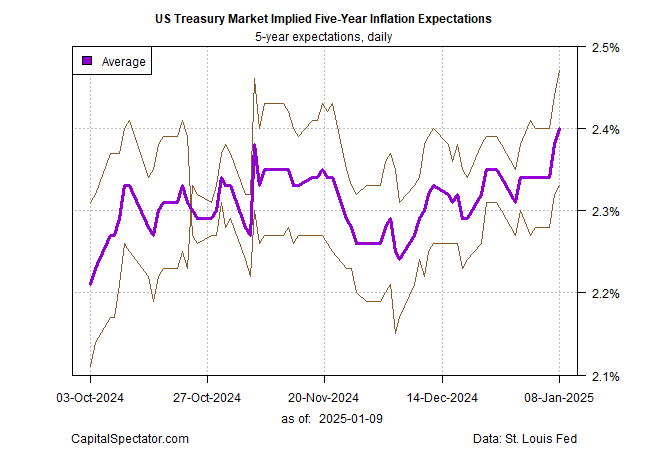

4. 5-Year Expectations US Treasury Market

A more concerning trend is shown by 5-year inflation expectations via the Treasury market, based on two models. One is the 5-Year/5-Year Forward Inflation Expectation Rate; the second model is based on the implied market forecast using the yield spread on the 5-year nominal Treasury less its inflation-indexed counterpart.

The upside bias for the average in recent weeks is starting to look worrisome. If this average continues to run higher, the trend will soon signal a flat-out warning on inflation.

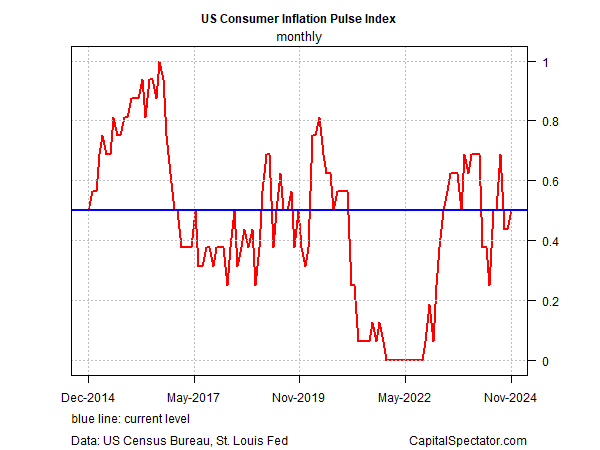

5. US Consumer Inflation Pulse Index

Finally, here’s a proprietary indicator routinely updated in The US Inflation Trend Chartbook that still looks relatively contained. The Inflation Pulse Index aggregates the 12-month percentage changes for all of the 32 components of the Consumer Price Index and scores each benchmark’s directional trend.

The master score – Inflation Pulse Index – reflects the overall inflation bias. Readings range from 0 (a strong disinflation/deflation bias) to 1.0 (a strong inflation bias). The current print has edged higher lately, but for now it still reflects a middling level. If it shows renewed upside momentum in the months ahead it would paint a concerning sign that reflation risk is building.