I'm not going to weigh-in on the 'trade war' or 'trade skirmish' which has been generating numerous headlines lately, but instead I would like to focus in this article on the boom in global trade growth. The turnaround in global trade was a big non-consensus call of ours in 2016, and helped underpin a bullish global macroeconomic view which has ended up driving big moves in the major asset classes (stocks and bonds).

In fact the only thing I would mention in passing in regards to the potential trade war/skirmish is that it's great timing, because if you *had* to have it happen it would be better when global trade growth is improving and you could even argue that the global economy can just absorb such headwinds at this stage of the cycle. This would be in contrast to were global trade growth to be decelerating and increased protectionism at that point would accentuate that downward momentum.

Anyway, if nothing else it's nice to reflect on some positive macro data as the market loses its head.

The main points/findings on global trade growth are:

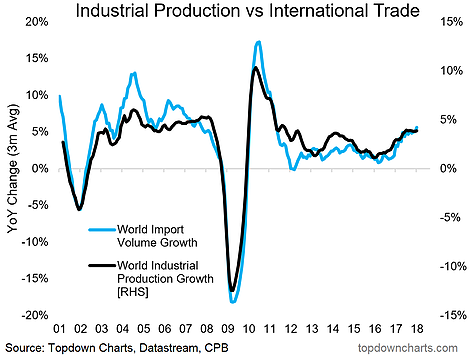

-Both global trade and industrial production growth are running at a solid pace.

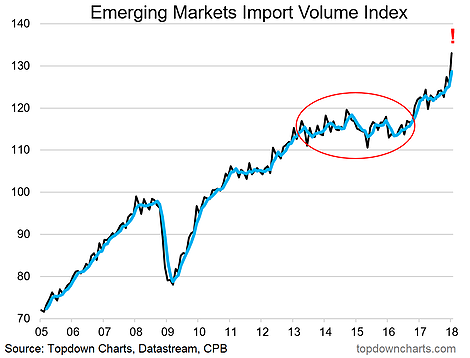

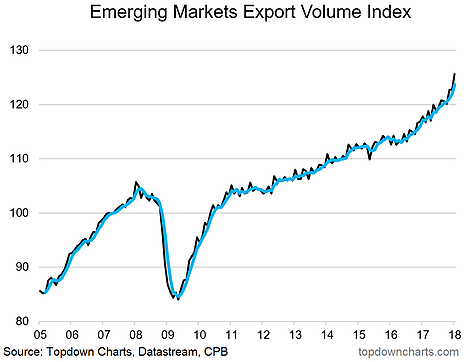

-Emerging markets in particular have seen a rapid acceleration in export and import volumes.

-Globally, trade growth appears to be in the middle of a synchronized upturn.

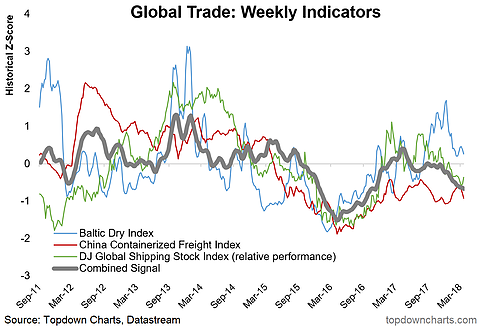

-There are however some doubts cast on the picture with the easing off in shipping cost indexes.

1. Global Trade and Industrial Production: The first chart I wanted to share is a key one as it gives reference to the inter-linkages between global trade and wider economic activity (i.e. greater levels of economic activity tend to flow through to higher export/import demand, and greater levels of import/export volumes tend to drive and broaden economic activity globally as growth in import oriented economies flows through to export oriented economies). Anyway, the key point is that industrial production growth is running at a solid pace and hence reinforces the revival in global trade growth.

2. Emerging Market Imports: The next set of charts I want to highlight because firstly emerging markets now account for the dominant share of global GDP, and secondly there are some very interesting things going on in this space. The last couple of months have seen a remarkable acceleration in emerging market import volumes, the growth has been relatively broad-based with LatAm and EMEA putting in solid numbers, but emerging Asia had been the biggest driver of the surge. This stands in stark contrast to the stagnant/recessionary period from 2014-16.

3. Emerging Market Exports: Looking at the export picture it's a similar story, where export volumes have been accelerating. This speaks to solid growth in developed economies, as well as the implied improved growth in emerging economies vis a vis the improved import volumes.

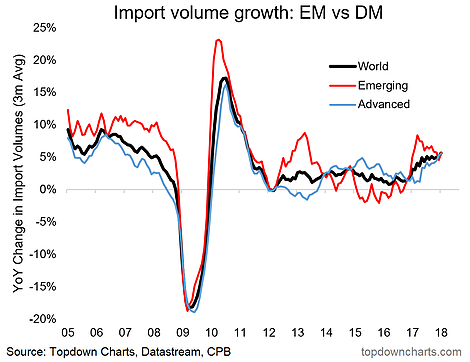

4. Synchronized Global Import Growth: I find this chart to be very informative on the path of global trade growth over the past 7 years. Global trade growth was basically stagnant throughout much of the period as initially the Eurozone crisis drove developed economies into recession, and then subsequently the China slowdown and commodity crunch drove emerging markets into recession. Whereas the past year or so has seen a synchronized acceleration in both EM and DM economies, hence in my view this makes the upturn in the global economy and hence global trade growth more robust.

5. Shipping Cost Indexes: The last one is one of those charts that causes one to go "hmmm". It shows high frequency global trade indicators: The China Containerized Freight Index (shipping costs for Chinese exports), the Baltic Dry Index (shipping costs for bulk commodities), and the relative performance of global shipping stocks (should be reflecting the profitability/outlook for the shipping sector. Now the recent weakness in these indicators could simply be a reflection of lower shipping costs (shipping costs reflect energy costs, supply of shipping, and demand i.e. volumes). My best guess is that it is the former two aspects since the demand side seems solid, but it is definitely one to watch.