Average one-year net dividend per share growth rate for the Canadian dividend stocks on our list has been 30.9%

SmallCapPower | August 15, 2017: Today we have identified five Canadian dividend stocks from across sectors with the highest dividend growth rates over the past five-year period. These stocks have a minimum average traded volume of 86,000 shares over three months and dividend yields for the companies are in the range of 0.6% to 3.7%. The average one-year net dividend per share (DPS) growth rate for the selected stocks has been 30.9%.

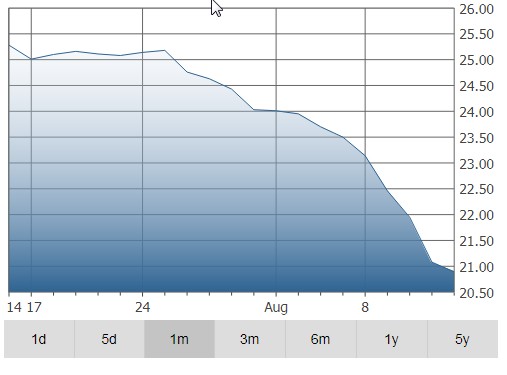

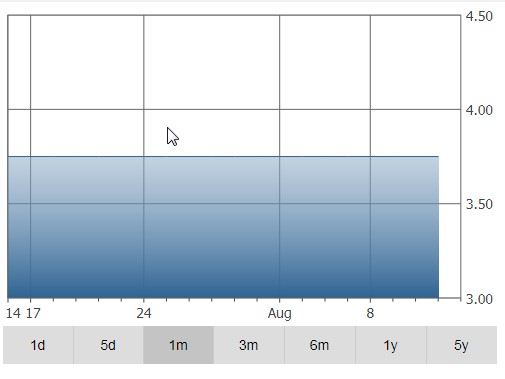

ZCL Composites Inc. (TO:ZCL)

ZCL Composites Inc. manufactures cost effective fiberglass underground storage tanks and distributes petroleum handling equipment. It offers underground and aboveground tank options that can be used for a variety of applications including storage of fuel/petroleum, potable water, wastewater and hazardous chemicals. The Company’s products are marketed under the Prezerver name as complete fuel storage systems, which carry a warranty against pollution. ZCL also manufactures E-Z Deck, a composite decking product that serves as a maintenance-free alternative to wood.

- Dividend Growth Rate CAGR (FY2012-2016) – 96.4%

- Market Cap –$398.3 million

- Dividend Yield –3.7%

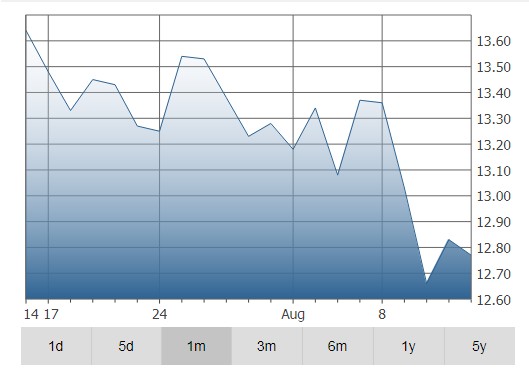

E-L Financial Corporation Limited (TO:ELF)

E-L Financial Corporation Ltd. operates as an investment and insurance holding company in Canada. The Company through its subsidiaries offers life insurance and wealth management products, employee benefit plans, and financial services.

- Dividend Growth Rate CAGR (2012-2016) – 77.8%

- Market Cap – $3,392 million

- Dividend Yield – 0.6%

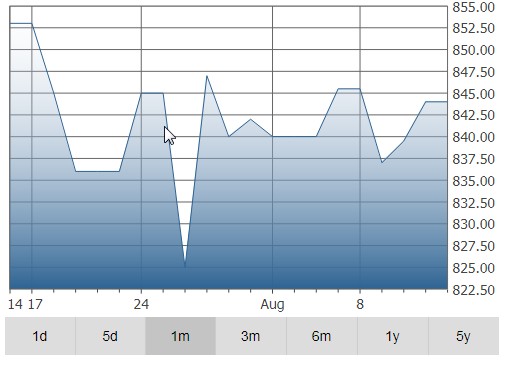

Hardwoods Distribution Inc. (TO:HWD)

Hardwoods Distribution, Inc. is a recognized premier wholesale distributor of hardwood lumber, plywood, MDF, melamine, particleboard and specialty products to the industrial and retail markets of North America.The Company operates distribution through 33 centers throughout North America and offers direct and international shipments.

- Dividend Growth Rate CAGR (2012-2016) – 67.6%

- Market Cap – $407 million

- Dividend Yield – 1.31%

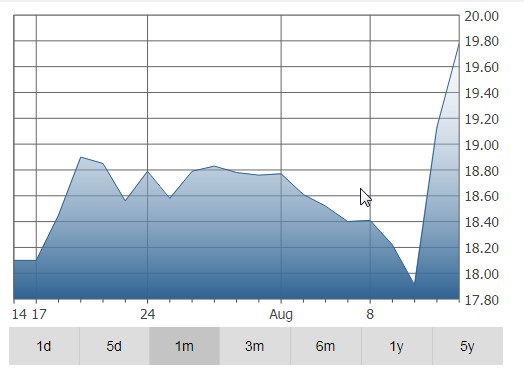

Intertape Polymer Group Inc. (TO:ITP)

Intertape Polymer Group is a recognized leader in the development, manufacture and sale of a variety of paper and film-based pressure sensitive and water activated tapes, polyethylene and specialized polyolefin films, and complementary packaging systems for industrial and retail use. IPG specializes in the woven coated fabrics industry. Its performance products, including tapes and cloths, are designed for demanding aerospace, automotive and industrial applications and are sold to a broad range of industry/specialty distributors, retail stores and large end-users in diverse industries.

- Dividend Growth Rate CAGR (2012-2016) – 61.1%

- Market Cap – $1,249 million

- Dividend Yield – 3.4%

Canlan Ice Sports Corp. (TO:ICE)

Canlan Ice Sports Corp. is an operator of recreational ice facilities with various ice surfaces at facilities in Canada and the United States. The Company, through the Adult Safe Hockey League, operates an adult recreational hockey league that also offers other programs, including youth leagues, hockey and figure skating schools, and tournaments.

- Dividend Growth Rate CAGR (2012-2016) – 51.9%

- Market Cap – 50 million

- Dividend Yield – 2.13%

Disclosure: Neither the author nor any of the principals at Small Cap Power, or their family members, own shares in any of the companies mentioned above.

The Content contained on this page (including any facts, views, opinions, recommendations, description of, or references to, products or securities) made available by SmallCapPower/Ubika Research is for information purposes only and is not tailored to the needs or circumstances of any particular person. Any mention of a particular security is merely a general discussion of the merits and risks associated there with and is not to be used or construed as an offer to sell, a solicitation of an offer to buy, or an endorsement, recommendation, or sponsorship of any entity or security by SmallCapPower/Ubika Research. To read more of this Disclaimer please click on the button below: