In case you missed last week’s confirmation hearing for incoming Federal Reserve Chief, Janet Yellen, I can sum it up for you in one word…

Clueless!

“It’s important for the Fed, hard as it is, to attempt to detect asset bubbles when they’re forming,” said Yellen. “[But] by and large, I would say that I don’t see evidence at this point in major sectors of asset price misalignments.”

No bubbles anywhere, huh?

Maybe Yellen has already donned the pair of rose-colored glasses worn by her predecessors, Greenspan and Bernanke – who completely missed the epic bubbles in tech stocks and real estate.

Or maybe it’s just that the asset bubbles I see forming don’t qualify as “major” enough to warrant a Fed response.

As an investor, though, any asset bubble spells trouble. So we need to be on the lookout for them at all times. Because once they pop, it’s too late to get out.

With that in mind, I’ve pulled together a set of charts to reveal five asset bubbles I’m convinced will soon burst. And no – the stock market isn’t one of them.

~Asset Bubble #1: Peat-Colored Elixirs

Some 30 years ago, only a couple dozen single malt scotch whiskies existed. Today, there are more than 200. Forget curious drinkers, though, investors are the ones getting drunk… on high prices, that is.

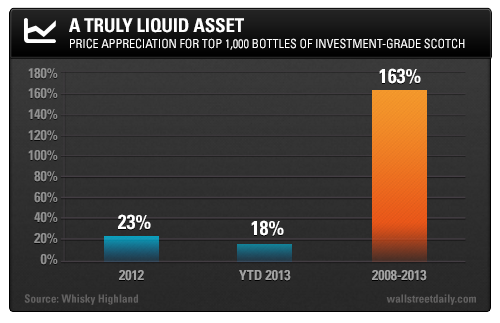

Last year, an index of top-selling scotches outperformed the S&P 500 Index’s 16% rally by climbing 23.3%. This year, the liquid assets are on the move again, up nearly 18%.

If we go back to the time the Great Recession hit, these highly liquid assets are up 163%, according to Whisky Highland.

Now, if that’s not indicative enough of a bubble, this is…

The rarest of whiskies keep fetching four- and five-figure prices at auction, prompting some collectors to utter the telltale phrase of a bubble: “Prices have nowhere to go but up.”

Look out below!

Barron’s Christiana Cefalu was spot on (but a little early) with her warning in October 2012, when she said, “Someone is going to have a massive hangover when the bottom inevitably falls out of the whisky barrel.”

Indeed!

If you bought into this hot alternative investment, I hope you like whisky. Because you could be drinking your losses before long.

~Asset Bubble #2: Farmland in the Heartland

Ultra-low interest rates. Booming prices for corn, wheat and soybeans. And an ethanol boondoggle.

Mix them all together and what do you get? Record income for farmers and a decade-long boom for farmland prices.

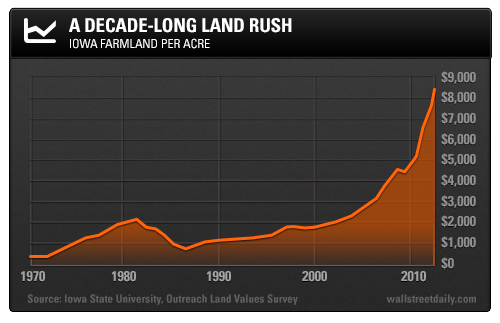

The average acre of farmland in Iowa is up 20% this year – and nearly 120% since 2009, according to the U.S. Department of Agriculture.

The bubble really stands out when you look at prices over the last decade. They’ve quadrupled to $8,400 per acre.

The problem is, commodity prices are cooling off (corn, for example, is down more than 30% this year). At the same time, interest rates are on the rise.

So instead of tailwinds, the industry is facing increasing headwinds.

Brent Gloy, Agricultural Economics Professor at Purdue University, says we’ve reached “the moment of truth.” If prices continue to surge in the face of these changing conditions, a bubble is definitely forming.

I don’t think we need to wait for confirmation, though.

According to John Taylor at U.S. Trust, “In general, if you ask if farmland is in a bubble, I’ll say no. But if you ask [if] some people [are] paying bubble prices, I’ll say yes.”

I’m sorry. But if people are paying bubble prices, it’s safe to say that we’re in a bubble.

Here’s more proof, courtesy of Shonda Warner, Managing Director of Chess Ag Full Harvest Partners. Back in 2006, she would be willing to buy one in five farms that she considered for investment. Now that ratio is closer to one in 20.

In other words, the bargains are gone, which means a bubble is definitely forming.

When it bursts, HF Financial Corp. (HFFC), the holding company for Home Federal Bank, promises to be hit hard. Farmland and farm loans make up 25% of its loan portfolio, according to the latest FDIC data.

Ditto for Deere & Company (DE). Its finance arm, John Deere Financial, holds almost $2 billion in farm loans, as of June 30. Not to mention, any slump in farm incomes from record levels promises to put a dent in demand for new equipment sales.

If I were you, I wouldn’t be holding tight to either of these stocks. Sell now and thank me later.

What other investments hold more downside risk than upside potential? Tune in tomorrow when I’ll share three more asset bubbles waiting to burst. Until then…

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

5 Asset Bubbles Ready To Burst: Part 1

Published 11/19/2013, 05:52 AM

Updated 05/14/2017, 06:45 AM

5 Asset Bubbles Ready To Burst: Part 1

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.