The world is changing fast right now in ways that many investors might not easily recognize or want to acknowledge. This could end up being a costly mistake. If you’re not paying attention, you could be letting opportunities pass you by without even realizing it.

With that in mind, I’ve put together a list of five agents of change that I think investors need to be aware of and possibly factor into their decision-making process.

1. Xi Jinping

At China’s 19th National Party Congress, Xi Jinping’s political thoughts were enshrined into the country’s constitution, an honor that, before now, had been reserved only for Mao Zedong, founder of the People’s Republic of China, and Deng Xiaoping. It was Deng, if you recall, who in 1980 established special economic zones (SEZs) that helped turn China into the economic powerhouse it is today.

But back to Xi. His elevation to Chairman Mao-status not only cements his place in the annals of Chinese history but also makes him peerless among other world leaders in terms of political and militaristic might, with the obvious exception of U.S. President Donald J. Trump.

But whereas Trump has been criticized by some for setting the U.S. on a more isolationist path—shrinking the size of the State Department, just to name one example—Xi sees China emerging as the de facto global leader by 2050. To get there, his country is spending billions on the “Belt and Road Initiative” and other massive infrastructure projects, opening its doors to foreign investors, reforming state-run enterprises, weeding out corruption, investing heavily in clean energy and public transportation and expanding its middle class. And let’s not forget that the Chinese yuan, also known as the renminbi, was included in the International Monetary Fund’s (IMF) basket of reserve currencies in 2015, placing it in the same league as the U.S. dollar, British pound, Japanese yen and euro.

During his three-hour speech before the congress, Xi made reference to the “Chinese dream,” adding that the “Chinese people will enjoy greater happiness and well-being, and the Chinese nation will stand taller and firmer in the world.”

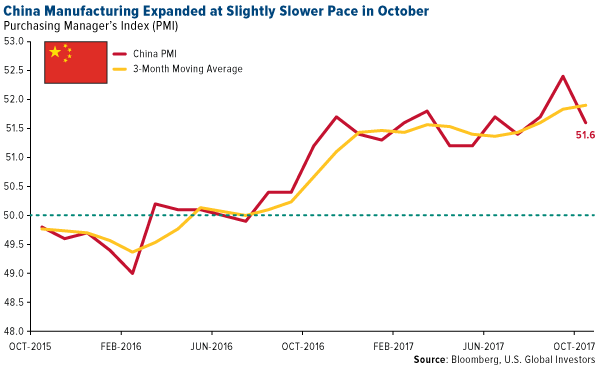

Xi has his own detractors, of course, who see China’s rise as a threat to established world order. But if his vision is to be realized, it might be prudent to recognize and prepare for it now. China’s economy grew a healthy 6.8 percent in the third quarter year-over-year, helping it get closer to meeting economists’ target of 6.5 percent for 2017. And although manufacturing expansion slowed in October, falling from 52.4 in September to 51.6, it was still well above the 50 threshold.

Citing these indicators as well as strong medium and long-term bank lending to nonfinancial corporations, research firm BCA recommended that investors overweight Chinese stocks relative to the emerging market aggregate.

2. Poland

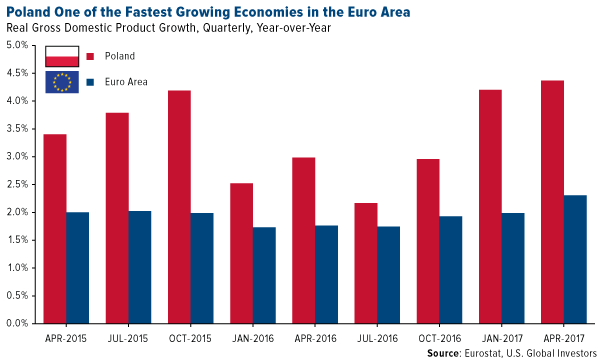

Besides China, another region I’m keeping my eye on is Poland. Already one of the fastest growing economies in Europe, the country was just upgraded from the “advanced emerging” category to “developed” by FTSE Russell, effective September 2018. This will place Poland in the same company as, among others, the U.S., U.K., Japan, Germany, Singapore and South Korea, the last country to have joined the club of top-ranking economies. Poland is the first Central and Eastern European (CEE) country to receive “developed” status.

Among the decisive factors behind the upgrade were the country’s advanced infrastructure, secure trading and a high gross national income (GNI) per capita. The World Bank expects Poland’s economic growth in 2017 to reach 4 percent, up significantly from 2.7 percent in 2016, on the back of a strong labor market, improved consumption and the child benefit program Family 500+.

Economists aren’t the only ones noticing the improvement. Young Polish expats who had formerly sought work in the U.K. and elsewhere are now returning home in large numbers to participate in the booming economy, according to the Financial Times. Banks and other companies, including JPMorgan Chase (NYSE:JPM) and Goldman Sachs (NYSE:GS), are similarly considering opening branches in Poland and hiring local talent.

This represents quite an about-face for a country that, as recently as 1990, was languishing under communist rule. One of U.S. Global’s analysts, Joanna Sawicka, has seen the dramatic transformation firsthand. A native of Bialystok, Poland, Joanna has vivid memories of waiting in line for hours just to buy food and school supplies. After returning to the U.S. from a visit to her hometown in 2015, though, she was singing its praises:

“I saw big changes. There’s now a small business on every street corner. A lot of my old friends own businesses now. Poland is the largest beneficiary of European Union funds, and people are clearly taking advantage of having more money and better opportunities.”

3. Bitcoin

One of the most influential agents of change right now is Bitcoin, and indeed the entire digital currency market. Cryptocurrencies are challenging underlying notions of the global monetary framework, upending the way many companies raise funds and disrupting the investment world.

All this from an asset class nobody even knew about 10 years ago.

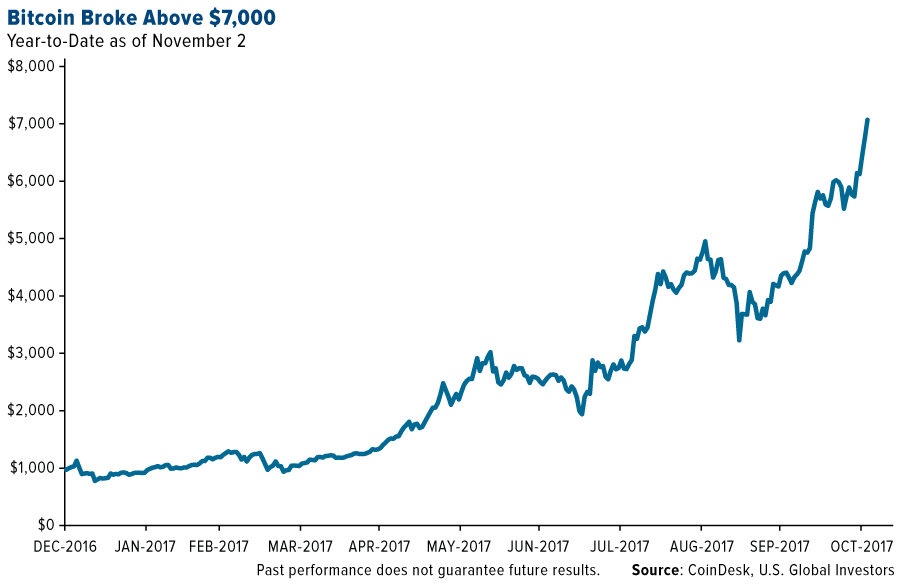

For the first time, Bitcoin traded above $7,000 a coin, bringing its 2017 gains to around 650 percent. Some are calling this a bubble, but I recently shared with you a chart that shows that, when placed on a logarithmic scale, Bitcoin doesn’t appear to have found its peak yet.

Bitcoin can no longer be called a curiosity or niche investment. Large brokerage firms and financial institutions, including Fidelity and USAA, now allow clients to use their websites to check their holdings of Bitcoin and other digital currencies alongside their more traditional assets. The Chicago Mercantile Exchange (CME) announced it will be offering a Bitcoin futures contract by the end of the year, giving investors an easier way to trade cryptos.

Following the announcement, Coinbase, a leading digital currency broker, saw a record number of people opening new accounts on its platform. Within a single 24-hour period, as many as 100,000 new users opened accounts, helping to double the number of Coinbase clients since the beginning of the year.

This explosion in interest hasn’t come without consequences in other markets, however. The U.S. Mint reported that this year’s sales of American Eagles, the popular gold coins, have fallen to their lowest level since 2007, presumably as investors who otherwise would have bought bullion have instead put money in bitcoin as a store of value.

4. U.S. Tax Reform

It’s been a generation at least since the U.S. has had meaningful tax reform. That might be about to change, though, as Congress and the President unveiled their plans to overhaul the tax code and deliver the “biggest tax cut in U.S. history,” according to Trump.

If passed and signed, the plan would consolidate the number of income brackets, currently at seven, down to only four, while also eliminating a number of tax credits and exemptions, including the alternative minimum tax (AMT). The fourth bracket, with a rate of 39.6 percent for the nation’s top earners, was added at the last minute to address concerns the new code would blow up the deficit. Many savers are no doubt relieved to learn that 401(k)s will be left alone, ending rumors that annual contribution caps would be lowered.

As for corporate taxes, the plan is to slash them from 35 percent—the highest among any country in the Organization for Economic Cooperation and Development (OECD)—to a much more competitive 20 percent. This change would be both immediate and permanent.

Right now, as much as $2.5 trillion or more in cash is estimated to be held overseas by multinational corporations to avoid having to pay the steep rate. Lowering it would allow these firms to bring profits home and reinvest them in workers, new equipment and more. It would also encourage American companies to relocate operations back to the U.S., as we saw with semiconductor manufacturer Broadcom.

After failing to repeal and replace Obamacare, both Congress and the President need this win if they expect voters to give them another term.

5. Jerome Powell

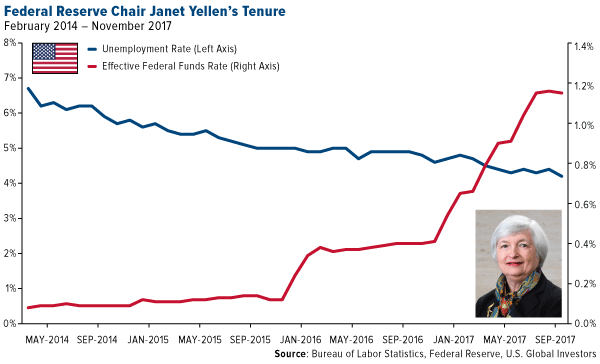

For the final agent of change, I’m picking someone who some readers might not agree reflects real change. Jerome “Jay” Powell, the person Trump has tapped to replace Federal Reserve Chair Janet Yellen—assuming he gets Senate confirmation—is being described as someone who’ll mostly hold to the status quo established by his two immediate predecessors, Yellen and Ben Bernanke. Powell appears to be dovish and supportive of the cautious interest rate hikes we’ve seen during Yellen’s tenure, which will come to an end in February 2018.

There’s one huge difference, however—one that likely convinced Trump a change was needed, despite his previous acclaim for Yellen’s handling of the job. Whereas Yellen has expressed support for the raft of financial regulations that were introduced in the wake of the financial crisis, Powell generally seems to be in favor of deregulation, in line with Trump’s own agenda. On numerous occasions I’ve written that our industry needs more streamlined rules and laws, so I see this as very constructive. Although Powell, as head of the Fed, won’t have any policymaking authority to alter or reverse such rules, at least he’ll serve as an ideological ally of Trump’s.

On top of all this, Powell’s appointment will set new precedent. He’ll be the first Fed chair in decades not to hold an advanced degree in economics—he’s a former investment banker with the Carlyle Group—and he’ll also be the first in nearly as many years to replace someone before the end of their full 14 years.

In any case, I speak for everyone at U.S. Global by wishing Powell the best, once confirmed, and hope his policies can help the U.S. economy continue moving in the right direction.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. This commentary should not be considered a solicitation or offering of any investment product. Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.