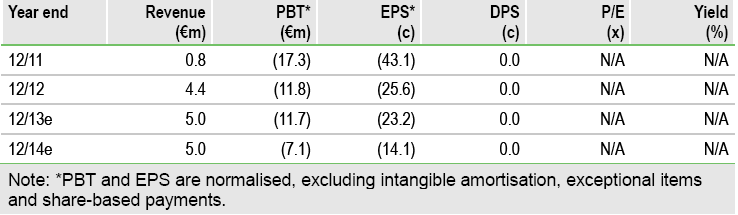

Lead programme resminostat progressed in Q313, with 4SC refining its Phase II/III plans in front-line HCC and Japanese partner Yakult initiating a Phase I/II trial in second-line NSCLC. Separately, 4SC’s two Phase I programmes should both readout by early 2014. We remain optimistic that 4SC can secure financing and/or a partner for the resminostat Phase IIb/III trial and model €789m peak sales. Our fair value is €122m or €2.41/share.

Resminostat: biomarker data and NSCLC trial start

In July 2013, Japanese partner Yakult Honsha initiated a Phase I/II study of resminostat in second-line non-small cell lung cancer (NSCLC). In September, 4SC presented a subgroup analysis from the SHELTER Phase II trial in advanced liver cancer (HCC), which suggests that baseline patient characteristics and a blood-based biomarker (ZFP64) correlate with improved survival in HCC subjects receiving resminostat. These findings are guiding 4SC’s pivotal trial design, which will shortly be submitted to the FDA for protocol approval (Q413). Pending further financing and/or a partnership, the Phase II/III trial could start mid-2014.

Earlier stage pipeline: Upcoming milestones

4SC’s other active clinical programmes – 4SC-202 (oral HDAC inhibitor), 4SC-205 (oral Eg5 inhibitor) – are nearing important clinical data points. In Q413, we expect results from the Phase I TOPAS dose-finding trial of 4SC-202 in up to 36 patients with haematological malignancies. Initial data suggest that 4SC-202 has good pharmacokinetic properties for oral therapy, is well tolerated, and can stabilise heavily pre-treated patients. Around end-2013/early-2014, we anticipate final results from the Phase I AEGIS trial of 4SC-205 in advanced solid tumours.

4SC Discovery: Deals continue apace

4SC Discovery announced its seventh drug discovery collaboration in Q3, this time with Panoptes Pharma in the field of inflammatory eye diseases. In early November, it added an eighth partnership with AiCuris (and CRELUX) to identify novel therapies for infectious diseases. Based on its strong operating performance in 2013, we expect 4SC’s Discovery business to be cash flow neutral in 2013.

Valuation: rNPV of €122m (€2.41/share)

We value 4SC at €122m (€2.41/share) based on a risk-adjusted NPV analysis. Our rNPV includes resminostat at €108.5m, an indicative contribution from Phase I assets of €20m, year-end net cash of €4.5m, and deducts €11m for central costs.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

4SC Upcoming Clinical Milestones

Published 11/15/2013, 02:07 AM

Updated 07/09/2023, 06:31 AM

4SC Upcoming Clinical Milestones

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.