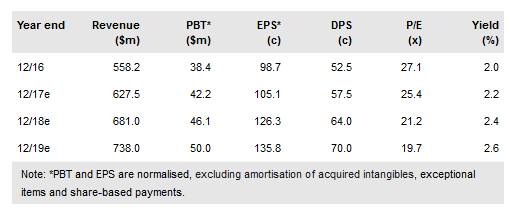

A continued strong performance in Q417 delivered 12% revenue growth in FY17 vs FY16, a shade ahead of our previous forecast. We see good top-line momentum into FY18e as the group takes further share in its large and fragmented market, benefiting from its targeted marketing. US taxation reforms will kick in for FY18 and our EPS forecast is lifted by 10%. Cash resource of $30.7m at end FY17 allows for an increased dividend with plenty of scope for additional investment as the business continues to scale. Our new FY19e numbers show further good earnings progress, with the valuation rating coming in to more attractive levels.

Marketing and data-led growth

4Imprint Group Plc (LON:FOUR) is first and foremost a marketing business and it has been at the forefront of its sector in using data to improve its targeting and content. The business model remains to fuel growth through investing in marketing, while keeping margins broadly stable (EBITDA margin is between 7.1% and 7.3% FY14-19e). FY17 marketing spend was more phased to H2 than usual and the benefit of this should continue to accrue in H118. The underlying market, estimated at $25bn in North America, remains highly fragmented, giving plenty of scope for further expansion.

To read the entire report Please click on the pdf File Below: