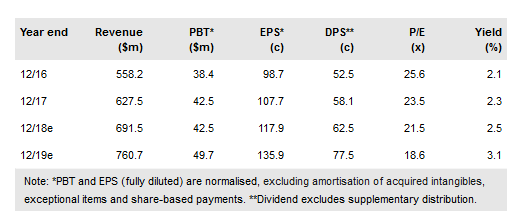

4Imprint Group Plc (LON:FOUR) has announced another set of strong results, accompanied by a supplementary dividend of $0.60 to be paid alongside the final. It has also outlined a program to build a more substantial longer-term business through adding brand awareness campaigns to the existing marketing spend. Revenues have grown at a CAGR of 18.1% over the last six years. Guidance for the next five years is for double-digit growth to reach the $1bn level by FY22 and we have lifted our forecasts to reflect this. Profit growth is restrained in the near term by the additional marketing spend, but should move on faster in FY19, with EPS further boosted by a lower US tax charge.

Brand campaign to leverage marketing spend

Management has clearly delivered on its strategy over FY12-17, growing the top line on stable operating margins and, crucially, addressing and de-risking the pension situation to the point where it is no longer an issue. The group is inherently highly cash generative. The new capital allocation framework prioritizes organic growth initiatives, a key one of which is to channel additional marketing spend to promote brand awareness which, in turn, should boost the efficacy of the existing budget. Revenue per marketing dollar would fall in the short term as new channels such as radio and TV are added to the mix, but this is a good opportunity to build the 4imprint brand as the ‘go-to’ distributor of promotional products. Although a (possibly the) leading distributor, 4imprint only has a share of around 2.5% of the market, estimated by management at $25bn in North America.

To read the entire report Please click on the pdf File Below: