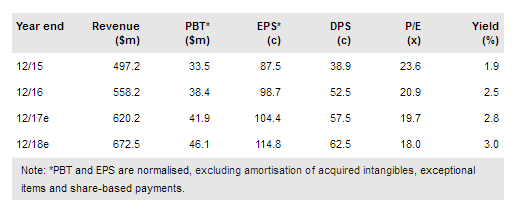

4Imprint Group Plc (LON:FOUR)’s interim results show that it continues to make steady progress building market share in the large and fragmented US market for promotional goods. H117 revenue growth of 11% compares to a market estimated to be growing in line with GDP at 2-3%, with the increase coming from both existing and newly recruited customers. Marketing spend, the key growth lever, is more heavily weighted to H2 this year and our revenue forecast is edged up, with a slightly higher tax charge leaving EPS unchanged. The group has good cash generation, a net cash position on the balance sheet and a growing dividend, underpinning the rating.

Marketing returns

The recovery in trading in December post an election-prompted hiatus has continued through the first half, with revenues ahead by 11% in both North America and the UK, although the reported numbers for the latter suffer from the translation of sterling into US dollars. This is primarily a marketing business and 4imprint has been at the forefront of the industry in using its data to improve its targeting and content. The model remains to invest in marketing to grow, while keeping margins broadly stable, with spend in the current year more phased into H2 than usual. This has meant the balance of additional business has been more due to existing than new customers in the period. The underlying market, estimated at $25bn in North America, remains highly fragmented, giving plenty of scope for further expansion.

To read the entire report Please click on the pdf File Below: