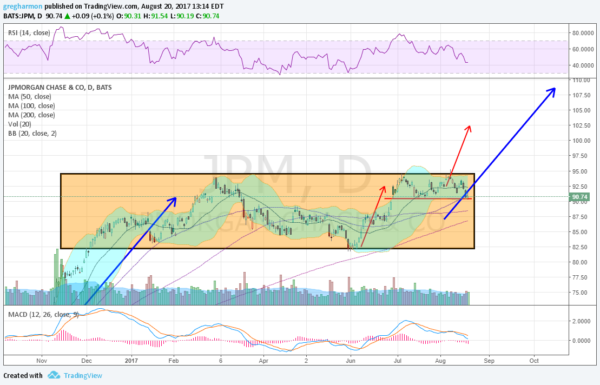

JP Morgan (NYSE:JPM) remains stuck in a box. The stock got a boost after the election in November like all financial stocks, but has since stalled in a range between 82 and 94.50. Since the beginning of June, JPM has looked positive, bouncing off the bottom of the range and reaching the top to start July. It has held in a tighter range much closer to the top since then.

The Bollinger Bands® are tight and flat and if it should break to the upside, there is a Measured Move to about 109 to match the move into the box. The recent up-leg would give a Measured Move to 102.50 along the way. The RSI is pulling back, though,and is nearly at the lower edge of the bullish zone, while the MACD is dropping and near zero. Momentum does not currently support a move up. There is no resistance above 94.50 and support sits below at 90.50 and 89, followed by 86 and 84.50 before 82. Short interest is low, under 1%, and the company is not expected to report earnings again until October 12.

The options chain for this week shows large put open interest at the 90 strike, which could act as support and spread on the call side from 91 to 95. September open interest ramps from 87.50 to a peak from 95 to 97.50 on the call side with the biggest at 90 on the put side, though much smaller. In October, the first after the next earnings report, open interest is biggest by far at the 95 and 100 Call Strikes, with smaller size from 85 to 92.50 in the puts. All this suggests options traders expect a drift higher through to the next earnings report.

The Trades

Trade 1: Buy the stock with a stop at 90.50.

Trade 2: Buy the stock and add an October 90/85 Put Spread ($1.60) for protection. Sell the December 100 Calls (70 cents) to lower the cost.

Trade 3: Buy the October 87.5/92.5 bullish Risk Reversal (20 cents) for a run higher into earnings.

Trade 4: Buy the October 92.5/September 95 Call Diagonal ($1.65). Continue to sell shorter dated higher strike Calls as the September Calls expire.