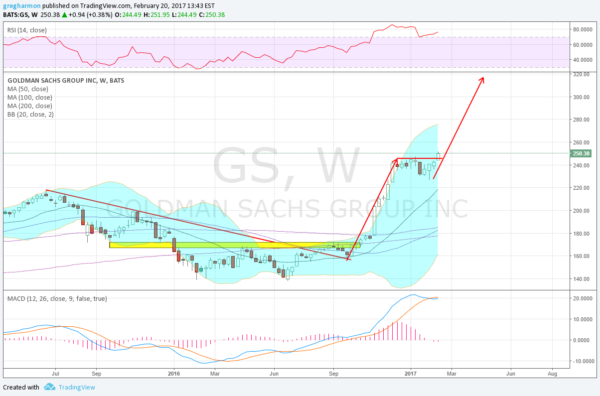

Goldman Sachs (NYSE:GS) is on the verge of a major breakout. The stock hit a high near 251 in 2007 before dropping precipitously during the financial crisis to a low under 50, a drop of over 80%. Since then, it had a strong rise through 2009 and then a 3-year pause before moving back higher in 2013. A 3-year bull market found a top in mid 2015 and pulled back again. This time it reset 36% lower with a double bottom in 2016 as shown in the chart below. This has not been a straight-up 8-year bull run for Goldman Sachs.

New Movement

The stock confirmed that double bottom at the end of October and then raced higher in November after the election. It stopped just short of the 2007 high in December and consolidated for over 2 months. Last week saw new movement in the stock, pushing up out of the consolidation zone and to the 2007 high. As it does so, it establishes a target to 317 with a natural spot for a stop loss near 230. Momentum is a bit hot but that is a good thing on the weekly chart.

Digging into the weeds a bit, the stop does go ex-dividend next week on the 28 and then looks to earnings on April 18. This will be well after the March 15 FOMC meeting, which could be a bigger catalyst. Short interest is very low at just over 1%.

The options chain shows little bias for any movement this week. The March options have their biggest open interest below at the 240 strike though. The April options chain suggests a net pullback but it has much more open interest above on the call side at 260 and 270 and then even 300.

Four Trades

- Trade Idea 1: Buy the stock now (over 246) with a stop at 230.

- Trade Idea 2: Buy the stock now (over 246) and add an April 250/230 Put Spread ($6.40) while selling a July 270 Covered Call ($6.50 credit).

- Trade Idea 3: Buy the April 255 Calls ($6.80).

- Trade Idea 4: Buy the April 230/255 bullish Risk Reversal ($4.25).