I have been meaning to write about this, but other, more important things seemed to get in the way. The latest BoAML Fund Manager Survey shows managers to be well overweight risk and equities (via The Telegraph):

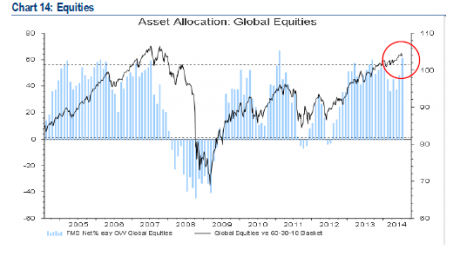

Bank of America’s monthly survey of world fund-managers shows that investors have their second highest allocation to stock markets in thirteen years at 61pc. It is led by shares in technology, energy, and even banks, and is stretched to a net 35pc overweight in Europe. “The summer 'melt-up' is likely to be followed by an autumn correction,” it said.

Four contrarian trades

Further, the report suggested four contrarian trades that appeared somewhat intriguing:

Bank of America recommends four contrarian trades (for the brave only of course, not for Welsh widows) based on herding effects. Go long bonds, and short equities; long the US dollar / short sterling; long telecoms (the most reviled equity group), and short energy; and long emerging markets/short eurozone.

When I consider contrarian "value" trades, I prefer to look for entry points where there is not only "value", but a positive catalyst that propels the trade in the right direction. When I evaluate the four from a technical perspective, I find one to be in that category, two that appear to be nearing a trade setup and one in a wait-and-see mode.

The first chart shows the long Emerging Markets (via iShares MSCI Emerging Markets ETF (ARCA:EEM)) and short eurozone (via SPDR Dow Jones Euro STOXX 50 ETF (NYSE:FEZ)) equity pair trade. Note how EM equities have bottomed out and begun a relative rally against eurozone equities - that is the positive catalyst that I like to see.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.