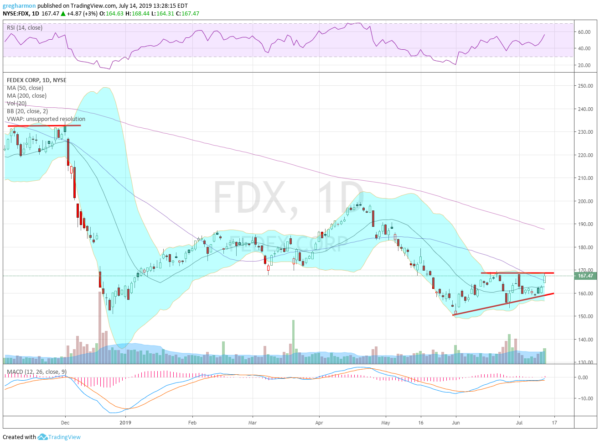

FedEx (NYSE:FDX), $FDX, stair-stepped lower, reaching a bottom in December after a gap down. It had a small bounce that continued into April before topping after that. From there it fell back to the December low at the start of June. Since then it has been consolidating in an ascending triangle. Friday saw the price rise back to resistance. A break higher would give a target to 186.25.

The RSI is rising toward a move over 60 into the bullish zone with the MACD moving up and about to cross to positive. There is resistance at 169 and 176 then 186 and 190 before 199. Support lower comes at 164 and 159 followed by 156 and 151. Short interest is low at 1.9%. The stock pays a dividend with a yield currently at 1.55% and started trading ex-dividend on June 21st. The company is expected to report earnings next on September 17th.

The July options chain shows the largest open interest on the put side at the 150 strike. On the call side it is big from 172.50 to 175 and then again at 195. The closer call strikes may play a role this week. The August options have the biggest open interest at the 150 put and then it is spread from 165 to 180 on the call side. The September options, covering the earnings report, have biggest open interest on the put side at the 160 strike. The call side is smaller and spread from 160 to 180 and then again at 200.

FedEx, Ticker: $FDX

- Buy the stock on a move over 169 with a stop at 164.

- Buy the stock on a move over 169 and add a September 165/155 Put Spread ($3.50) while selling an October 190 Call ($1.75).

- Buy the August/September 175 Call Calendar ($2.75) and sell the August 160 Put ($2.00).

- Buy the September 155/170/180 Call Spread Risk Reversal (70 cents).

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.