Here is your Bonus Idea with links to the full Top Ten:

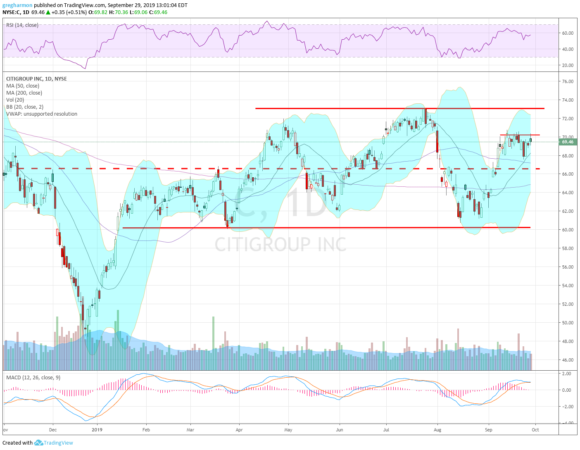

Citigroup (NYSE:C), $C, has been bumbling along between 60 and 73 since moving off of the December low and settling in January. Coming into the week it is consolidating in the upper part of the zone with 55 upside to the top. The RSI is turned back up in the bullish zone with the MACD flat, avoiding a cross down.

There is resistance at 70.20 and 72 then 73 and 75.20 before 76.30 and 77.70 then the cycle high at 80. Support lower comes at 68 and 66.50 then 64.50 and 62 before 61.30 and 60. Short interest is low under 1%. The company is set to report earnings the morning of October 15th. The stock pays a dividend with an annual yield of 2.94% and went ex-dividend last August 2nd.

The weekly options chain shows big open interest at the 68.50 put and at 66.50 and 70.50 on the call side. The October chain, covering the earnings report, shows the biggest open interest on the put side at the 65 strike. On the call side it is much bigger and focused at the 70 strike as well as 67.50 and 72.50. November options suggest a possible draw to the 62.50 to 65 area and the December options are biggest there on the put side as well. But on the call side they are focused from 70 to 75.

Citigroup (NYSE:C), Ticker: $C

Trade Idea 1: Buy the stock on a move over 70 with a stop at 69.

Trade Idea 2: Buy the stock on a move over 70 and add an October 69/65 Put Spread ($1.05) while selling the November 72.50 Call ($1.20).

Trade Idea 3: Buy the October/November 72.50 Call Calendar (65 cents) and sell the October 11 Expiry 67.50 Puts (62 cents).

Trade Idea 4: Buy the December 70/75 Call Spread ($2.00) and sell the December 60 Put (95 cents).

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.