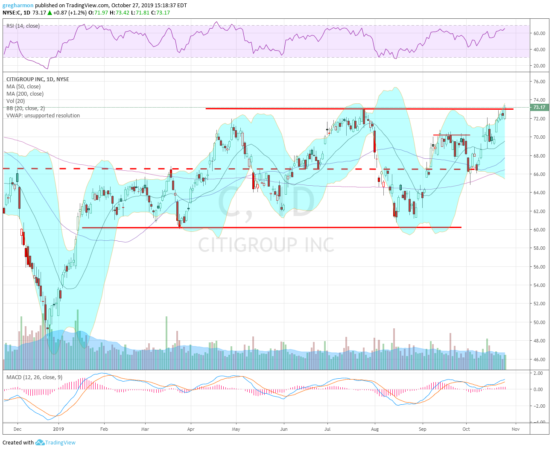

Citigroup Inc (NYSE:C) started higher off of a bottom in December. It filled a gap in January and started to morph into a sideways channel. It would stay on this channel for the next 9 months. It comes into the week pushing through the top and making a new 52 week high. The RSI is rising in the bullish zone with the MACD positive ad moving up.

The Bollinger Bands® have also opened to the upside. There is resistance at 74 and 76.35 then 77.50 and 80.25. Above that you have to look back to before the Great Financial Crisis. Support lower comes at 72 and 70 then 68.50. Short interest is low under 1%. The stock pays a dividend with an annual yield of 2.79% and starts trading ex-dividend November 1st. The company is expected to report earnings next on January 14th.

The November options chain shows biggest open interest at the 72.50 strike on the call side, twice as big as that at the 70 calls and 5 times the 70 puts. The December chain sees open interest spread from 60 to 72.50 on the put side, biggest at 65, and from 70 to 75 on the call side and very level. The January chain, covering the next earnings report, shows large open interest from 70 all the way down to 45 on the put side. It builds from 60 to a peak at 80 on the call side.

Citigroup, Ticker: $C

4 Trade Ideas

- Buy the stock on a move over 73.50 with a stop at 71.50.

- Buy the stock on a move over 73.50 and add a November 73/70 Put Spread ($1.00) while selling the November 75 Calls (50 cents).

- Buy the November/January 75 Call Calendar ($1.65) and sell the November 70 Puts (55 cents).

- Buy the January 65/75/80 Call Spread Risk Reversal (65 cents).

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.