Here is your Bonus Idea with links to the full Top Ten:

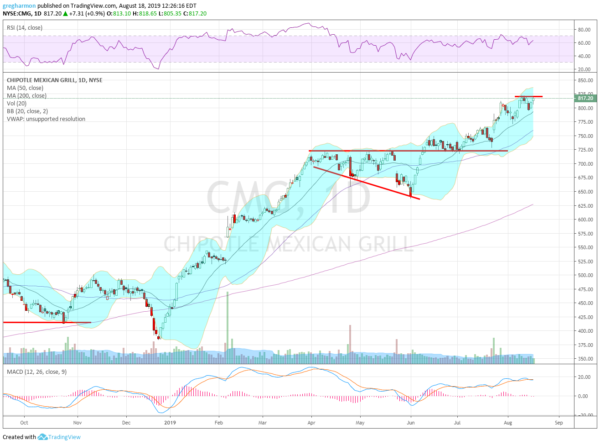

Chipotle Mexican Grill Inc (NYSE:CMG), started to move higher off of a December bottom. It stalled in April and consolidated, moving sideways, in an expanding wedge for the next 2 months. It finally broke the wedge to the upside and consolidated in a flat pattern until the end of June when it lifted higher again. The last two weeks have seen it hit resistance and pull back then reverse up to resistance again where it enters the week.

The RSI has continued to hold in the bullish range with the MACD flat but positive. The Bollinger Bands® are shifted to the upside. There is no resistance above 822. Support lower comes at 795 and 780 then 765 and 745 before 725. Short interest is moderate at 5.9%. The company is expected to report earnings next on October 23rd.

The September options chain shows the open interest on the put side spread from 725 up to 810. On the call side it is big at 820 and grows from 835 to a peak at 880. The October options open Monday. The November options, the first to cover the next earnings report, show light activity from 740 to 820 on the put side. On the call side it is biggest at 800 and 900.

Chipotle, Ticker: $CMG

Trade Idea 1: Buy the stock on a move over 822 with a stop at 795.

Trade Idea 2: Buy the stock on a move over 822 and add a September 820/800 Put Spread ($10.00) while selling the November 900 Call ($21.00).

Trade Idea 3: Buy the November 740/820/860 Call Spread Risk Reversal for free.

Trade Idea 4: Buy the September/November 860 Call Calendar (25.80) and sell the September 760 Puts ($8.20).

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original Post