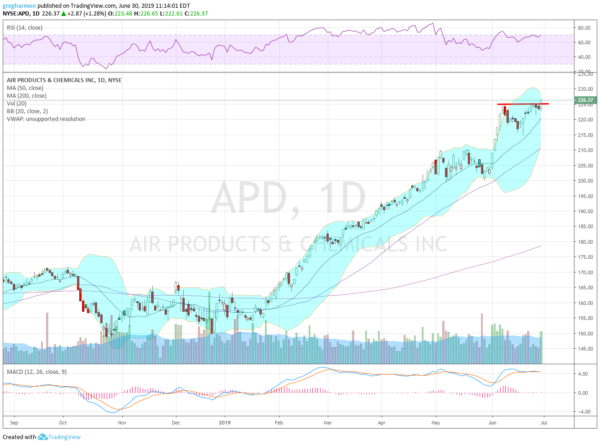

Air Products (NYSE:APD), had been trading in a consolidation range for 18 months before it broke to the upside in February. It continued to move higher for until hitting resistance and pausing in May. The consolidation from there lasted 1 month and it resumed to the upside. Into June it also met resistance and pulled this time. Last week saw it resume to the upside and it ended the week breaking the high.

The Measured Move for the next leg gives a target to 240. The RSI is high in the bullish zone with the MACD flat but positive. There is no resistance above. Support lower comes at 225 and 217 then 210 and 200.50. Short interest is low at 1.5%. The stock pays a dividend with a yield of just over 2% and started trading ex-dividend on Friday. The company is expected to report earnings next on July 25th.

The July options chain shows the largest open interest at the 220 strike on both the calls and puts. The August chain is the first to cover the next earnings report, and it has light open interest. What is there implies about a $14 move in the price between now and August expiration. September options have more liquidity and show open interest spread from 160 to 220 on the put side. The call side is more focused, rising from 190 to a peak at 210 that is 3 times the size of any other strike.

Air Products, Ticker: $APD

4 Trade Ideas For Air Products

- Trade Idea 1: Buy the stock now (over 225) with a stop at 220.

- Trade Idea 2: Buy the stock now (over 225) and add an August 220/210 Put Spread ($2.25) while selling the September 240 Calls ($3.00) to fund the protection.

- Trade Idea 3: Buy the July/August 230 Call Calendar ($3.15) and sell the August 210 Put ($1.75) for $1.40.

- Trade Idea 4: Buy the August 210/230/240 Call Spread Risk Reversal for $1.65.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.