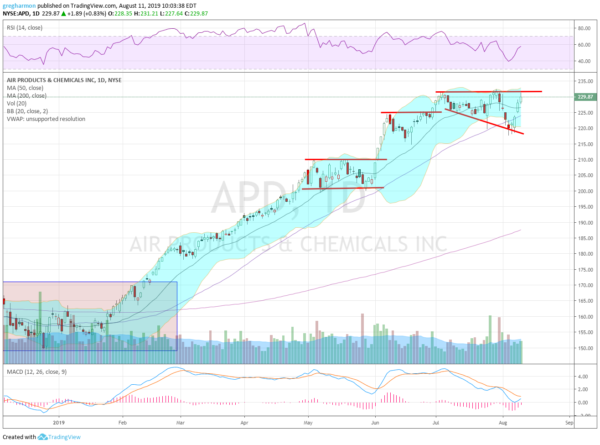

Air Products (NYSE:APD) broke out of consolidation in February and rose to a plateau in May. It did not pullback though but consolidated there until another move up in June. It broke that to the upside at the end of the month and has since been building an expanding wedge against resistance at the early July high.

The RSI is rising in the bullish zone after a reset to the bottom of the range with the MACD about to cross up after also resetting to zero. There is no resistance above 232 but a Measured Move on a break out higher would give a target to 246. Support lower comes at 225 and 220 then 217 and 210. Short interest is low at 1.1%. The stock pays a dividend-yielding just over 2% and starts trading ex-dividend September 30th. The company is expected to report earnings next on November 4th.

The August options chain shows the biggest open interest at the 220 put and 230 call, suggesting a tight range for this week. The September options have the majority of open interest lower, and it is biggest at the 210 strike on both sides. December options, the first covering the next earnings report, show open interest from 190 to 220, but biggest at 200 on the put side. While the December 230 calls have the biggest open interest on both side by a factor of 2.

Air Products (NYSE:APD), Ticker: $APD

- Buy the stock on a move over 230 with a stop at 227.

- Buy the stock on a move over 230 and add a September 220/210 Put Spread ($1.85) while selling a September 240 Call ($2.20).

- Buy the December 210/230/240 Call Spread Risk Reversal (60 cent).

- Buy the September/December 240 Call Calendar ($6.70) and sell the September 210 Put ($1.35).

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.