- Buying stocks can often be a challenge if you don't have access to the right data

- It can also become a challenge if you don't know where to look

- Here are 4 easy steps to evaluating any stock with InvestingPro

- Missed out on Black Friday? Secure your up to 55% discount on InvestingPro subscriptions only this Cyber Monday.

When it comes to fundamental analysis, InvestingPro stands out as a premier tool, having forged partnerships with esteemed data providers like S&P Global Market Intelligence.

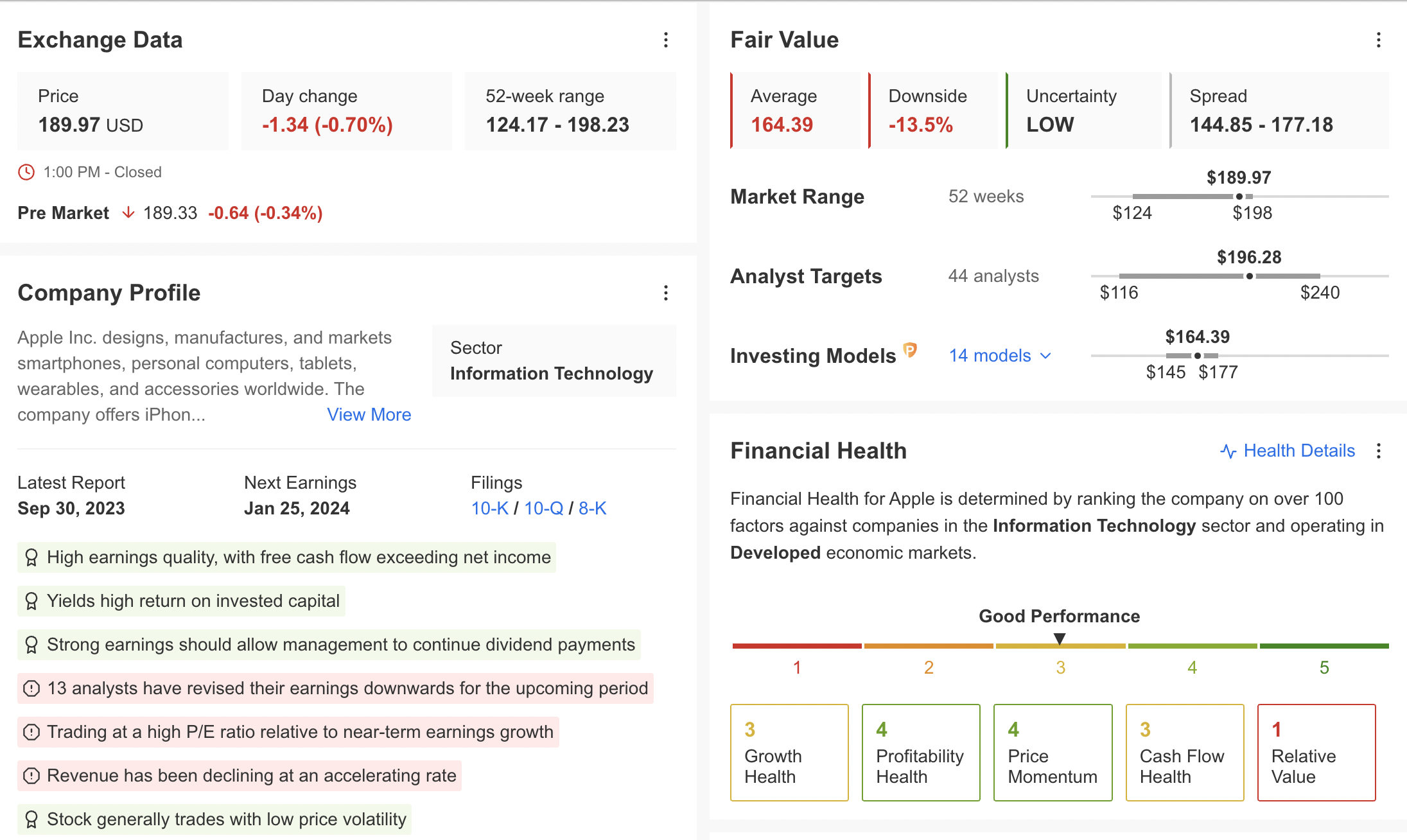

Users of InvestingPro gain access to the identical data employed by some of the globe's major investment banks and money managers. The foundational assumptions underlying the models are rooted in analyst estimates wherever applicable. Source: InvestingPro

Source: InvestingPro

From this screen, we can view the main sections and features of InvestingPro, now let's focus on what to look at when analyzing a stock using this tool:

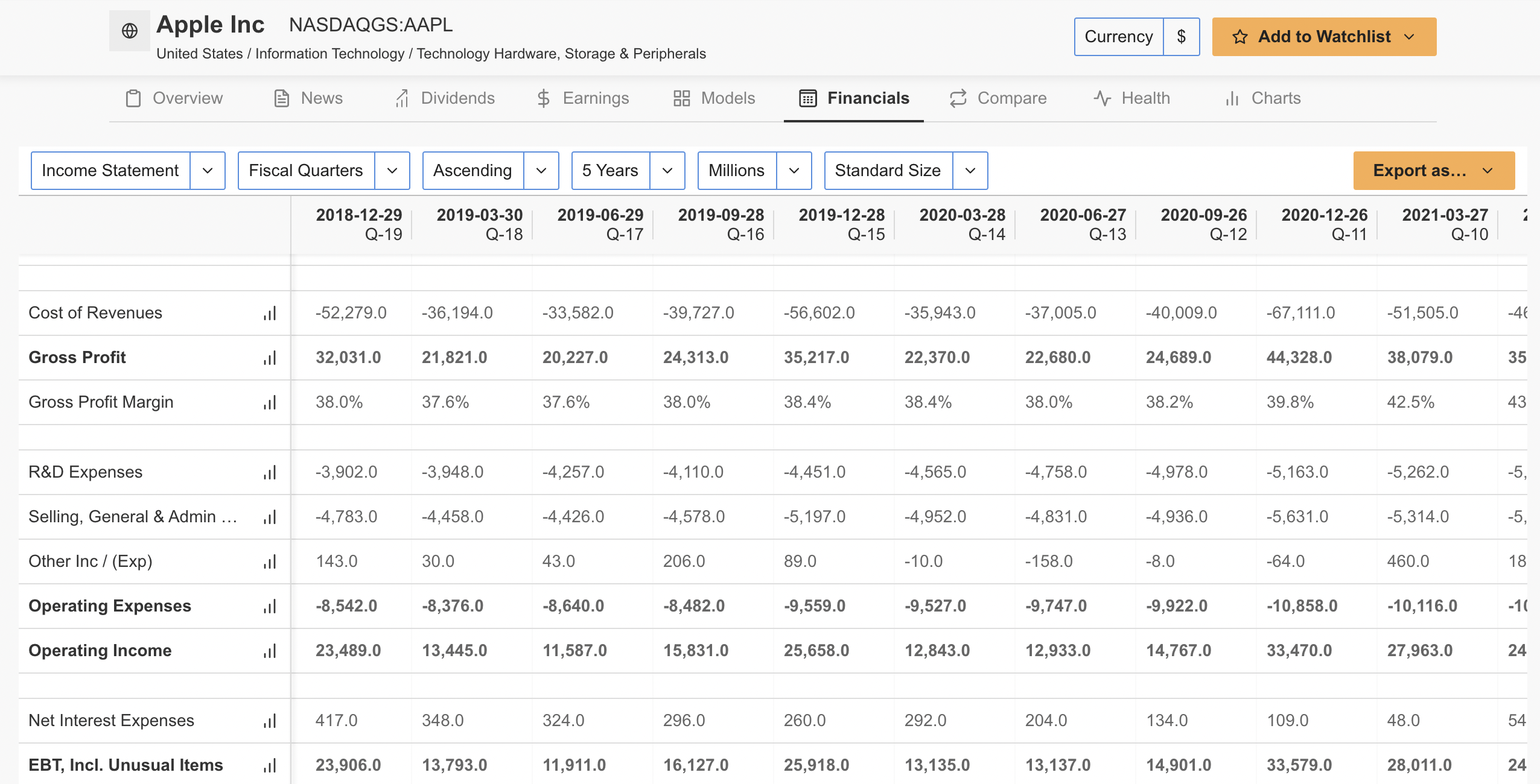

1. Balance Sheet, Cash Flow and Income Statements

These are vital data entries for any investor when evaluating a company. In fact, they represent the strength and health of the company at any given time. And they show the difference between assets and liabilities, as well as capital.

Source: InvestingPro

Source: InvestingPro

Analyzing the income statement, much like cash flows, proves more insightful when considering not just the last year but comparing it across multiple historical periods, such as the last 3 or 4 years.

The richness of historical data enhances our understanding, and InvestingPro excels in this regard, allowing for a thorough analysis spanning the past 10 years.

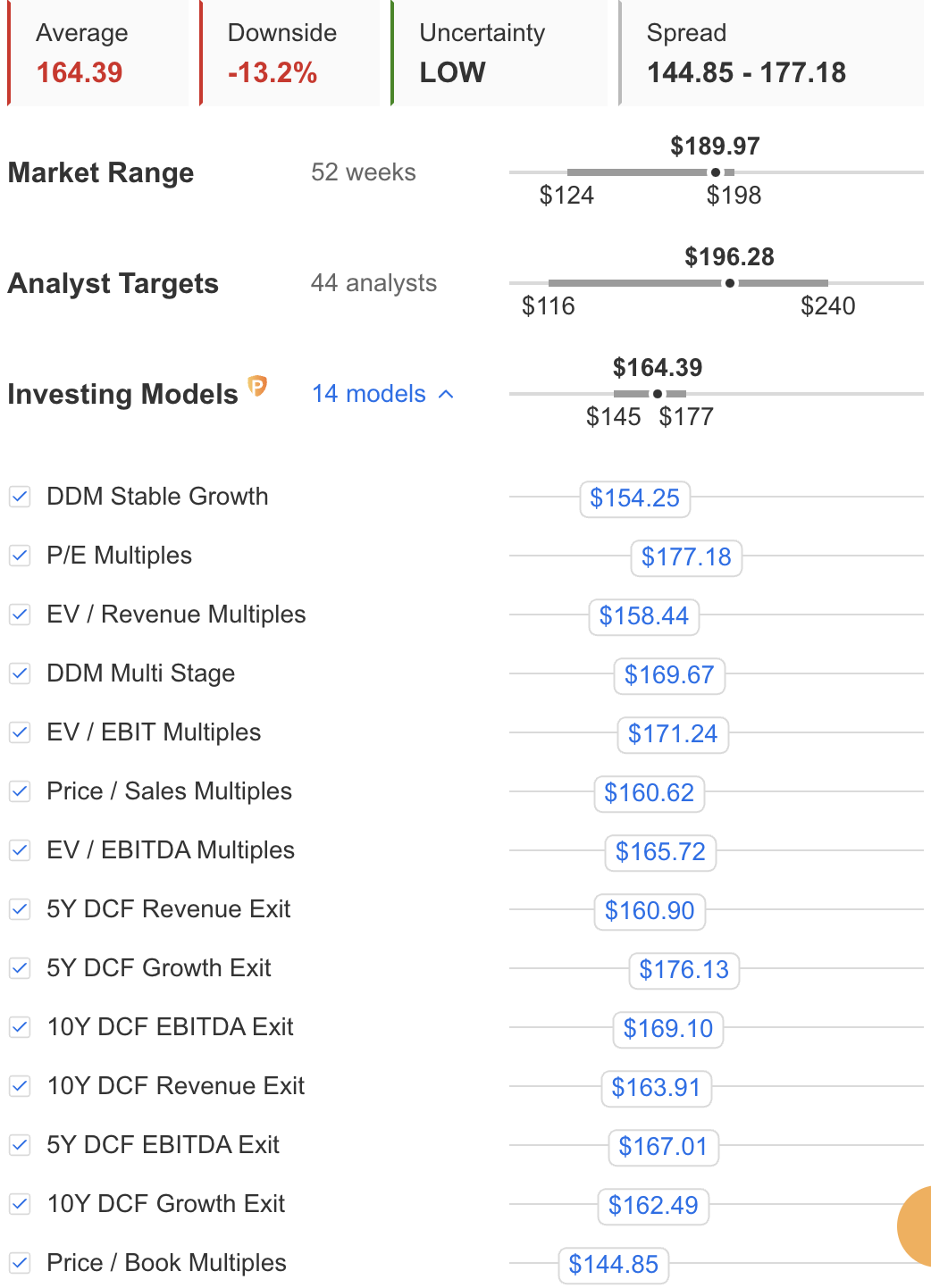

2. Fair Value

This is the essential indicator that shows whether the stock is overvalued or undervalued relative to the market price.

Source: InvestingPro

InvestingPro's fair value employs advanced financial modeling techniques akin to those utilized by analysts in investment banks or equity research agencies.

This approach facilitates the identification of undervalued or overvalued companies, providing quick access to crucial metrics such as the stock's average target price, upside potential, and uncertainty.

In essence, the fair value of a stock we intend to evaluate represents its genuine intrinsic value. Serving as an objective estimate of potential, it proves instrumental in fundamental analysis for gauging a company's value based on anticipated future cash flows.

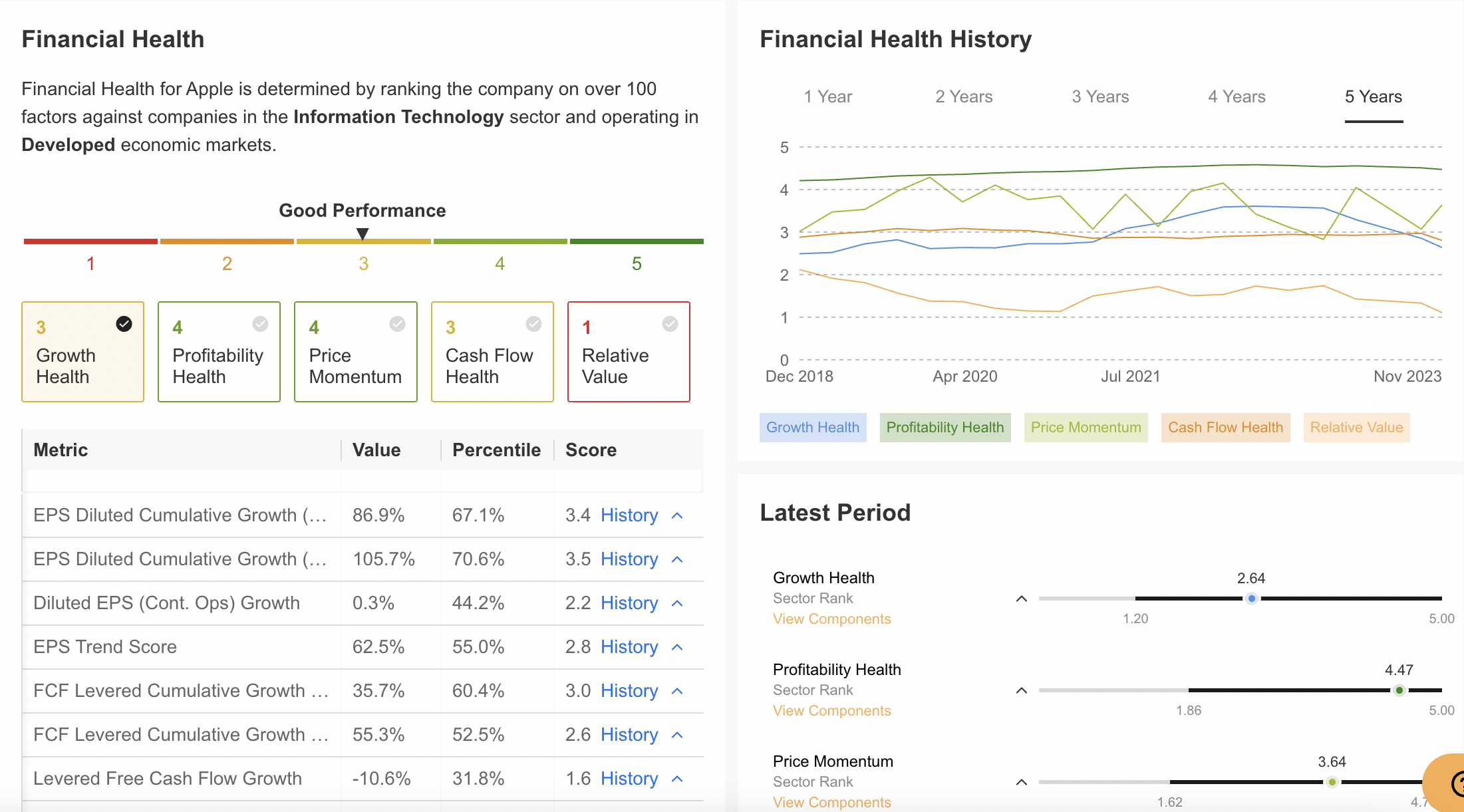

3. Financial Health

This self-explanatory strategy is determined by ranking the company on over 100 factors against companies in the Balance Sheet sector operating in Developed economic markets. Source: InvestingPro

Source: InvestingPro

4. Rival Analysis

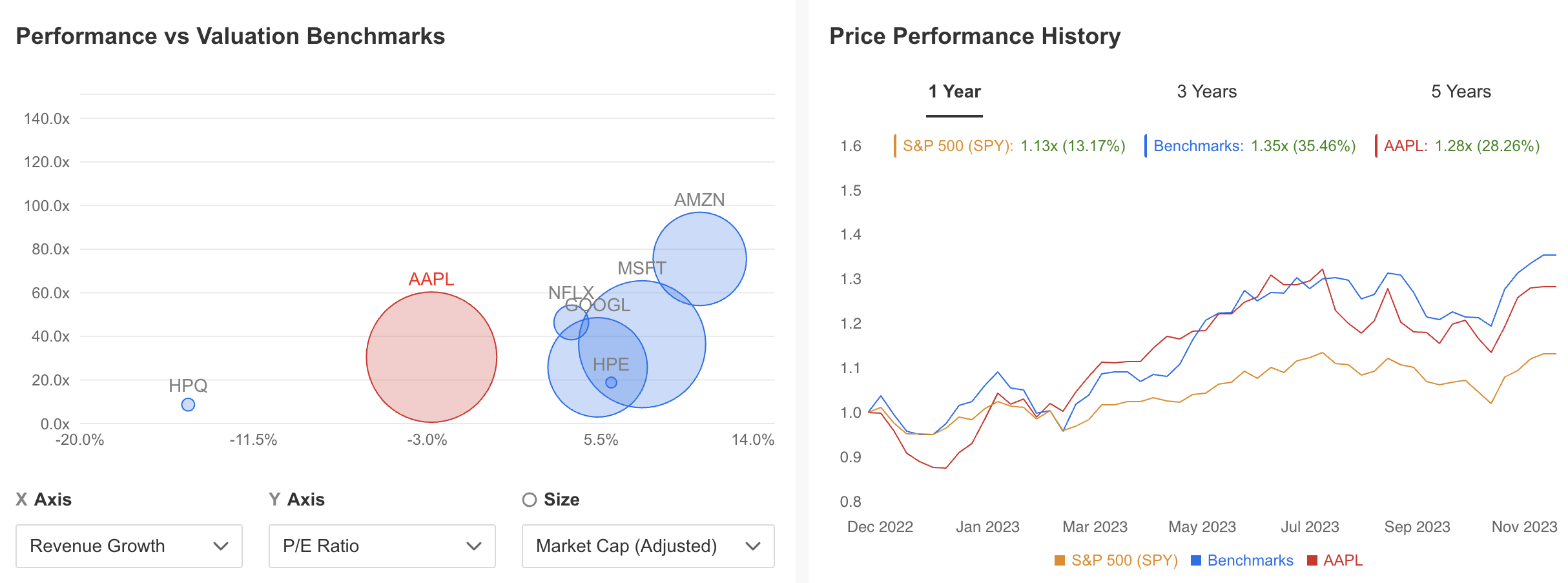

InvestingPro allows investors to compare any company in the market with stocks of companies in the same industry.

Source: InvestingPro

By going to the compare section we can analyze the stock by comparing it with its competitors based on performance and valuation. This is a very important step to take before closing the deal on any stock as there's always a chance that you are in the right sector, just with the wrong stock.

***

Missed out on Black Friday? No problem, we've got you covered for Cyber Monday at InvestingPro! There's still time to enjoy generous discounts. Elevate your market research with faster data, giving you the edge you need. Don't let this opportunity pass—act now and make your market insights even more powerful.

Disclosure: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.