- There are 97 companies in the S&P 500 that will not pay a dividend this year

- But, 77 in the index are expected to have a dividend yield of more than 4%

- In this article, we will focus on examining 4 of such companies

When it comes to dividends, an important factor is their yield, as it indicates how much of the investment we can recover solely through dividend distributions.

Typically, it's calculated before taxes, known as the gross dividend. It's expressed as a percentage and calculated by dividing the investment's earnings by the amount invested:

Yield (%) = (Earnings / Initial Investment) * 100.

For instance, imagine a company's shares trading at $60, with an upcoming dividend of $1.5 per share. By applying the formula: (1.5/60) x 100 = 2.5, the dividend yield materializes at +2.5%.

This means that shareholders in that company can expect a return of +2.5% of their initial investment each time dividends are distributed, irrespective of their investment size.

It's crucial to recognize that dividend-oriented investments can take two paths: investing in individual company shares or opting for specialized investment vehicles. In the latter category, we find investment funds like:

Turning to ETFs, notable options encompass:

- Vanguard Dividend Appreciation Index Fund ETF Shares (NYSE:VIG)

- S&P Dividend ETF (NYSE:SDY)

- iShares Select Dividend ETF (NASDAQ:DVY)

Furthermore, there are individual stocks presenting enticing dividend opportunities:

- Altria (NYSE:MO): 8.92%

- Verizon (NYSE:VZ): 7.78%

- AT&T (NYSE:T): 7.77%

- KeyCorp (NYSE:KEY): 7.70%

- Truist Financial (NYSE:TFC): 7.20%

- Walgreens Boots Alliance (NASDAQ:WBA): 7.08%

- Lincoln National (NYSE:LNC): 7.07%

- Kinder Morgan (NYSE:KMI): 6.51%

- Simon Property Group (NYSE:SPG): 6.39%

- Crown Castle (NYSE:CCI): 6.27%

With this foundation set, let's now delve into four stocks boasting attractive dividend prospects, leveraging insights from InvestingPro.

1. Altria

Formerly known as Philip Morris (NYSE:PM), Altria is an American company with a focus on food, beverages, and tobacco products. Headquartered in Virginia, it boasts the renowned Marlboro brand and holds a significant stake in Anheuser Busch Inbev (NYSE:BUD), along with its acquisition of Kraft Heinz (NASDAQ:KHC).

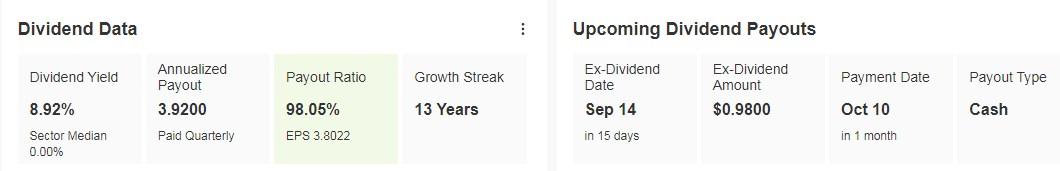

On October 10, Altria is set to distribute a dividend of $0.98 per share. This marks an increase from its previous dividend of $0.94. To snag this dividend, make sure you're holding the shares before September 14. And here's the kicker: Altria's annual dividend yield stands strong at +8.92%. That's an enticing return for dividend-seeking investors.

Source: InvestingPro

Source: InvestingPro

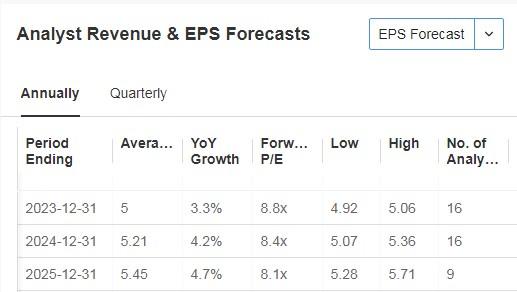

On October 26th, the company presented its earnings. The EPS forecast shows a 3.3% increase for this year and a 4.2% increase for next year.

Source: InvestingPro

InvestingPro's model predicts a potential value of $57.59, while the market estimates it at $49.54.

Source: InvestingPro

This August, the stock reached support and is bouncing upward from there.

This August, the stock reached support and is bouncing upward from there.

2. Verizon

Verizon holds the title of the largest mobile operator in the nation, it boasts an impressive customer base of over 80 million users. Nestled in Basking Ridge, New Jersey, Verizon has firmly established its presence.

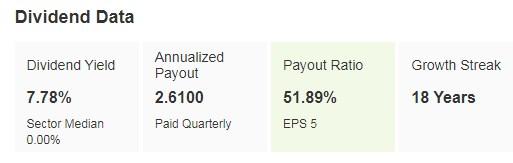

When it comes to dividends, Verizon recently doled out a payout of $0.6525 per share. And here's what's eye-catching: the annual yield clocks in at +7.78%. With such a substantial yield, Verizon's dividends make a compelling proposition for investors seeking solid returns.

Source: InvestingPro

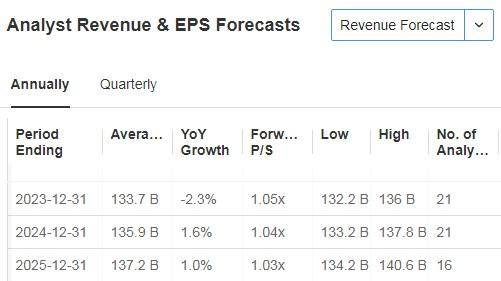

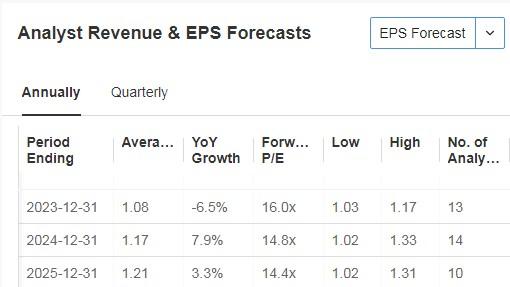

It will report its results on October 24. Revenue forecasts are expected to be favorable for 2024 and 2025.

Source: InvestingPro

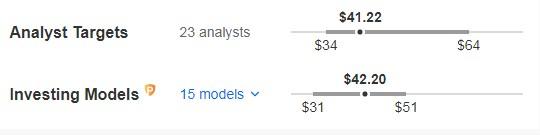

There are a total of 26 ratings available for this stock. Out of these, 17 are hold, 6 are buy, and 3 are sell. Citi's rating is the most recent one, which values it at $40.

Based on market potential, the item is estimated to be worth $41.22, while InvestingPro has estimated its value at $42.20.

Source: InvestingPro In mid-July, it formed a floor when it entered oversold conditions, and from there, it bounced upwards.

In mid-July, it formed a floor when it entered oversold conditions, and from there, it bounced upwards.

3. Kinder Morgan

Kinder Morgan is a major player in the North American energy infrastructure sector, known for being the largest pipeline operator in the United States, responsible for moving approximately 40% of the country's natural gas consumption.

Established in 1997, the company has built a strong presence in the industry.

Turning our attention to dividends, Kinder Morgan recently distributed dividends of $0.2825 per share, resulting in an annual yield of 6.51%.

This figure underscores the company's commitment to providing consistent returns to its shareholders, making it an attractive option for investors seeking a reliable income stream.

Source: InvestingPro

On October 18, it will present earnings. Both revenue and earnings per share forecasts for 2024 and 2025 are very favorable.

Source: InvestingPro

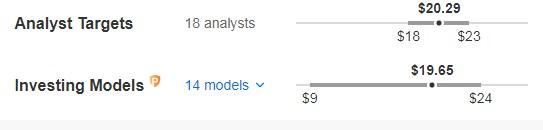

The company has a total of 21 ratings, with 5 buy, 15 hold, and 1 sell. InvestingPro's models predict a potential of $19.65, while the market estimates it at $20.29.

Source: InvestingPro The support at $16.05 has consistently boosted the stock every time it was touched.

The support at $16.05 has consistently boosted the stock every time it was touched.

4. Crown Castle

Headquartered in Houston, Texas, Crown Castle is a prominent provider of electronic components and infrastructure crucial for mobile telecommunications.

With a presence in over 100 diverse markets, the company serves as a vital service provider to industry giants like Verizon, AT&T (NYSE:T), and T-Mobile (NASDAQ:TMUS).

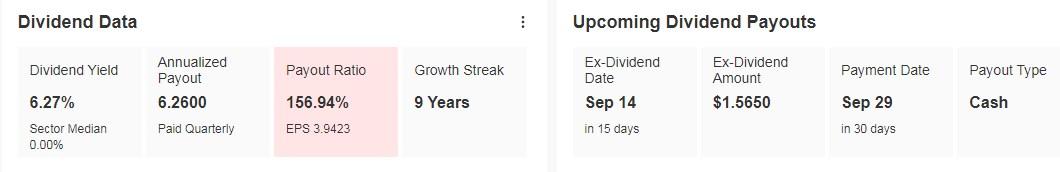

Crown Castle has scheduled a dividend distribution of $1.5650 per share on September 29. To qualify for this dividend, investors need to have ownership of shares by September 14.

Crown Castle's attractive annual dividend yield of +6.27% makes it a decent stable income choice for investors.

Source: InvestingPro

It will release its quarterly results on October 18.

Source: InvestingPro

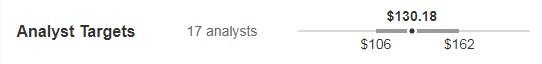

The security has 19 ratings: 8 buy, 8 hold, and 3 sell. The projected market value is $130.18.

Source: InvestingPro

***

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.