I track and follow approximately 50 different commodities and I must say that the softs sector where I do a fair bit of trading for clients is ignored too much in my opinion.

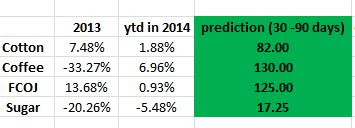

In this piece I am going to briefly touch on four soft commodities that I track and trade with clients. Below you can see the 2013 performance, ytd 2014 performance and what I see developing in the next 30-90 days.

Cotton

March cotton futures have appreciated a dime or 13% in the last 60 days after bottoming in mid-November. Futures are trading at 15 week highs and over 85 cents I do not think current values are justified for any length of time. Global demand does not merit this sort of price appreciation and looking at at the 14' supply and demand projections I think we are closer to a top than a bottom forecasting a trade closer to 80 cents in the coming months.

Coffee

Coffee lost over 33% last year but futures have been rebounding in recent weeks with current trade just under the 50 day MA (light blue line). In fact in recent sessions we've seen settlements above that pivot point which did not happen all of 2013. The story in recent years has been an abundant world supply which remains the case even on "off" years. An economic recovery globally should help increase demand and a penetration of the down sloping trend line just below $125 would be a game changer in my eyes.

FCOJ

A freeze premium was built into OJ futures contributing to the upward assault we experienced in future prices in Q4 of 13. Since March futures have started to depreciate off the last 4 sessions giving up 15 cents H/L. A settlement below the 50 day MA (light blue line), currently at $138.95 would confirm a trade back to the 61.8% Fibonacci level as the weather premium is removed...in my opinion.

Sugar

Sugar not the worst performer in 13' but certainly a bearish standout in the last three months faltering better than 20% matched last years total loss. This too like coffee is a supply story with another global surplus forecast for the coming year, larger than previously anticipated. Where will demand come from is the $1M question as China was an aggressive buyer last year and that likely will not be the case in 14'. My stance is we get at minimum a bounce from over sold levels as the ship is leaning too much in the opposite direction.As one can see above my target is a 38.2% Fibonacci retracement