Bitcoin has surged to record highs. We discuss the four factors pushing Bitcoin higher and analyze the cryptocurrency’s technicals.

1. Bitcoin ETF Approvals

In January, the Security and Exchange Commission approved spot Bitcoin ETFs after clearing the way for such products at the end of 2023. The event was a milestone and a bullish driver of Bitcoin prices for two primary reasons.

Firstly, it marked the further legitimization of the asset class, with the historically anti-crypto SEC lowering regulatory barriers for financial product providers to promote crypto products. Secondly and more importantly, the creation of spot Bitcoin ETFs significantly shifts the supply and demand curves, with providers needing to purchase physical Bitcoin to make the product. Recently, other jurisdictions have opened the door to allowing similar products, with the UK regulatory body flagging possible Bitcoin Exchange Traded Notes.

(Past performance is not a reliable indicator of future results)

2. The Halving

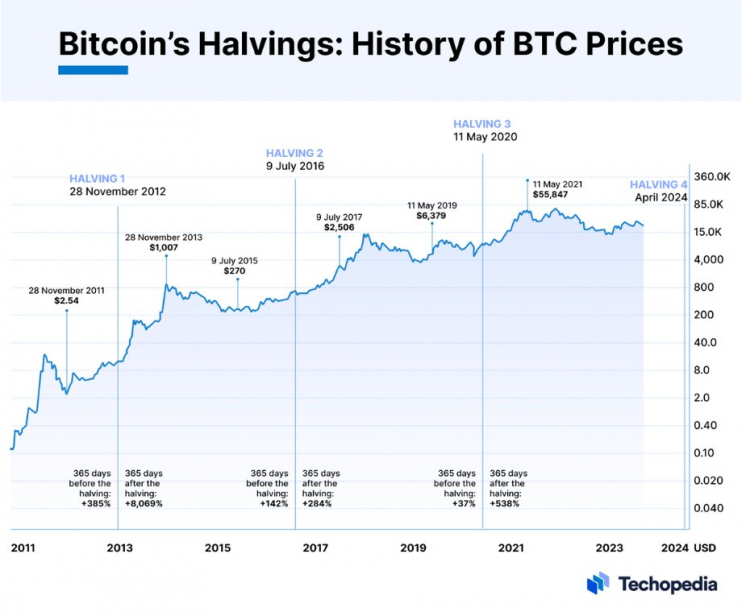

The next Bitcoin halving is expected to occur sometime in April and is another factor likely supporting prices. The halving occurs roughly every four years and represents the scheduled reduction in the amount of Bitcoin miners are rewarded for mining new coins. The principle underpinning the halving is that it constrains the supply of new Bitcoin over time because it reduces the incentive of miners to mine and releases fewer new coins into circulation during the mining process.

History suggests that Bitcoin rises going into and shortly after halving events. As conveyed below, the crypto rallied before and following the three previous halvings in 2012, 2016, and 2020.

Source: Techopedia

3. Potential US Rate Cuts

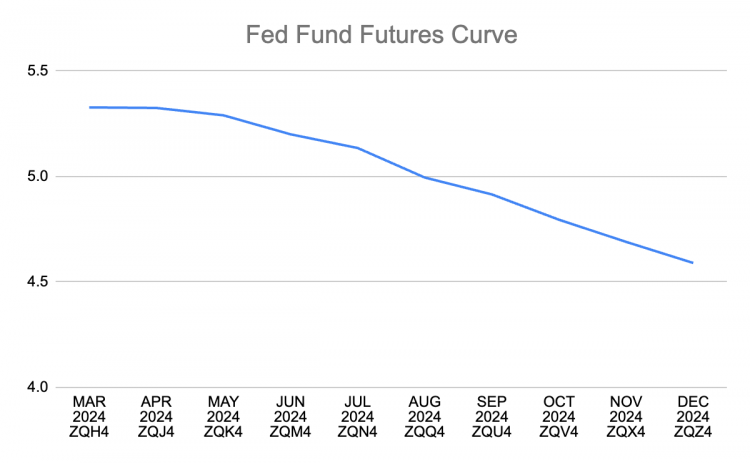

At the margins, the macroeconomic backdrop has also been more supportive of Bitcoin. As a non-yielding asset, bought by some as a store of value, Bitcoin has been pushed higher by the prospect of interest rate cuts in the United States.

In an absolute sense, policy settings remain restrictive and unaccommodating for non-yielding assets like Bitcoin: unlike the last record high achieved in November 2021, this rally has come despite positive “real” yields, which in theory should push money flow towards cash and Treasuries.

However, market expectations for three rate cuts from the Fed this year is a tailwind for Bitcoin, with the pricing in of a quicker or deeper cutting cycle a potential bullish driver in the future.

Source: CME Group

4. Elevated Risk-Appetite

Bitcoin is often seen as a barometer for risk appetite in broader financial markets. Recently, the appetite for risk has been elevated, with bullish behavior observable across asset markets. The driving factor behind such strong sentiment is greater liquidity, lower implied volatility, and an improving investment outlook, which itself is generated by expectations for lower interest rates globally and a so-called “soft-landing” for the US economy.

There is also the excitement surrounding artificial intelligence, which, despite impacting the fundamentals of a handful of companies, is supporting market sentiment. While it has split from the index recently—perhaps signaling that the most recent leg of its rally is due to separate factors or maybe momentum chasing—Bitcoin’s performance has been correlated with the high-performing US tech stocks.

Source: TradingView

In particular, Bitcoin has traded in a relatively tight correlation with Nvidia (NASDAQ:NVDA), which has been at the centre of the artificial intelligence boom. Over the past 12 months, Nvidia climbed approximately 250%, while Bitcoin has risen roughly 230%.

Source: TradingView

Technical Analysis: Bitcoin (BTC/USD)

Charting Bitcoin (BTC/USD) on a logarithmic scale provides a better perspective on the crypto’s long-term trend and potential direction. Bitcoin remains in a long-term uptrend, with price action suggestive of a possible new bull market.

Historically speaking, the three previous bull runs have seen Bitcoin appreciate approximately 55,000%, 12,000%, and 2000%, with every bull run diminishing in size over time. So far, the rally from previous lows has seen Bitcoin climb around 330%.

Source: TradingView

(Past performance is not a reliable indicator of future results)

All price information and forecast data in this article is sourced from TradingView