Commerce Bancshares, Inc. (NASDAQ:CBSH) offers a profitable investment opportunity driven by steady earnings growth and a strong liquidity position. In second-quarter 2017, the bank recorded nearly 14% year over year increase in earnings.

Analysts also seem to be optimistic about its growth prospects as evident from the upward estimate revisions. Over the last 30 days, the Zacks Consensus Estimate for the current year was revised 3.5% upward.

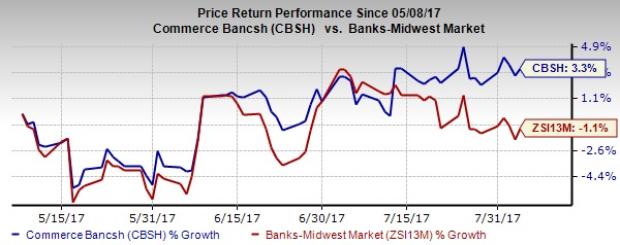

Further, this Zacks Rank #2 (Buy) stock has rallied 3.3% in the last three months against the industry’s decline of 1.1%.

Fundamentals Show a Lot of Promise

Revenue Growth: Commerce Bancshares’s net revenue reflected compounded annual growth rate of 4.5%, over the last three years (2014–2016). The same trend persisted in the first six months of 2017. The sturdy top-line increase has been backed by strong loan and deposit growth.

The company’s projected sales growth (F1/F0) of 7.6% for 2017 (as against the industry average of about 2.6%) indicates its superiority in generating revenues.

Earnings Per Share (EPS) Strength: Commerce Bancshares has witnessed 10.7% growth in earnings per share over the last three to five years. The trend is expected to continue in the near term as well. The company’s projected EPS growth is 12.6% and 5.3% for 2017 and 2018, respectively.

Further, its long-term (three to five years) expected EPS growth of 6.2% promises rewards for shareholders.

Strong Leverage: Commerce Bancshares’s debt/equity ratio is at 0.04 compared with the industry average of 0.45, indicating lower debt burden relative to the industry. It highlights the financial stability of the company even in an unstable economic environment.

Superior Return on Equity (ROE): Commerce Bancshares’s ROE is 11.24% compared with the industry average of 9.22%, reflecting the company’s commendable position over its peers.

Other Stocks to Consider

Some other stocks in the same space worth considering include Peoples Bancorp Inc. (NASDAQ:PEBO) , Wintrust Financial Corporation (NASDAQ:WTFC) and First Merchants Corporation (NASDAQ:FRME) .

Peoples Bancorp has an expected year-over-year earnings growth of 19.3% for 2017. Its share price has risen more than 41.3% over the last one year. It currently boasts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Wintrust Financial also sports a Zacks Rank #1. For the current year, it has an expected year-over-year earnings growth of 17.4%. Its share price has increased 38.8% in the last one year.

First Merchants Corporation carries a Zacks Rank #2. It has an expected year-over-year earnings growth of 15.2% for 2017. Over the last one year, its share price has jumped 47.7%.

"5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>"

Commerce Bancshares, Inc. (CBSH): Free Stock Analysis Report

Wintrust Financial Corporation (WTFC): Free Stock Analysis Report

First Merchants Corporation (FRME): Free Stock Analysis Report

Peoples Bancorp Inc. (PEBO): Free Stock Analysis Report

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

4 Reasons To Buy Commerce Bancshares (CBSH) Stock Right Now

Published 08/07/2017, 08:08 AM

Updated 07/09/2023, 06:31 AM

4 Reasons To Buy Commerce Bancshares (CBSH) Stock Right Now

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.