The Oil/Energy sector is more than halfway through the Q3 earnings season. Let’s take a look at the factors influencing quarterly results this time around.

A Combination of Lower Oil & Gas Prices

So, how does the price of oil and gas compare with the year-ago period?

According to the U.S. Energy Information Administration, WTI prices started the third quarter of 2018 at around $74 per barrel and exited the period at $73 per barrel. This year, prices were $59 a barrel at the start of the third quarter and fell to $55 at the end of September.

The news is not rosy on the natural gas front either.

In Q3 of last year, natural gas prices were around $2.85 per MMBtu in the beginning and rose steadily to end September at more than $3 per MMBtu. Coming to 2019, the fuel was trading at $2.25 per MMBtu in the beginning of July and struggled throughout the quarter to end at $2.33 per MMBtu.

Companies Across the Board to Have Suffered

Taking into account the commodity price drop, the picture looks rather downbeat for the Q3 earnings season.

Per the latest Earnings Trend, Energy is one of the three sectors likely to have experienced double-digit earnings decline in the third quarter. Per our expectations, the sector’s earnings are likely to fall 34.8% from third-quarter 2018 on 3.3% lower revenues.

For the companies that have already reported, total earnings are down 23.8% from the same period last year on 0.4% lower revenues, with 50% positive earnings surprises and 37.5% beating revenue estimates.

Some Energy Firms Likely to Stand Out Despite Pricing Woes

Clearly, energy investors have ample reasons to worry about. But pricing woes do not necessarily indicate that all energy scrips have lost potential. In fact, the bottom-line beat ratios so far are suggestive of encouraging numbers this season and is validated by the ‘Big Oil’ results. While biggies like ExxonMobil (NYSE:XOM) , Chevron (NYSE:CVX) and Royal Dutch Shell (LON:RDSa) RDS.A bore the brunt of weaker oil and gas prices and fell short of year-ago earnings, all beat profit expectations.

Investing in companies with an earnings beat potential can fetch handsome returns for investors. This is because a stock generally surges on an earnings beat.

How to Identify Such Stocks?

But with a wide range of energy firms thronging the investment space, it is by no means an easy task for investors to arrive at stocks that have the potential to deliver better-than-expected earnings. While it is impossible to be sure about such outperformers, our proprietary methodology makes it fairly simple.

Our research shows that for stocks with the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), the chance of a positive earnings surprise is as high as 70%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP is our proprietary methodology for determining stocks, which have the best chances to surprise with their next earnings announcement. It is the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate.

Our Choices

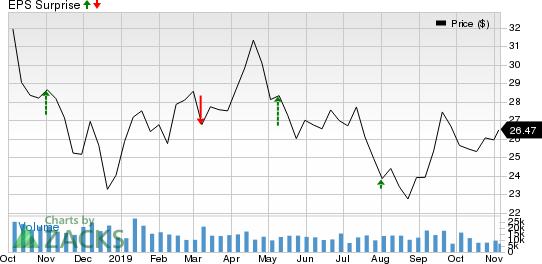

Canadian Natural Resources Limited (TSX:CNQ) is one of the largest independent energy companies in Canada. The company, with an Earnings ESP of +7.42% and a Zacks Rank #3, is scheduled to release earnings on Nov 7.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

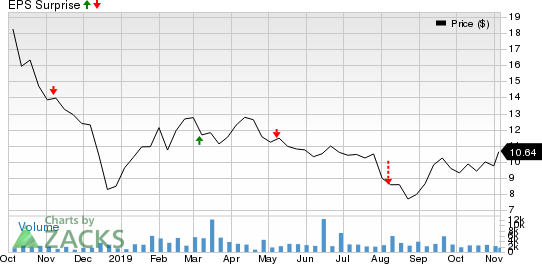

You may also consider Nine Energy Service, Inc. (NYSE:NINE) , which has a Zacks Rank #3 and an Earnings ESP of +10.76%. The North American onshore completion and production services provider is scheduled to release earnings on Nov 11.

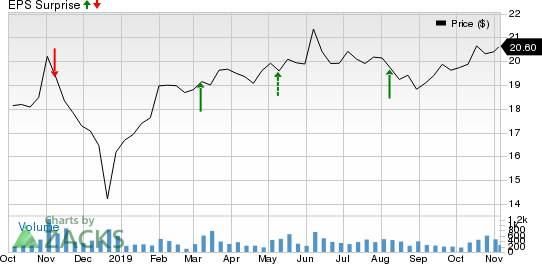

Berry Petroleum Corporation (NASDAQ:BRY) also deserves a mention. The stock has a Zacks Rank #3 and an Earnings ESP of +0.21%. Berry Petroleum, an oil and gas producer focused on California, is set to release results on Nov 7.

Another worthwhile option is Global Partners LP (NYSE:GLP) , which has a Zacks Rank #3 and an Earnings ESP of +61.91%. The supplier and operator of gasoline stations and convenience stores is scheduled to release earnings on Nov 7.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Global Partners LP (GLP): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

Berry Petroleum Corporation (BRY): Free Stock Analysis Report

Nine Energy Service, Inc. (NINE): Free Stock Analysis Report

Original post

Zacks Investment Research