So often we get caught up in the day to day movements in the market as traders and investors. Will stocks break out? Is a correction coming? What about that inflation impact on Gold? Will the Government shutdown ruin my account? With instant news all day long every day it is easy to get swept away.

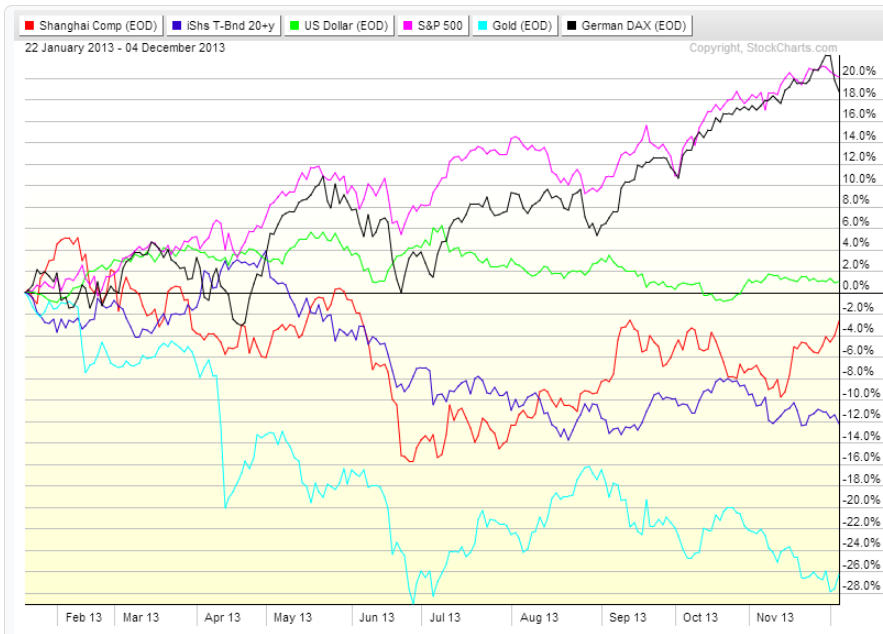

But when you step back from the day to day action and take a longer perspective what has really happened this year? The performance chart below is very simple. It shows the year to date performance of six markets: S&P 500 (SPY), German DAX (DAX), Gold (GLD), US Dollar (UUP), Shanghai Composite (SSEC) and US Treasuries (TLT). Just six lines emanating from the same point yet there is so much information displayed.

The first thing that stands out to me is that both Germany and the US have similar returns, despite the Euro crisis and all the US Government messes. And the progress throughout the year tracks very closely. This was a great year for stocks.

Second, despite all of the talk about a flow from US Treasuries into Equities, the real flow seems to be from Gold into Equities. The curve for Gold is nearly an identical inverted one of the S&P 500. If there is to be a flow from Treasuries to Equities it is still to come.

Next, easy monetary policy and increasing QE was supposed to kill the US Dollar, but it has basically done nothing all year. Is this because all of the other countries are doing a better job of debasing their currencies? Maybe, but the DAX move in line with the S&P 500 suggest that is not a factor.

Finally there has been the debate about whether the Chinese economy is picking up or falling into recession. It has gone back and forth a few times from what I recall. This was important, from the debate, because they are a huge economy and could impact the global economy. But the chart shows that despite the Shanghai Composite moving from a flat period to a hard sell off to a rise, and now stability, has had no impact on either the S&P 500 or German DAX outside of a brief correlation at the beginning of the turn down in May. But you may recall there was a lot of other news going on then as well (taper talk was the big one).

Buying stocks and selling Gold was the big winner. Were you in the market? What do you see and what will the next 12 months bring?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post