The gold mining stocks on our list are trading at industry-low Price to Cash Flow multiples

SmallCapPower | January 4, 2018: The VanEck Vectors Junior Gold Miners (NYSE:GDXJ) Index advanced 12% over the past month, driven by a 2.5% increase in the price of gold. Today, we have identified four gold mining stocks that trade on average at Price to Cash Flow multiples of 1.8x, well below their industry median of 4.8x.

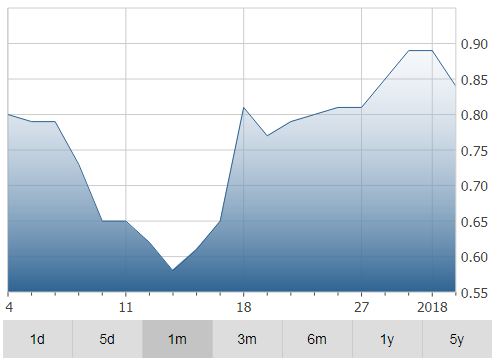

Asanko Gold Inc (TO:AKG) – $0.89

Asanko Gold is a Canada-based gold producer with operations across Africa. The Company’s Asanko Gold Mine is located in Ghana, and comprises two large deposits (Nkran and Esaase) and several satellite deposits. In addition, the Company owns significant land concessions in the Asankrangwa Gold Belt, where the Company is conducting exploration activities. There have been two short reports released by Raymond James and Clarus Securities.

- Market Cap: $181 Million

- M/M Return: 11.0%

- P/CFPS FY2018: 1.7x

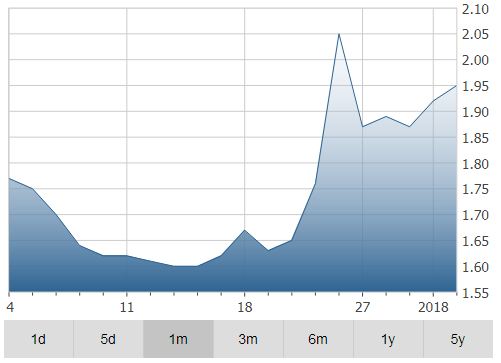

Brio Gold Inc (TO:BRIO) – $1.87

Gold

Brio Gold is a Canada-based gold producer operating in Brazil. The Company’s portfolio comprises of three operational mines and one new development project. Brio expects to double its production with the commencement of the Santa Cruz operations in December 2018.

- Market Cap: $220 Million

- M/M Return: 5.7%

- P/CFPS FY2018: 1.9x

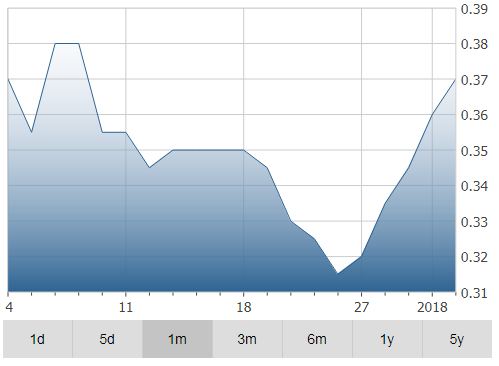

Jaguar Mining Inc (TO:JAG) – $0.35

Gold

Jaguar Mining is a Canada-based gold company operating in Brazil. The Company operates two mines and a number of exploration projects. Jaguar has a strong exploration pipeline initiative in place for its operating mines in Turmaline, Pilav, and Roca Grande.

- Market Cap: $112 Million

- M/M Return: -8.1%

- P/CFPS FY2018: 1.7x

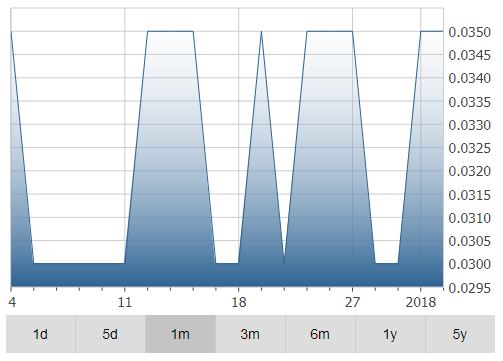

Avesoro Resources Inc (TO:ASO) – $0.03

Gold

Avesoro Resources is a Canada-based gold company operating in Liberia and Burkina Faso. The Company’s assets include four mines with exploration and expansion potential. ASO recently acquired another company. In addition to its mines, the Company has a 100% interest in the 300 km2 Batouri property in Cameroon.

- Market Cap: $165 Million

- M/M Return: -6.4%

- P/CFPS FY2018: 2.4x

Disclosure: Neither the author nor his/her family own shares in any of the companies mentioned above.