- The sector has an exciting outlook and expects revenues of 580 billion by 2027.

- Meanwhile, Puig, a luxury brand is set to debut in the stock market.

- Apart from the IPO, we will also take a look at 3 other investment opportunities in the market.

- Want to invest by taking advantage of opportunities in the luxury sector? Don't hesitate to try InvestingPro. Sign up HERE & NOW for less than $10 per month and get almost 40% off for a limited time on your 1-year plan!

The global beauty market is experiencing a surge, with a projected revenue of $580 billion by 2027. This explosive growth reflects consumers' unwavering interest in beauty products and the industry's remarkable ability to adapt to evolving customer preferences and tastes.

Given this promising outlook, let's delve into the recent IPO of Puig Brands (BME:PUIGb), a major player in the sector, and explore other intriguing investment opportunities within the beauty market.

As always, we'll leverage InvestingPro's powerful tools to gather the most relevant data and insights to guide our analysis.

1. Coty

Coty (NYSE:COTY) is an American beauty products manufacturer based in New York. Originally, the company was founded in Paris, France in 1904. It is known for using movies, entertainment, or sports professionals to name its products.

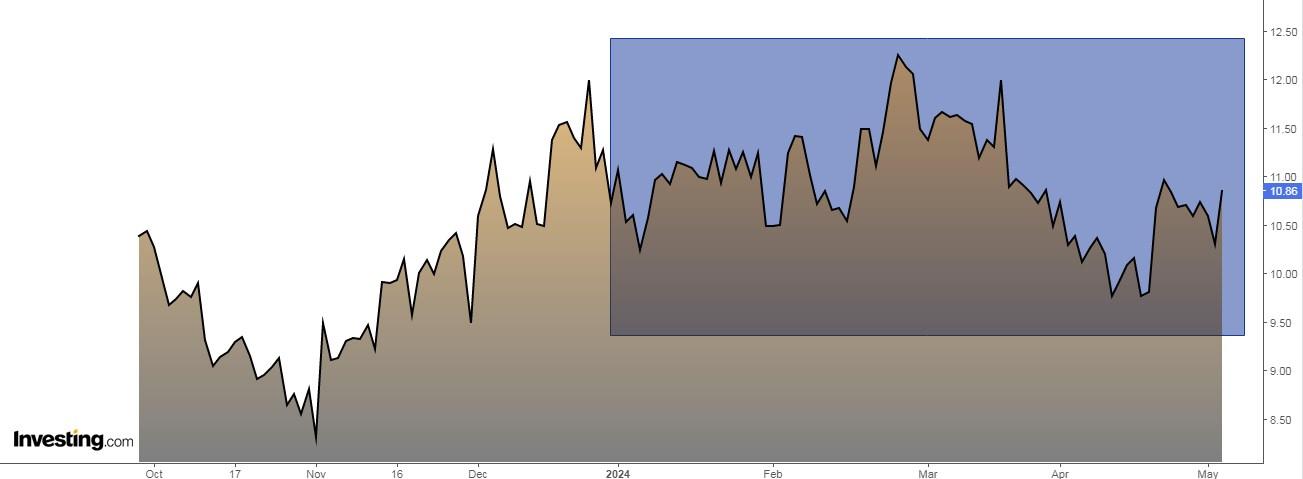

On May 6, it published earnings, beating market expectations in terms of revenue, but failing to meet EPS expectations.

Source: InvestingPro

Here are the earnings highlights:

- Revenue: $1.39 billion vs analyst estimates of $1.37 billion (small beat)

- EPS (non-GAAP): $0.05 vs analyst expectations of $0.06 (17% miss)

- Full-year EPS (non-GAAP) guidance: maintained from previous, $0.46 at the midpoint roughly in line with analyst expectations (although expected adjusted EBITDA margin increase is higher than previously expected)

- Gross Margin (GAAP): 64.8%, up from 62.9% in the same quarter last year

- Free Cash Flow was -$234.3 million, down from $363 million in the previous quarter

- Market Capitalization: $10.38 billion

Perfumes Chloé, Calvin Klein, Burberry (OTC:BURBY) and Hugo Boss (OTC:BOSSY) (ETR:BOSSn) accounted for 62% of its revenues in the last financial year.

Its key markets are Europe, the Middle East, and Africa, which account for 50% of its business, followed by the Americas. By 2027, it expects to reach US$7.5 billion in revenues.

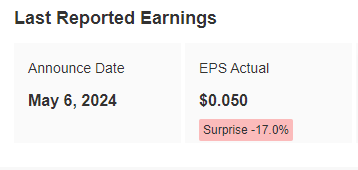

Its fair value would be at $12.54.

Source: InvestingPro

2. LVMH

A multinational luxury goods conglomerate based in Paris, France, LVMH (OTC:LVMUY) (EPA:LVMH) was founded in 1987 through the merger of Louis Vuitton and Moët Hennessy.

It went public in 1989 and has since become the world's largest luxury goods company.

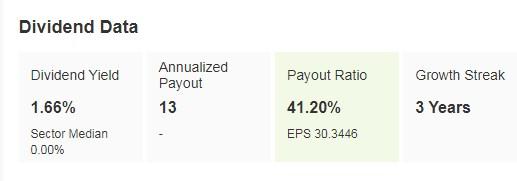

Its dividend yield is 1.66%.

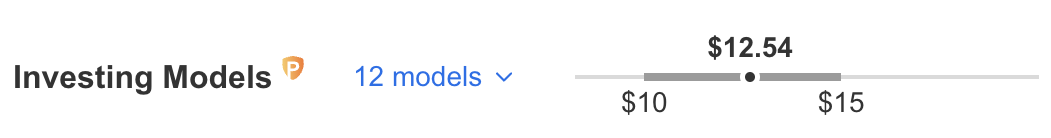

Source: InvestingPro

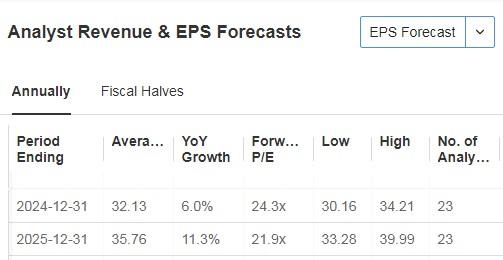

On July 23 it presents its quarterly results. By 2024 it expects EPS to increase 6% and revenue 4%.

Source: InvestingPro

Market consensus sees potential at €879.23.

Source: InvestingPro

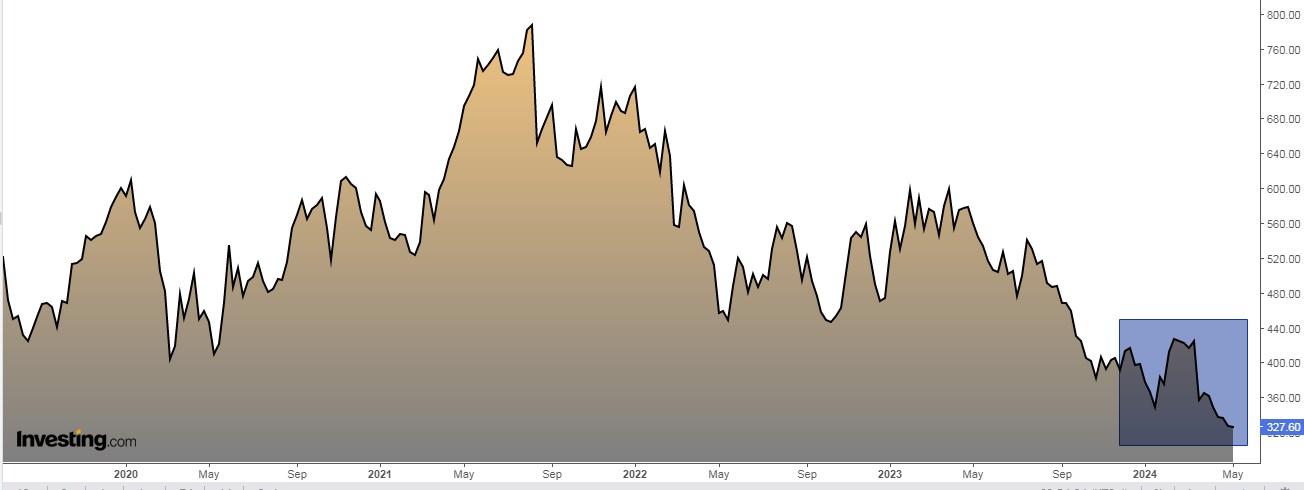

3. Kering

Kering (OTC:PPRUY) (EPA:PRTP) is a French business group of luxury brands.

It was previously known as PPP (Pinault-Printemps-Redoute). On March 22, 2013, Pinault announced that the group would change its name to Kering, which shareholders approved on June 18, 2013.

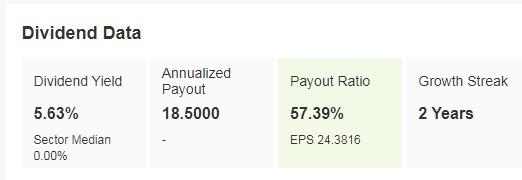

Its dividend yield is 5.63%.

Source: InvestingPro

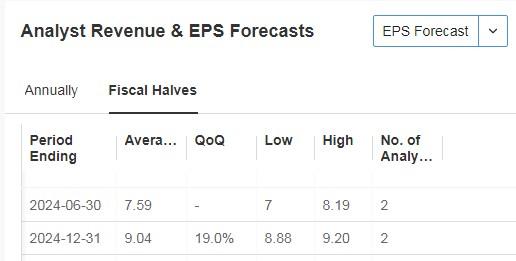

It will release its accounts on July 24. The outlook for the following quarters is favorable with an increase in EPS.

Source: InvestingPro

The market gives it potential at €377.08.

Source: InvestingPro

4. Puig

It is a perfumery founded in 1914 in Barcelona that covers cosmetics, fashion and skin care. In 2023 it had a turnover of 4,304 million euros.

It debuted on the Spanish stock exchange last week at a price of €24.5, giving it a market capitalization of €13.92 billion, making it Europe's largest IPO in 2024.

Its debut could serve as a "barometer" for other companies that are ready to go public, such as Europastry, Tendam and Hotelbeds.

At its debut, only institutional investors could buy shares, but retail investors can now do so as well.

The company aims to distribute 40% of its net profit as dividends to its shareholders.

Admittedly, the exit price was at the high end of the range, reflecting the company's positive outlook for its future. However, the exit price represents a 15% discount to the industry average in terms of enterprise value.

The market estimates that a "reasonable discount" could be 20% versus France's L'Oreal or a 3% premium to the sector, which would mean it would be attractive as long as it is below €31.

In its favor:

- Looking ahead to this year, the company expects to expand further, especially in the Asian market.

- In 2023 it turned over €4,304 million, achieved an ebitda of €849 million (+33%) and posted a net profit of €465 million (+16%).

- The Puig family's retention of a majority stake and voting rights ensures continuity in management, generating confidence for long-term investors.

- Its solid position in the market.

- Its strategic acquisitions.

- Its pricing strategy.

Analyzing its market prospects is still too early, but we will follow it closely.

***

Do you want to invest successfully? Take the opportunity HERE AND NOW to get the InvestingPro plan that best suits your needs. Use code INVESTINGPRO1 and get almost 40% off your 1-year subscription - less than a Netflix subscription costs you! (And you get more out of your investments too). With it you'll get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

-

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.