"Most people get interested in stocks when everyone else is. The time to get interested is when no one else is. You can't buy what is popular and do well." - Warren Buffett

The stock market is making new all-time highs once again. So naturally, more and more amateur investors are piling in.

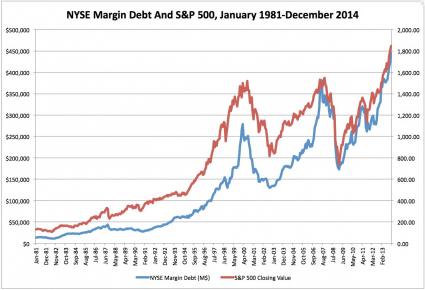

According to a recent article in the Wall Street Journal, discount brokerages are seeing record daily trading volumes, and investors are borrowing more money than ever to buy stocks. Margin debt hit an all-time in December of $444.93 billion, which was up 35% year-over-year.

Historically speaking, soaring margin debt has provided a warning signal that a bull market is nearing its end. Take a look at this chart from Seeking Alpha:

This Time Isn't Different

"There are always people who say that the rules have changed. But it only looks that way, if the time horizon is too short." - Warren Buffett

Equity investors are certainly feeling more confident these days. While it's difficult to say whether or not the market as a whole is overvalued at this stage, there is certainly a bit of "irrational exuberance" among investors in some individual stocks.

That's because investors often forget this simple axiom during raging bull markets: valuation matters.

Not Just Pieces of Paper

"The value of any stock, bond or business today is determined by the cash inflows and outflows - discounted at an appropriate interest rate - that can be expected to occur during the remaining life of the asset." - John Burr Williams

Let's think about what a stock is for a minute: it is a share in the ownership of a company. So as a shareholder, you're really a part owner in a business. And whether it is a lemonade stand or a multinational conglomerate, the intrinsic value of that business is the present value of its future cash flows.

Granted, forecasting cash flows for almost any business is difficult and often fraught with error. However, decent proxies for discounted cash flow analysis are valuation multiples on earnings and cash flow. Study after study has shown that stocks with low price/earnings or low price/cash flow ratios have outperformed the market. Meanwhile, those with high P/E or P/CF multiples have underperformed.

Good Business, Bad Stock

"Obvious prospects for physical growth in a business do not translate into obvious profits for investors." - Benjamin Graham

Simply buying a stock just because you expect its cash flow to grow at a high rate over time isn't enough. You have to buy it at a reasonable price.

Keep in mind that in most cases the market has already "priced in" a company's growth. And if its growth fails to meet (or even sometimes exceed) the market's expectations, then its stock can get pummelled. In other words, a sky-high P/E multiple will eventually contract if a company misses those lofty earnings expectations or when (not if) growth inevitably slows.

Examples like this occur every earnings season.

The Power of Earnings Estimate Revisions

"Earnings estimate revisions are the most powerful force impacting stock prices." - Len Zacks

Our research here at Zacks has shown that stocks with rising earnings estimates have significantly outperformed the market year after year, while stocks with falling earnings estimates have underperformed the market.

Why is this?

Think back to what the intrinsic value of a business is: the present value of all future cash flows (or earnings). So if earnings estimates rise, then the value of that business rises. Conversely, if earnings estimates fall, then so does its intrinsic value.

However, our research has also shown that value stocks with rising earnings estimates perform much better than expensive stocks with rising earnings estimates.

Stocks to Avoid

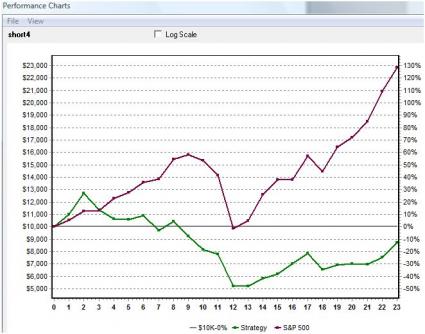

I ran a screen in Research Wizard based on the following criteria:

- Price to Cash Flow > 40

- 12-month Forward P/E > 30

- Zacks Rank >= 4

- Current Price > $5

I backtested this screen with a 24-week holding period over the last 10 years. The results show that a group of stocks that fit this criteria significantly underperformed the S&P 500 and actually provided a negative return, as you can see here:

So what are some stocks to avoid based on these criteria?

Here are 4 names from the list:

Price to Cash Flow: 45x

Price to Forward Earnings: 166x

Zacks Rank: 4

I get it: online retail is growing rapidly, and Amazon is the juggernaut in this space. But who doesn't know that already? If you're buying Amazon at these prices, then you're implicitly saying that the stock market isn't factoring in enough growth for this company. That's a very bold statement.

Bulls may argue that Amazon is investing for tomorrow and doesn't care about turning a profit today. That might be fine for a new company in a new industry, but Amazon is 20 years old now. When will tomorrow finally come?

It looks like investors might be starting to lose their patience. Shares of Amazon are down more than -12% since the company's Q4 results fell short of expectations on both the top and bottom lines. Unsurprisingly, earnings estimates have come down considerably too.

Medidata Solutions (MDSO)

Price to Cash Flow: 99x

Price to Forward Earnings: 150x

Zacks Rank: 4

Medidata Solutions provides cloud-based solutions for clinical research in life sciences. These solutions allow its customers to increase the value of their development programs by more efficiently and effectively designing, planning, and managing key aspects of the clinical trial process.

Revenue has been growing at a healthy clip for Medidata, but its stock price has grown even faster. And consensus estimates have fallen significantly following the company's latest earnings report on February 6. With shares trading a frothy 150x forward earnings, investors should strongly consider investing their money elsewhere.

Qualys (QLYS)

Price to Cash Flow: 87x

Price to Forward Earnings: 471x

Zacks Rank: 5

Qualys provides cloud security and compliance solutions for corporations. Similar to Medidata, the company has delivered strong revenue growth. But by the company's own non-GAAP EPS numbers, earnings were flat in 2013. And operating cash flow increased by a fairly tame 15%.

Meanwhile, consensus earnings estimates have fallen since the company's Q4 earnings report on February 10, sending the stock to a Zacks Rank #5 (Strong Sell).

LinkedIn (LNKD)

Price to Cash Flow: 132x

Price to Forward Earnings: 1,087x

Zacks Rank: 4

Social media is hot right now, and LinkedIn is becoming an important part of the job market. Nobody denies that. But LinkedIn is expected to barely turn a profit this year. And earnings estimates for both 2014 and 2015 have plummeted since the company reported its Q4 results on February 6. It is a Zacks Rank #4 (Sell) stock.

LinkedIn is down more than -20% from its 52-week high set last September. But does this stock really look like a value with a forward P/E ratio over 1000?

The Bottom Line

No matter what the stock market is doing, stay focused on the underlying value of the business you're invested in. Don't buy a stock just because you think its earnings are going to grow. It's not that simple. The market has likely already priced that growth in, especially during bull markets. Look for reasonably priced companies who are exceeding expectations and avoid those who aren't.