In yesterday's post I discussed the impact of rate increases on the financial markets given a low economic growth environment.

"Secondly, what David's analysis misses is the level of economic growth at the beginning of interest rate hikes. The Federal Reserve uses monetary policy tools to slow economic growth and ease inflationary pressures by tightening monetary supply. For the last six years, the Federal Reserve has flooded the financial system to boost asset prices in hopes of spurring economic growth and inflation. Outside of inflated asset prices there is little evidence of real economic growth as witnessed by an average annual GDP growth rate of just 1.2% since 2008, which by the way is the lowest in history....ever."

While an interesting debate, it is a primarily a moot point given the unlikely scenario the Federal Reserve will raise rates in 2015. This was a point made by Jeffrey Gundlach, via Reuters, yesterday:

"Jeffrey Gundlach, chief executive of investment firm DoubleLine Capital, said on Tuesday he believes the U.S. Federal Reserve will probably not raise interest rates this year, in part because of a lack of wage inflation."

Just for the record, this was something I discussed back in March stating:

"I spent a few minutes with my friends at Fox 26 Houston yesterday discussing the FOMC's recent two-day meeting and why the Fed will not raise interest rates this year."

While I discussed the issue of rate hikes and extremely low annual rates of economic growth in yesterday's missive, the following four charts go to the heart of why the Fed will not raise rates this year.

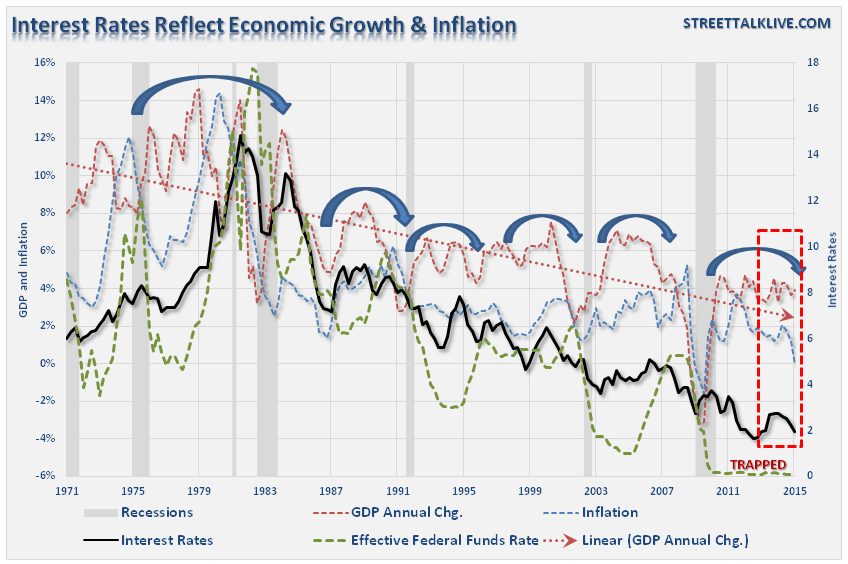

Inflation

Interest rates, in general, are a function of economic growth and inflationary pressures. The rate at which individuals and corporations will borrow or lend money is based upon the demand for credit that is driven by the strength of the underlying economy.

There are a couple of important things to note about the following chart. The first is there is not a high correlation between increases in the Fed Funds rate and the 10-year Treasury rate. While many bond bears are suggesting that long rates are about to start a long-term rise, there is sufficient evidence that they would decline with the onset of a higher Fed funds rate.

Secondly, the downward trend in inflationary pressures is historically consistent with declines in the Fed funds rate. The Fed generally LOWERS borrowing costs in an attempt to CREATE inflation, not vice versa. With very low levels of inflation, interest rates, and economic growth currently, there is little historical precedent that would suggest the Fed would lift rates in such a weak environment.

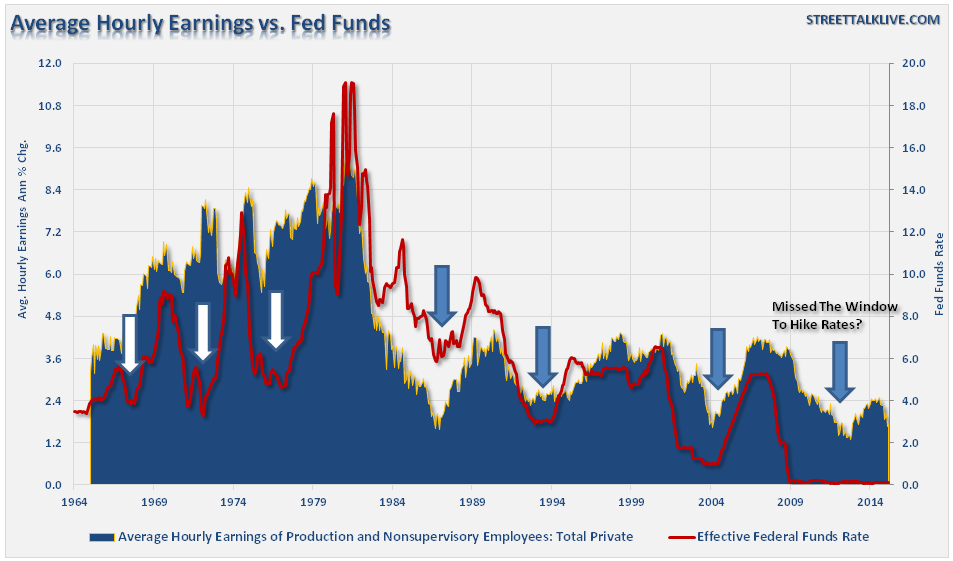

Wages

As mentioned by Mr. Gundlach, weak wage growth is also likely to keep the Fed on hold for now. Interestingly, the Fed may have actually missed it window for a rate hike in 2013 when wages and incomes spiked due to the onset of the "fiscal cliff.

Historically, as noted by the arrows, the Fed has generally started a rate hike campaign coincident with a turn up in wage growth and increases in employment and lowered rates as wages fell. With wage growth currently on the decline, an increase in rates would likely depress growth further.

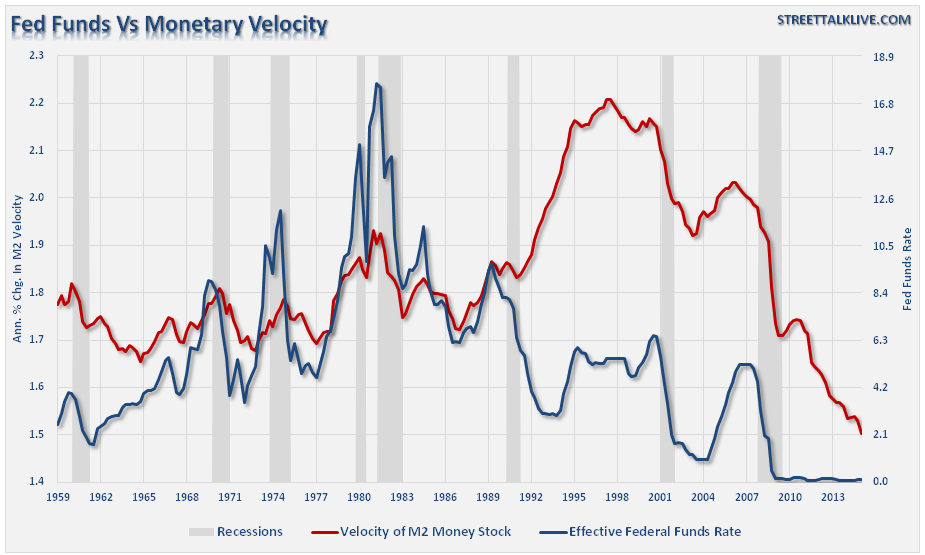

Monetary Velocity

Monetary velocity is a key indicator to underlying economic activity. Historically, peaks and declines in monetary velocity have been an early indicator of a weaker economic environment in the future.

Furthermore, Fed rate hikes have been coincident with a rise in monetary velocity as increases in economic activity was able to absorb the impact of higher borrowing costs.

Despite statistical headlines, economic activity by many measures has continued to operate at levels normally associated with recessions rather than expansions. The decline in monetary velocity is evidence of the same. It also explains much about weak wage growth, the shrinkage of the labor force, and high levels of welfare dependency. The key point is that monetary velocity suggests that the Fed should remain on hold for now.

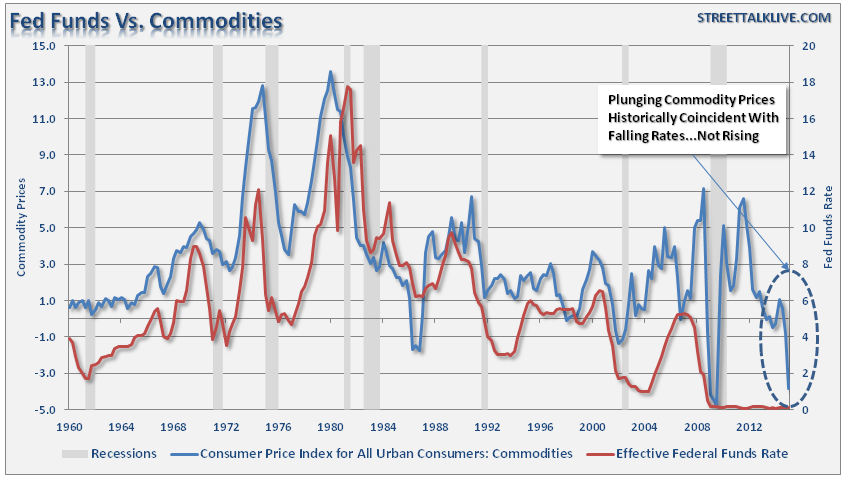

Commodities

Lastly, commodity prices, as measured by CPI-All Commodities, also suggest that the Fed should not engage in hiking rates anytime soon. Historically, the Fed funds rate has risen coincident with rising commodity prices brought about by stronger economic activity. As economic activity gains strength, higher borrowing costs can be levied.

However, like with wage growth, the Fed likely missed its window to increase lending rates following the financial crisis when economic activity picked up along with a surge in commodity prices. However, now, with global commodity demand languishing, and prices slumping there is little room to raise interest rates without further crimping already weak economic activity.

Data Be Damned

Currently, there is little evidence that is supportive of higher overnight lending rates. In fact, the current environment continues to support the idea of a "liquidity trap" that I began discussing in 2013. To wit:

"...a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels."

Please review the chart on monetary velocity above. This is a major issue for the Federal Reserve, which remains firmly committed to a line of monetary policies that have had little effect on the real economy.

While the Federal Reserve clearly should not raise rates in the current environment, there is a possibility that they will anyway -- "data be damned." (Which is ironic for a "data dependent Fed.")

They understand that economic cycles do not last forever, and that we are closer to the next recession than not. While raising rates would likely accelerate a potential recession and a significant market correction, from the Fed's perspective if just might be the 'lesser of two evils.' Being caught at the "zero bound" at the onset of a recession leaves few options for the Federal Reserve to stabilize an economic decline. The problem is that it already might be too late.