The ultra-strong U.S. dollar is making its presence felt throughout the globe and is on the verge of wreaking havoc on a much larger scale. A premature Fed rate hiking cycle could be the catalyst to send the USD into overdrive and send global markets tumbling lower – 4 charts that clearly illustrate why the Fed won’t be entering a rate hiking cycle anytime soon:

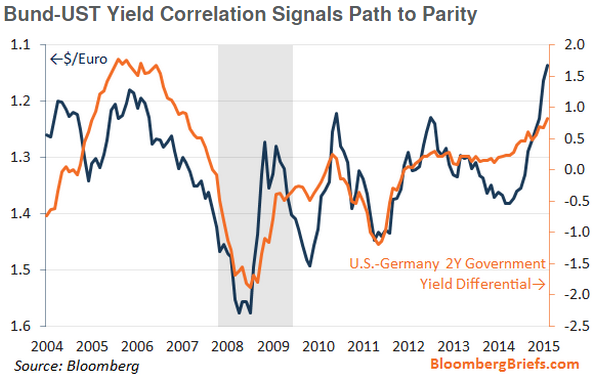

- The gap between the yield on 2-year Bunds and 2-year Treasury notes indicates even more USD appreciation in the near future -this is a clear negative for U.S. exports and economic growth.

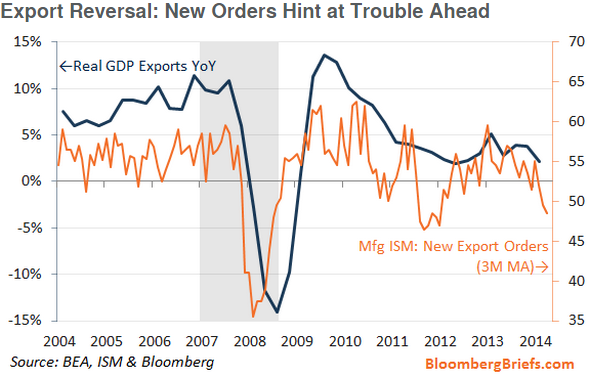

- The pace and trend of new orders and real GDP exports indicates trouble ahead. Meanwhile, the strong USD adds nothing but a further headwind for U.S. export growth.

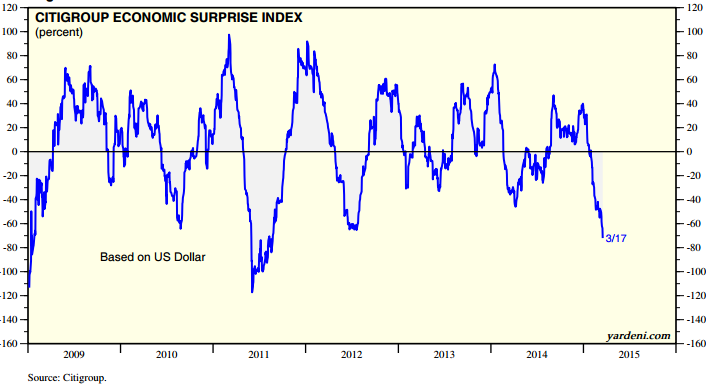

- The Citigroup (NYSE:C) Economic Surprise Index is at its lowest level since summer of 2011 when the eurozone was on the brink of falling apart. Moreover, the trajectory of the decline strongly correlates with the parabolic rally in the USD.

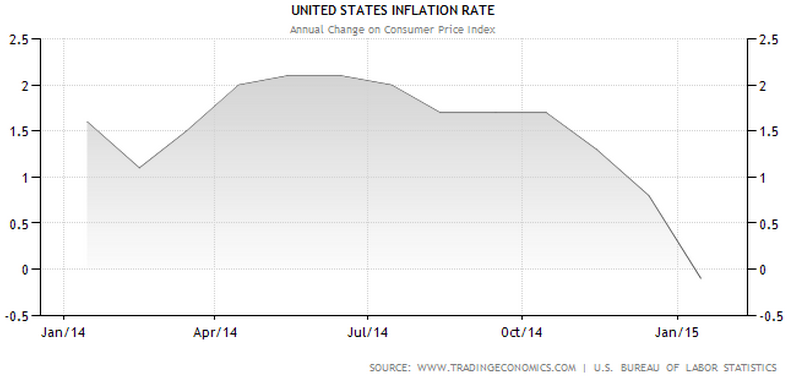

- Last month the U.S. fell into deflation for the first time since the 2008-2009 Global Financial Crisis – a stronger USD does nothing but add to the disinflationary headwinds.

While the Fed could certainly initiate a single rate increase for symbolic reasons, there is little chance that a protracted rate hiking cycle will begin anytime soon. At least not if the Fed wants to avoid crushing the economy and triggering another global financial crisis…