- This article aims to analyze four companies with impressive earnings growth potential, significant upside potential, and strong analyst buy ratings.

- We'll delve deeper into each company, examining their recent performance, upcoming earnings releases and much more.

- Leveraging insights from InvestingPro, we'll uncover valuable data and information to support our analysis.

- If you want to take advantage of some amazing insights as well, don't hesitate. Try InvestingPro: sign up NOW and get almost 40% discount for a limited time on your 1-year plan!

While analyzing earnings reports, it's crucial to identify companies that not only boast impressive earnings growth but also present significant upside potential and attract numerous buy ratings from analysts.

Here are four such companies that have caught our eye:

To analyze these companies further, we'll leverage the insights provided by the InvestingPro tool.

1. Baker Hughes

Baker Hughes is one of the largest oilfield services companies in the world and offers well-drilling products and services.

It was incorporated in 2016 and is headquartered in Houston, Texas.

On May 16, it distributed a dividend of $0.21 per share to its shareholders and to be eligible to receive it, it is necessary to own shares before May 3.

Thus, the company increased its quarterly dividend to 21 cents per share, up from 19 cents per share the previous year.

Source: InvestingPro

On July 17 it will release its results, expecting an EPS increase of 8.26%. For 2024, the forecast is for a 31.2% increase and revenue of 8%.

Source: InvestingPro

In the first quarter, it had a 50% increase in earnings per share (EPS) compared to the previous year and a significant increase in EBITDA margins.

Expected net earnings for this fiscal year will also be historic and the market is projecting a profit of more than $2 billion.

The company has secured major contracts with industry giants such as Petrobras (NYSE:PBR), Aramco (TADAWUL:2222) and Black & Veatch, and is focusing on growth opportunities in the natural gas, LNG and new energy sectors.

With a positive outlook for international markets and a strategic emphasis on artificial intelligence and decarbonization, Baker Hughes is positioning itself to meet the changing demands of the energy sector.

Its shares are up 16.79% over the past 12 months. The potential given by the market consensus is at $40.49.

Source: InvestingPro

2. Dollar Tree

Formerly known as Only $1.00 (Everything for $1.00), Dollar Tree is a discount retail chain that sells items for $1.25 or less.

It was established in 1986 and is headquartered in Chesapeake, Virginia. The company operates stores under the Dollar Tree and Dollar Bills names and also a chain of multi-price variety stores under the Family Dollar brand.

Dollar Tree does not pay dividends.

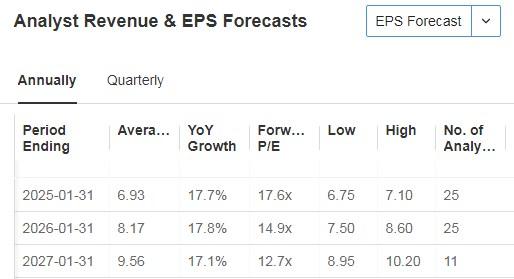

It will release its quarterly numbers on May 23. For 2024 the forecast is for EPS growth of 17.7% and revenue of 2.7%. The company's gross profit margin stands at 30.77%, with an operating income margin of 5.87%.

Source: InvestingPro

Transactions made by a company's executives with its shares usually provide information about the future prospects of the business.

In this case, we have Jeffrey A. Davis, chief financial officer of Dollar Tree, who purchased shares worth approximately $244,794 on April 1.

Specifically, he purchased 1,800 shares at a weighted average price of $135.9969 (a lot of 1,700 shares purchased at $135.9976 each and another 100 shares at $135.9850). After this purchase, he holds 19,047 shares.

Its shares are down -20.60% in the last 12 months. The market consensus gives it a potential at $149.44.

Source: InvestingPro

3. PDD

PDD is a conglomerate of Chinese origin whose headquarters is located in Shanghai. It is currently the most visited digital commerce application in China behind only Taobao and Temu.

The company was formerly known as Pinduoduo and changed its name to PDD Holdings in February 2023. It was incorporated in 2015 and is headquartered in Dublin, Ireland.

It reports its quarterly results on May 24 and is expected to report EPS up by 120% and revenue up by 102.74%.

Source: InvestingPro

It made its stock market debut in 2018. It presents a market capitalization of $154.99 billion and a P/E ratio of 18.57.

Its earnings are up are on an upward trajectory. It went from losses in 2018 of $1 billion to earning $4.5 billion in 2022. Now, the market expects it to earn more than $10 billion (its highest ever) this year, which would be a 35% increase over 2023.

Among the main elements in its favor are:

- Strong financial results.

- Strong revenue growth of 89.68% in the last twelve months.

- A significant gross profit margin of almost 63%.

- Solid liquidity position.

- Good financial health and efficiency in its operations.

In the last 12 months, its shares have risen 95%.

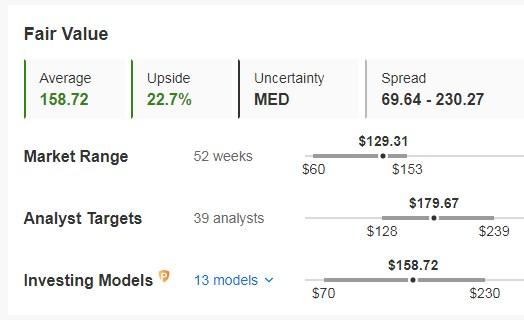

Its 'reasonable' price (fair value) is at $158.72, although the market sees potential at $179.67, even Citi goes further and sees it at $185.

Source: InvestingPro

4. T-Mobile (TMUS)

T-Mobile offers mobile communications services and also provides wireless devices, including smartphones, handhelds, tablets, etc.

The company was founded in 1994 and is headquartered in Bellevue, Washington, with headquarters in Bonn, Germany.

On June 13 it distributes a dividend of $0.65 per share and to be eligible to receive it, shares must be held before May 31.

Source: InvestingPro

In 2024, EPS (earnings per share) is expected to increase by 21.3%, revenue by 2.2%, and to exceed $10 billion in net profit. Its P/E is 17.

Source: InvestingPro

The company raised its annual forecast for paid subscriber growth as more people adopt its plans that combine high-speed Internet with access to streaming services.

The forecast is to have between 5.2-5.6 million subscribers this year. T-Mobile's discounted plans have helped it attract customers looking for more flexible offerings than the competition.

It also had its lowest churn rate in the first quarter (the percentage of customers who stopped using the company's services) at 0.86%.

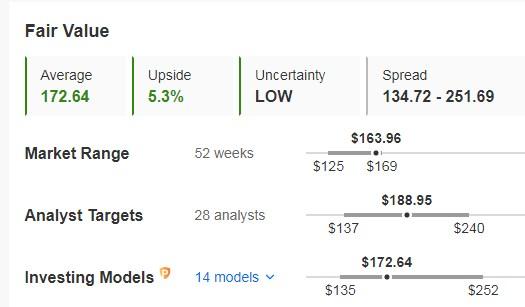

Its shares over the last 12 months are up 10.27%. It presents 28 ratings, of which 24 are buy, 3 hold 1 sell.

It started Friday at $174. Its "fair value" price stands at $172.64 and the market gives it potential at $188.95.

Source: InvestingPro

***

Want to invest successfully? Take the opportunity NOW to get the InvestingPro plan that best suits your needs. Use code INVESTINGPRO1 and get almost 40% off your 1-year subscription - less than a Netflix subscription costs you! (And you get more out of your investments too). With it, you'll get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your OFFER HERE!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.