Friday was hot and sponsored by the letter “P”. Payrolls were published and Powell made the first speech as the Fed Chair, pushing the price of gold to proliferate. What picture does it paint for gold?

Payrolls Disappoint, But So What?

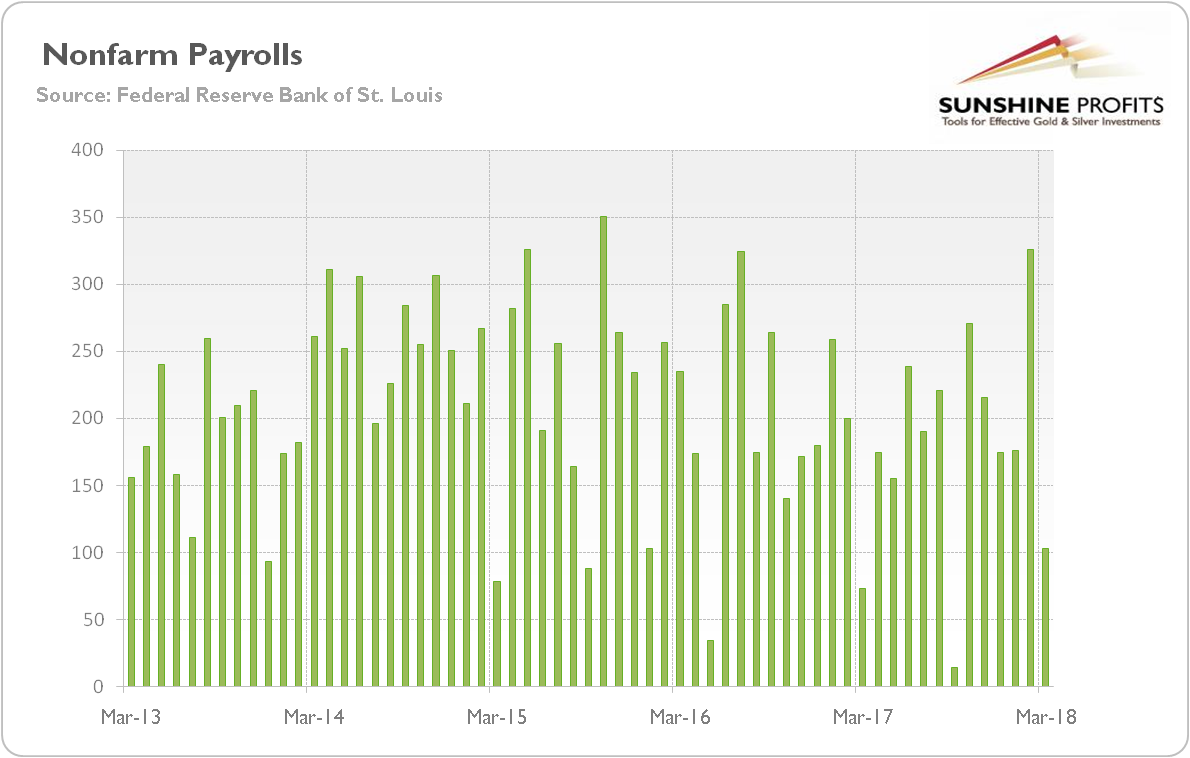

U.S. nonfarm payrolls disappointed in March. The economy added only 103,000 jobs last month, according to the Bureau of Labor Statistics, while the markets expected 175,000. That disenchanting increase followed a rise of 326,000 in February (after an upward revision) – actually, it was the smallest gain in six months, as one can see in the chart below.

Chart 1: Nonfarm Payrolls (change, in thousands of persons) from March 2013 to March 2018.

However, the U.S. labor market remained tight. The unemployment rate stayed at a 17-year low of 4.1 percent. Although a revision subtracted 50,000 job gains, they have averaged 202,000 over the last three months, which is more than enough for the Fed to continue its policy of gradual tightening.

Indeed, the U.S. central bank should welcome the recent employment report. The average hourly earnings rose by 8 cents to $26.82, which implies that they have increased 2.7 percent over the year. In other words, the tight labor market is slowly pushing up wages. Hence, although the headline was below expectations in March, the details and the general trend are positive. Gold cannot count on the labor market’s support.

Powell’s Speech Sounds Hawkish, But Doesn’t Say Anything New

Powell spoke. He delivered remarks on the outlook for the U.S. economy at The Economic Club of Chicago. Powell made his debut as a hawk. He noticed that many indicators suggested that the U.S. labor market was in the neighborhood of maximum employment. Powell also expressed confidence that the traditional relationship between the unemployment rate and inflation, although weakened over the recent years, still persists. Thus, he reiterated the view that inflation would finally move up toward our 2 percent target. Given such a positive outlook, Powell argued for further gradual increases in the federal funds rate:

It remains the case that raising rates too slowly would make it necessary for monetary policy to tighten abruptly down the road, which could jeopardize the economic expansion.

Hence, Powell’s speech was a bit hawkish, but not very distant from Yellen’s stance. Given the economic growth, he has to be a little more confident in the tightening, as we have argued for a long time (e.g., in the January edition of the Market Overview). As he didn’t say anything new and his stance has already been priced in, Powell’s speech shouldn’t affect the gold market significantly.

Price of Gold, or Conclusions

Let’s look at the chart below. As one can see, gold prices jumped on Friday, after the BLS published the employment report.

Chart 2: Gold prices between April 6 and April 9.

Apparently, the upsetting payrolls turned some investors to gold. It makes sense, as the weak job gains may discourage the Fed from the fourth rate hike this year (or signaling it early, at least).

However, the report wasn’t as weak as the headline suggest. And the general trend remained positive. Hence, the jump in gold prices may be only temporary. Indeed, the yellow metal declined on Monday. If the trade war rhetoric between the U.S. and China recedes (as between the U.S. and North Korea), the greenback may catch its breath, sending gold prices lower.

Hence, payrolls were (short-term) positive for the price of gold, while Powell sounded hawkish, which should be negative. But although he is more optimistic about the economy than Yellen, Powell will not rush to signal the fourth interest rate hike this year – instead, he will adopt a wait-and-see approach for some time. Gold will, thus, remain under the strong influence of the U.S. dollar. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.