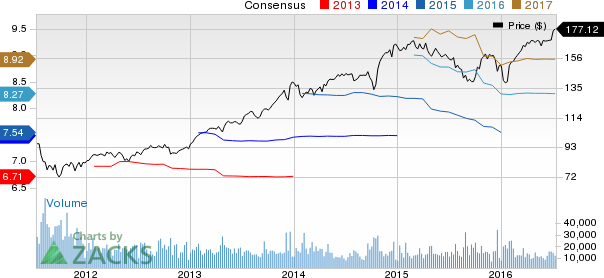

Shares of diversified conglomerate 3M Company (NYSE:MMM) hit a new 52-week high of $177.79 on Jul 8, 2016, before closing the trading session a notch lower at $177.12, for a healthy year-to-date return of 17.6%.

3M’s share price has been on a steady uptrend since Feb 2016. Despite its strong price appreciation, this Zacks Rank #3 (Hold) stock still appears to have enough room for further upside. The stock currently has a long-term earnings growth expectation of 9.6%.

Growth Drivers

3M recently reiterated its financial objectives for the next five years, covering 2016 through 2020. During 2016–2020, 3M expects 8–11% growth in earnings per share driven by organic sales growth of 2–5%. The company expects about 20% return on invested capital during this period with a free cash flow conversion rate of 100%. For 2016, the company expects organic local currency sales growth to be between 2–5%. In addition, the company expects its 2016 sales to marginally go up compared to 2015. The company also projects a favorable ROE of 40.46%.

Portfolio management, investment in innovation and business transformation are the three key areas on which 3M intends to focus to gain a competitive advantage in the industry. The company also plans to continue investing in capital expenditures and research and development efforts to support organic growth. 3M's global footprint, diversified product portfolio and the ability to penetrate into different markets remain its forte.

3M continues to deliver a sustainable increase in earnings and free cash flow, benefiting from its long-term strategy of accelerating investment in high-growth programs. The company’s ability to convert high R&D spends into up-cycle market share gains and strong pricing power drives its success.

Organic growth remains the first priority of the company as it continues to invest in infrastructure and commercialization capability. 3M has taken a number of steps to strengthen its core portfolio of businesses. Since 2012, the company has pruned its businesses from 40 to 26, thereby improving customer relevance, productivity and speed through a leaner operating structure. At the same time, 3M has maintained a steady investment in R&D to develop innovative products. The company expects to invest $1.8 billion in R&D in 2016 for higher organic growth and complement it with strategic acquisitions.

Furthermore, 3M is standardizing its business processes through a new, global ERP system. The company expects these efforts to result in annual savings of $500 million to $700 million by 2020. It would also bring about an additional improvement of $500 million in working capital. All these factors must have instilled investor confidence in 3M driving its shares to a 52-week high.

Stocks to Consider

Some better-ranked stocks in the industry include Carlisle Companies Incorporated (NYSE:CSL) , Leucadia National Corporation (NYSE:LUK) and Honeywell International Inc. (NYSE:HON) , each carrying a Zacks Rank #2 (Buy).

3M CO (MMM): Free Stock Analysis Report

HONEYWELL INTL (HON): Free Stock Analysis Report

LEUCADIA NATL (LUK): Free Stock Analysis Report

CARLISLE COS IN (CSL): Free Stock Analysis Report

Original post

Zacks Investment Research