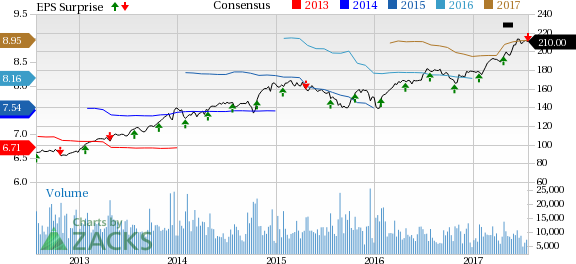

Driven by broad-based organic growth across all segments, 3M Company (NYSE:MMM) reported strong second-quarter 2017 results with healthy year-over-year increase in earnings and revenues. GAAP earnings for the reported quarter were $1,583 million or $2.58 per share compared with $1,291 million or $2.08 per share in the year-earlier quarter. The year-over-year improvement in earnings was largely due to higher sales. However, the reported earnings missed the Zacks Consensus Estimate by a penny.

Net sales during the quarter were $7,810 million, up from $7,662 million in the year-ago quarter, but missed the Zacks Consensus Estimate of $7,879 million. Foreign currency translation impact and divestures decreased sales by 0.6% and 1%, respectively, while organic local-currency sales improved 3.5%.

On a geographic basis, total sales increased 8.3% in Asia Pacific, 2.5% in Latin America/Canada, and 0.5% in the U.S and declined 3.6% in EMEA (Europe, Middle East and Africa). From a segment perspective, total sales increased 7.5% in Electronics and Energy, 2.5% in Industrial, 1.8% in Health Care, and 0.5% in Consumer, somewhat offset by a 0.9% decline in Safety and Graphics. Operating income in the reported quarter increased to $2,184 million from $1,866 million in the year-ago-quarter, resulting in respective operating margins of 28.0% and 24.4%.

Segment Results

Industrial segment sales increased 2.5% year over year to $2,720 million with improvement in all regions, driven by higher sales of advanced materials, automotive and aerospace solutions, and industrial adhesives and tapes, partially offset by lower sales of separation and purification sciences products. Operating income decreased 15.6% year over year to $523 million for operating margin of 19.2%.

Health Care segment sales improved 1.8% to $1,440 million in the reported quarter, driven by higher sales in drug delivery systems, food safety, and medical consumables. Operating income decreased 10.6% year over year to $412 million for operating margin of 28.6%.

Consumer segment revenues were $1,137 million, up 0.5% year over year, driven by higher sales in home improvement, home care and consumer health care. Operating income was $195 million, down 30.4% year over year for operating margin of 17.2%.

Safety and Graphics segment sales decreased 0.9% year over year to $1,547 million, owing to lower sales in roofing granules and transportation safety. Operating income increased 102% year over year to $852 million for operating margin of 55.1%.

Electronics and Energy segment revenues were $1,214 million, up 7.5% year over year due to growth in electronics material solutions and display materials and systems. Operating income was up 38.8% year over year to $301 million for operating margin of 24.8%.

Balance Sheet and Cash Flow

Cash and cash equivalents at quarter end were $2,654 million, while long-term debt stood at $11,088 million. Cash flow from operating activities for the reported quarter was $1,642 million compared with $1,285 million in the year-ago period, bringing the respective tallies for the first six months of the year to $2,630 million and $2,545 million. Free cash flow generated for the quarter was $1,340 million, up from $962 million in the prior-year period.

During the reported quarter, 3M paid $701 million in cash dividends and repurchased $494 million worth of shares.

Updated Guidance

Buoyed by strong quarterly results and favorable growth dynamics, 3M raised its earlier guidance for 2017. The company anticipates 2017 GAAP earnings in the range of $8.80 to $9.05 per share, up from prior projections of $8.70–$9.05. This represents year-over-year growth of 8–11%, up from 7–11% expected earlier. Organic local-currency sales are expected to be 3–5%, up from 2–5% expected earlier, while free cash flow conversion rate is anticipated to be 95–100%.

With continued restructuring activities for a focused portfolio, 3M expects to report relatively healthy results in 2017. 3M currently has a Zacks Rank #2 (Buy). Some better-ranked stocks in the industry include Danaher Corporation (NYSE:DHR) , Honeywell International Inc. (NYSE:HON) and Crane Co. (NYSE:CR) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Danaher has a long-term earnings growth expectation of 12.8% and has a positive earnings surprise history with an average of 2.5% in the trailing four quarters, beating estimates on all occasions.

Honeywell has a long-term earnings growth expectation of 9.3% and has a positive earnings surprise history with an average of 2% in the trailing four quarters, beating estimates thrice.

Crane has a long-term earnings growth expectation of 10.1% and has a positive earnings surprise history with an average of 8.4% in the trailing four quarters, beating estimates in each.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

3M Company (MMM): Free Stock Analysis Report

Danaher Corporation (DHR): Free Stock Analysis Report

Honeywell International Inc. (HON): Free Stock Analysis Report

Crane Company (CR): Free Stock Analysis Report

Original post

Zacks Investment Research